As it happens, Business banking happens to be one of the most important factors when it comes to running a business.

However, if you are a small-scale business or a freelancer, or don’t use your money very frequently, then it is troublesome finding the most convenient bank for yourself.

With that being said, this Azlo Bank review is bound to bring you some facts which will make you decide that Azlo Bank is the perfect choice for you!

Azlo has many features and has a lot of services to offer for small-scale business owners and freelancers.

This article is going to be covering all the pros and cons that there are for you to know about Azlo.

This will also allow you to figure out whether or not Azlo is the right choice for you.

Contents

What is Azlo Bank?

You have probably heard the name of Azlo Bank for the first time around, and that’s okay!

Just in case you were wondering what Azlo Bank actually is, this Azlo Bank review will help you find out all about Azlo Bank!

Azlo bank is a name of an online bank. This online bank specifically has shifted its focus to make the process of banking rather easy and simpler for online entrepreneurs.

Now, there are a lot of people that come under the title of the online entrepreneur.

That being said, Azlo bank was specifically made to help people like Freelancers and small-scale business owners.

Azlo bank is committed to changing the traditional business bank, and it goes an extra mile to do that.

However, Azlo Bank is only available online, and it can be accessed from online United States of American and the neighboring country, Mexico.

The name of the genius behind Azlo bank is Cameron Peake.

Not only is Cameron Peake the CEO of Azlo bank, but he also happens to be a co-founder of Azlo Bank. Azlo bank is not as old as it might seem.

Azlo bank surfaced only a few years back when it was officially announced in 2017.

