A lot of people face a money shortage in their life. From the poor to those who have a lot of budgets to run their house.

If you are in a financial crisis then you definitely want to listen about the options that are helpful for you.

You definitely want to get rid out of the financial crisis. One of the best options is that you can go for an online loan.

For this, a lot of people show concerns about an online loan. They ask whether it is a personal loan legit or not.

There is a service named Amone funds. There are a lot of positive Amone reviews in the market about their services.

A lot of people suggest that it is a trustworthy service.

Moreover, it is a very convenient lending service. Amone funds help you to get access to a lot of personal loan options.

This helps you find the right loan for your specific financial situation.

Furthermore, it will not put any damage to your credit score.

Basically, Amone works as a broker. It connects the consumers and the small business owners.

The purpose of this service is that a consumer can meet with the owner for taking loan benefits.

This service is for those people who want a loan from 90$ to 9999$. Amone helps you to search for the best deals.

What they do is that they find the best option for their client to provide consultancy about the best financial benefits.

They have experts who work for this purpose. In simple words, it is like a consultant company where you can go to meet a consultant.

You can share your financial problems with him. Then the expert will do research and tell you about the best financial plan that you can grab for your needs. Like you go to the insurance company.

As we discussed above that there are a lot of Amone reviews that came up from the customer side.

But there is a question that they always ask. The questions that people use to ask are placed below.

Contents

Is Amone a Legitimate Company?

The answer is Yes! Actually, the reason amone is a legitimate company is that your personal information is not being stolen by them.

They have an excellent security system. The hackers can not get access to the information storage site easily.

Only those people whom they registered as a lending partner, can get the information of the client.

Then, it is up to the customer that to which person he wants to contact.

The best part about their security system is that you will not get any telemarketing brand call on your phone.

Moreover, the process is very safe, secure, and confidential.

What can I use Amone Loans for?

As we have discussed above that if you are in a financial crisis then you definitely want to listen about the options that are helpful for you.

You definitely want to get rid out of the financial crisis. One of the best options is that you can go for an Amone loan.

Their personal loan service is very helpful for a person who is facing a shortage of money.

The most important usage of their personal loan is:

- Loans for startups or for small businesses.

- Paying debts.

- For high purchasing.

- To pay your medical bills.

So these are the most important situations where you can get a loan through the Amone funds.

Even in the Amone reviews that have come up from the customer side, they told that these are the most important situations where they pursue this service.

There are a lot of people who face a shortage of money for starting a business they prefer to grab a personal loan for their requirements. The Amone funds help them to start a business by providing them loans.

There are a lot of people who borrowed money for their needs and now unable to return.

Amone help them by providing them a personal loan on very easy and customer-friendly regulation so that a person can easily pay his debts

There are a lot of companies that have opportunities to grow but they are not growing because of a shortage of money.

The shortage of money is the reason they are unable to buy the pieces of equipment that is beneficial in their business.

Amone helps them to in their high purchasing. Amone works as a broker. It connects the consumers and the small business owners.

The purpose of this service is that a consumer can meet with the owner for taking loan benefits.

This service is for those people who want a loan from 90$ to 9999$. Amone helps you to search for the best deals.

They find the best option for their client to provide consultancy about the best financial benefits.

They have experts who work for this purpose. In simple words, it is like a consultant company where you can go to meet a consultant.

How Much Does it Cost?

Here comes another best part, the Amone funds do not charge any fee for their service. Yes! You have heard right. They do not take money for matching loan services.

You go for their loan services free of cost. They will connect you with the lending partners. Even there is no hidden cost for their service.

So a good choice to grab their services. You do not need to share your credit card information. This will be ensuring that you will not be paying them even a single cent.

How Does Amone Make their Money?

You probably thinking that if they don’t charge a single penny then how they earn to run their business.

The answer is that they don’t charge you, but they charge to the lending partner who gives a loan to the client.

They take their commission from the profit that a lender earns when the deal is finalized.

It is like the Amazon e-commerce website that performs a liaison role between the buyer and the seller.