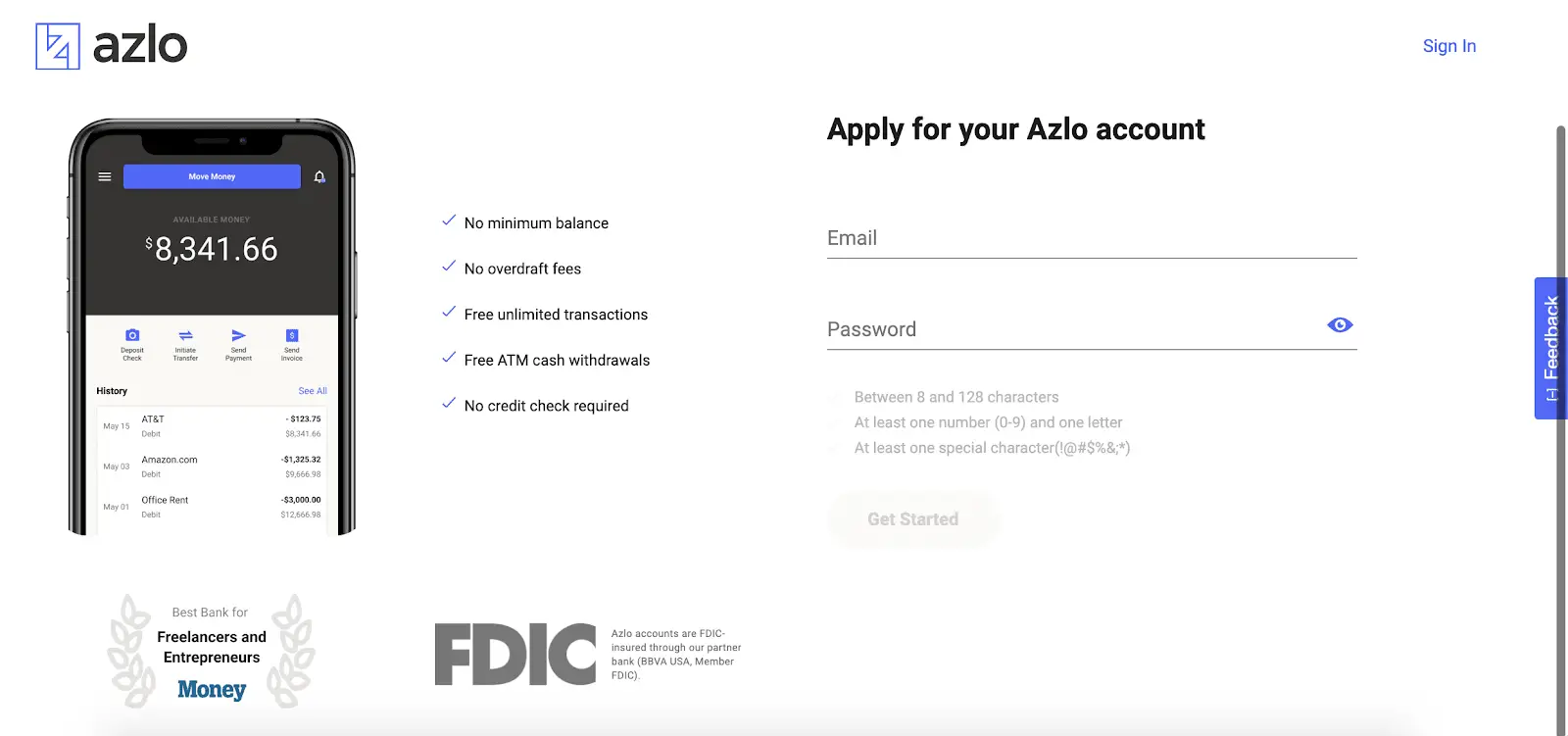

Being launched in 2017, Azlo Bank also happens to be a part of BBVA USA, an FDIC member.

The CEO, Cameron Peake, has this ideology where he says that in the big banks within the banking industry, the small-scale business owners and freelancers or entrepreneurs are not treated as well as they treat the other clients or in a lot of cases, they are not even taken on as a customer.

As we have already mentioned, Azlo Bank has been released to do something different from the start.

Azlo bank breaks the rule of prioritizing the bigger customers over the smaller customers, and they are inclined to treat all of their clients equally.

To give you an example of how things are going to be different at Azlo bank, Azlo bank has no caps for minimum balances and does not have any additional monthly fees either.

This happens to be one of the most important things for a small-scale business owner who is just starting right now!

What makes Azlo bank beneficial for such people is due to the fact that in the initial stages of the business, it is tough for these businesses to make solid profits in the initial stages.

Until a business starts generating revenue, it will be difficult for one to manage the expenses.

The Azlo bank CEO thinks that money is always better put forward in business rather than paying extra money in fees.

How Does Azlo Work?

Now that you know all about Azlo bank, it’s time that we ascended towards the next topic in this Azlo Bank Review.

But, before we proceed any further, let us clarify that we are not saying that Azlo bank is only a good choice for freelancers.

With that being said, let us see the working process of Azlo Bank. Azlo Bank works a little differently than traditional banks.

However, Azlo Bank is only good for satisfying a specified amount of banking needs for your business.

Azlo bank allows users to deposit checks in their bank accounts and accept deposits rather than directly.

Just because Azlo bank is an online bank does not mean that it will lack the functionality offered by the other banks.

WIth Azlo Bank, you will be able to withdraw cash from ATMs, just like the traditional banks.

Other than withdrawing money and having the ability to send and receive direct deposit checks, Azlo also allows you to send out the invoices to the clients of the person holding the account with Azlo Bank.

Other than that, if none of the above sounds like you and you want an account to save money, even in that case, Azlo bank happens to be the best option for you!

There are many reasons we love Azlo, but our favorite thing about Azlo bank is the fact that Azlo bank allows its signed-up users to access it from any of the 50 States of the United States of America.

Keeping that in mind, Whether you are a freelancer, a photographer, an owner of a business, You have the option to take Azlo as your banking option.

However, it would help if you were located in Either the USA or Mexico for Azlo bank to work.

As mentioned above already, Azlo bank will not work for you if you are located out of the mentioned reasons.

Having mentioned all the things, Azlo bank is not available to all the users.

There are some professions and some people to which the use of Azlo bank is limited.

For example, your business happens to be a limited partnership or your business is a limited liability partnership, you cannot work with Azlo bank.

Except for that, if you are involved in gambling, or you run a business of gambling, then it does not work for you either.

Other than that, Azlo bank is not also available to people that belong to the business of Cryptocurrency or sell products that contain cannabis and other related products.