Amazon does not charge any single penny from the buyer, but they charge their commission from the seller.

So for you, it is like a win-win situation.

What makes Amone Different from other Lending Sites?

As we discussed above that they provide a loan service of up to 10000$. They have experts who work for this purpose.

In simple words, it is like a consultant company where you can go to meet consultants.

You can share your financial problems with them. Then the experts will do research and tell you about the best financial plan that you can grab for your needs.

Moreover, there you can also grab a credit card. A credit card that you are looking for. Amone receives approximately 1.5 million requests each month.

There are a lot of positive Amone reviews in the market about their services. A lot of people suggest that it is a trustworthy service.

Moreover, it is a very convenient lending service. Amone funds help you to get access to a lot of personal loan options.

This helps you find the right loan for your specific financial situation.

So these are the things that make Amone different from other lending sites.

What are the Requirements to Get a Loan?

As we all know that Amone is not a lender, but works as a third-party broker. So, there are no requirements that have been set by them.

We have already discussed it above that what they do is that they find the best option for their client to provide consultancy about the best financial benefits.

We also know that Amone works as a broker. It connects the consumers and the small business owners.

The purpose of this service is that a consumer can meet with the business owner for taking loan benefits.

So all the regulations and requirements are being set by the business owners or lending partners.

These requirements are very easy and customer-friendly. Even you can negotiate with them to make the requirements easier for you.

Especially, for the applications of annual income, credit score, and credit history.

How to Find Loans through Amone?

The criteria for the loan process through Amone is very simple.