Other than that, you are good and ready to sign up with Azlo!

Azlo Features:

There are a lot of features about Azlo, which make Azlo one of the best options when it comes to looking for a bank for a small-scale business or freelancers.

With that being said, here are some features of Azlo Bank which make it one of the best options on the market.

Allows You to Send Invoices:

If you run a business and your business requires you to send invoices through the internet, then Azlo bank has got you covered!

Azlo bank allows its users to send clients through the web account or the mobile app.

Allow you to Deposit Check Through Your Smartphone:

If you prefer to resort to the old methods, you have the option to do that in the smartphone apps.

The Mobile deposits on this bank are only limited to $10,000 per check and up to $20,000 total per month.

Allows you to Deposit Through E-mail:

Azlo bank goes the extra mile when it comes to providing comfort to the users. That being said, Azlo bank allows you to clear checks over $10,000 through Email.

Comes with Integration with Apps and Payment Processors:

Azlo happens to be integrated with the modern-day leading payment processors like PayPal, Stripe, Square, and Kabbage.

Other than that, Azlo can also pair up with other popular accounting software solutions.

Fee-Free Business Banking:

This is what makes Azlo one of the best when it comes to competing with bigger banks.

All of the Azlo Bank Accounts happen to be free and come with an option to send and transfer funds to the contractors and vendors.

Offers All the Functionality on the Internet:

Some people see this as an inconvenience, while others find it very convenient.

Needless to say, Azlo bank explicitly provides its services online, including the process wherein you have to register your Azlo bank account.

FDIC Insurance:

If you are worried that Azlo is not a big bank and that your money can be at risk if you invest in Azlo, then let us correct you there!

Azlo happens to be FDIC insured. This means that your deposits for up to $250K per account are going to be protected by the US Government,

Azlo Visa Debit Card:

Just like the other big banks, Azlo too comes with its very own Visa Debit Card!

With this Debit Card, you get the option to shop online at any time of the day that you want, and it can be used anywhere as long as you charge it from the US.

Azlo Fee-Free ATM’s:

This happens to be one of the best things about Azlo. All ATMs are a part of the Allpoint network.

There are no charges for the users to pay when they use their Azlo debit card to withdraw money!

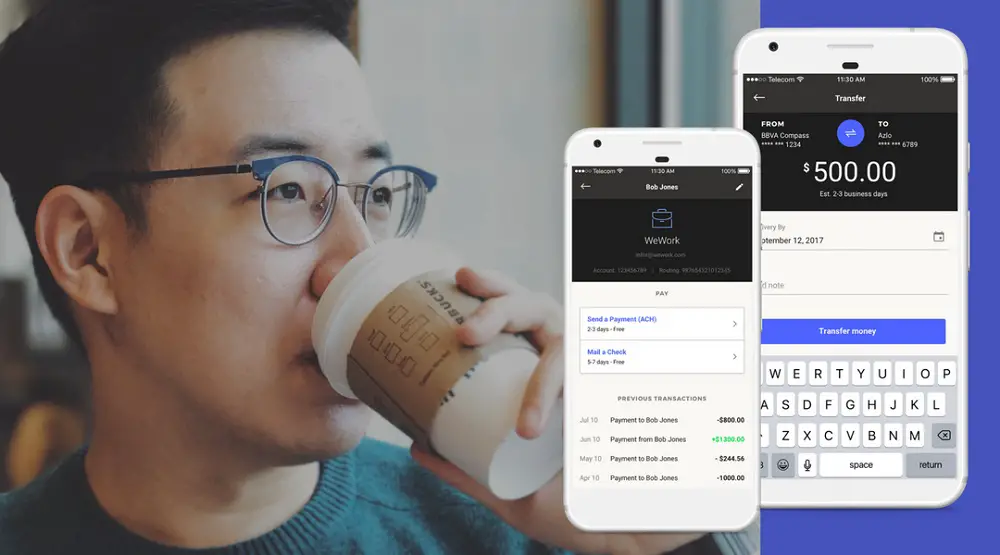

Dedicated Business Banking App:

Azlo comes with its very own dedicated app, which has amazing ratings on both mainstream stores.

This App has gained nice ratings for all the right reasons!

Azlo app allows you to make a lot of transactions and allows you to attain the functionality of traditional banking from the palm of your hand.

Who Is Azlo Best For?

For anyone that runs an online business or they are a solo entrepreneur or a Freelancer, Azlo is one of the best choices when it comes to Online Business banking options.

We endorse Azlo banking for being one of the best in its field, and the current customers of Azlo bank are also rather happy with the Service that Azlo Bank is currently providing.

Considering everything, the users are willing to suggest Azlo bank to the other people that they know.

That being said, If your business is dependent on handling cash, Process checks over $10K frequently, or even if you want to use multiple products from one place, such as a Business credit card or a savings account, Azlo bank is not the right choice for you.

However, if you are looking to have the best of both worlds, then we suggest that you get multiple banking accounts!

However, when you sign up an account with any other bank, ensure that you steer clear of any bank that depends on you to pay extra amounts under the terms of fees.

Having mentioned all the things, Azlo bank is not available to all the users. There are some professions and some people to which the use of Azlo bank is limited.

For example, your business happens to be a limited partnership or your business is a limited liability partnership, you cannot work with Azlo bank.

Except for that, if you are involved in gambling, or you run a business of gambling, then it does not work for you either.

Other than that, Azlo bank is not also available to people that belong to the business of Cryptocurrency or sell products that contain cannabis and other related products.

Other than that, you are good and ready to sign up with Azlo!

We hope that all the information provided in this section is adequate to help you decide whether or not Azlo Bank is the correct option for you!

Pros & Cons of Azlo Bank:

This Azlo Bank Review is focused on mentioning all the information of Azlo Bank, and Pros and Cons happen to be a part of that information!

That being said, here are some pros and cons of Azlo Bank:

Pros:

Fee-Free Business Accounts:

This is what makes Azlo Bank one of the best options out of all the options!

Azlo bank offers all of the services that it has to offer without needing to spend any money in terms of additional fees.

This allows one to invest the money in better places to improve the position of their business.

Easy to Sign Up:

A lot of business banks out there have a rather complicated signing-up process.

This makes so many people take a step back from signing up with banks in the first place. Azlo Bank realizes that and features a simplistic process of signing up.

This process is rather easy, and anyone can sign up with it.

Great Option for Solo Business Owners and Freelancers:

It is no secret that fees and charges of the famous banks are rather too much for small businesses and freelancers.

Azlo Bank is the perfect option as it does not come with any additional charges.

This allows the owners to save that money and utilize it for the betterment of their business.

Integration with all the Pioneer Money Processors and Apps:

Now, we know that you may be thinking that Azlo bank is fairly new, and it may not have integrations of money processors that you are concerned with.

Hold that thought, as Azlo Bank comes with so many integrations, and with all the big names as well!

Cons:

Customer Support does Not Assist 24/7:

This comes off as a turn-off. Granted that Azlo bank is very simplistic to use and comes with features that make it the perfect option for any solo business owner, but it can get difficult when you hit a stone.

When there is no support to help you resolve the issue, you will not have any other option but to either wait or take the risk.

Totally Online:

Since Azlo Bank has no branches or ATMs of its own, this can be a little bit of an issue.

To operate Azlo bank, you will need an internet connection.

Azlo Bank is totally cloud-based, which means that you will not be able to use it in case of any problem with your internet connection.

Even signing up with Azlo bank is online, which is not something that can be considered ideal.

Also Read: 7 Ways to Double Your Money (Fast)

Conclusion!

Here goes our Azlo Bank Review. Baking is one of the most serious and one of the most important aspects of the business as you are going to be trading and receiving all of your money through it.

You only have to stick with the best options that there are to ensure that you get the best services.

To help the headhunt for the best bank for you, we have written this Azlo bank review.

This Azlo Bank review consists of all the listings that will help you identify what Azlo bank actually is and what benefits you can gain, and where it lacks.

This read is also going to tell you about all the basics of Azlo and the method of its operation as well.

We have tried to be as detailed as possible to explain the whole application and the processes.