1. The criteria include:

- 18 years old or above

- Social Security Number

- United State citizen

- Permanent resident

- Steady source of income

- A valid bank account

- Telephone number

- Email Address

2. If you qualified for the above criteria then visit Amonefunds.com.

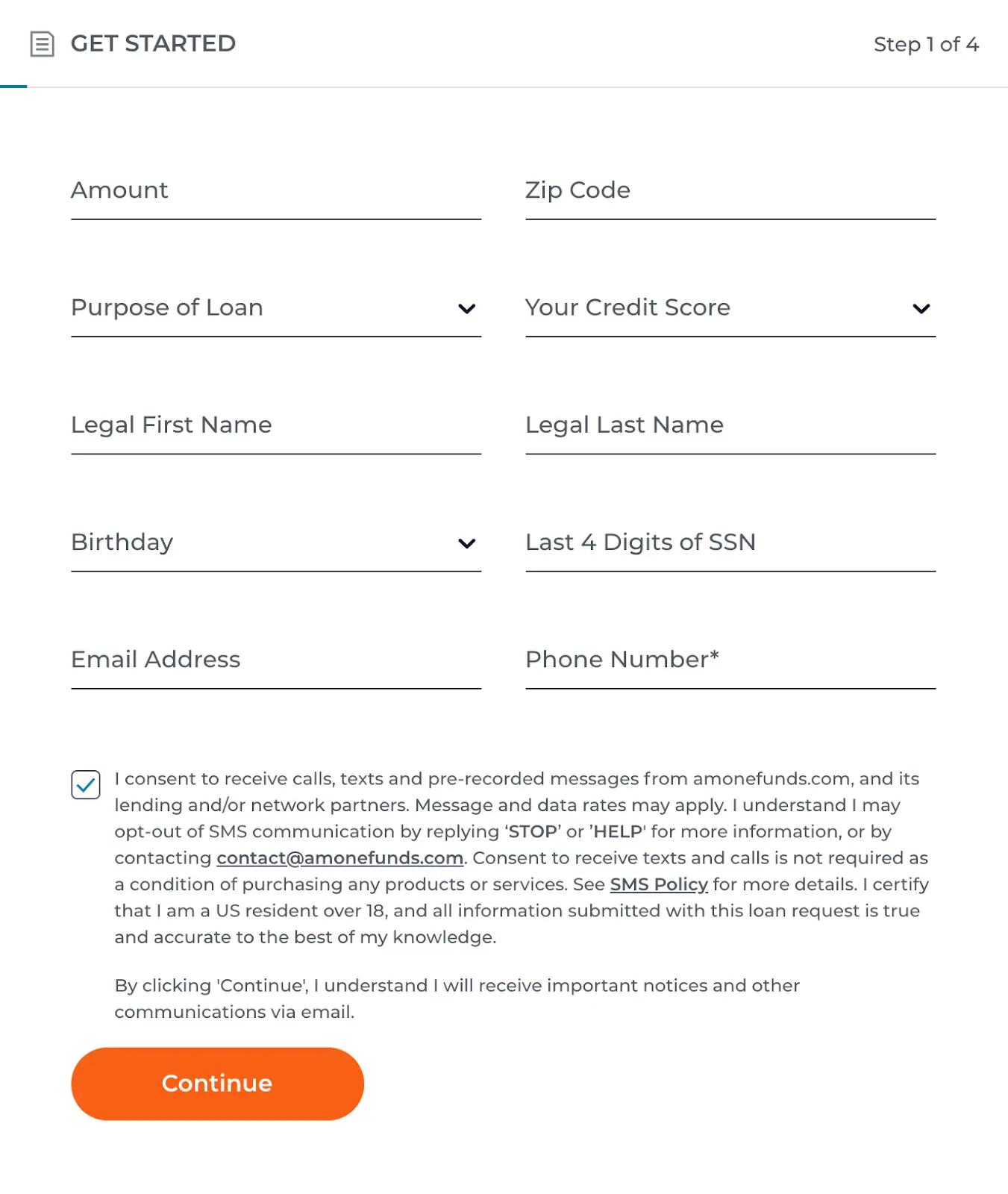

3. Insert the amount of money that you want in a loan in the option “Find my loan” on the website. Then click the tab under the option.

4. Insert the phone number. Moreover, insert the last digit number of your social security card. You have to enter this information into the corresponding boxes.

5. Click the “Continue” option that you see at the bottom in orange color.

6. There will be an online form that comes out the window where you have to put the required information. There will be some questions that you need to answer.

The questions are:

- What is your credit score?

- What is your desired amount that you want to take in a loan?

- What is the purpose of your loan?

Furthermore, you need to put information including your name, birthday, phone number, etc, so that a lender can contact you to keep in touch with you.

7. After the fulfillment of the required data, you will be able to see and select different options of personal loans with the terms. So what you need to do is to elect anyone of them. The lender will get a notification of your application.

He will contact you and will tell you the details about the loan. After that, within 24 hours, the loan will be in your bank account.

If you have any queries, mail at [email protected]. Their phone is still not available on their website.

Will Amone Look at My Credit Report?

Again as we have discussed above that Amone works as a broker. It connects the consumers and the small business owners. The purpose of this service is that a consumer can meet with the owner for taking loan benefits.

That is why Amone itself does not look at your credit report.

But, it might be possible that the lender that is providing you a loan would ask you for your credit report. It is an obvious thing. The lender has a right to do that.

We used to see a lot of scams in this type of situation.

Amone Reviews: Pros & Cons

Now, let’s discuss what are the pros and cons of Amonefunds service. For the Amone reviews, we have collected the data from different sources where customers have put their Amone reviews.

Pros:

- It is a trustworthy service.

- It is a very convenient lending service.

- Helps you find the right loan for your specific financial situation.

- It Will not put any damage to your credit score.

- Connects the consumers and the small business owners.

- Helps you to search for the best deals.

- Find the best option for their client to provide consultancy about the best financial benefits.

- Have experts who work for this purpose.

- Experts do research and tell you about the best financial plan that you can grab for your needs.

- You can share your financial problems with him.

Cons:

- Some users show concerns about their transparency.

- Some users cannot find the APR of the loans

- The interest rate can get pretty sleep

Conclusion!

The verdicts of this article are that Amone finds the best option for their client to provide consultancy about the best financial benefits.

They have experts who work for this purpose. In simple words, it is like a consultant company where you can go to meet a consultant.

You can share your financial problems with him. Then the expert will do research and tell you about the best financial plan that you can grab for your needs.