I’m sure you’ll agree with me when I say that getting your financial life in order is not easy. It’s way too easy to become overwhelmed when it comes to managing money.

Just think about all the things we need to do: get out of debt, save for retirement, budget daily expenses, and make sure you have enough money in case of emergencies.

Fortunately, Dave Ramsey wrote a book called The Total Money Makeover in which he prescribes his 7 baby steps.

These baby steps are designed to bring someone from financial despair to financial independence. It’s a great system to start with if you feel overwhelmed when it comes to your money.

Contents

Who is Dave Ramsey?

Before we dive into the actual baby steps, you’re probably asking yourself: who is Dave Ramsey? And why should I listen to him?

Dave Ramsey is an author and radio personality whose show is heard by over 8.5 million listeners each week. He’s written five New York Times best-selling books on personal finance.

He has helped thousands of people to become debt-free and changed their lives entirely. He has financially changed the life of many people by giving no-nonsense advice who have gotten in over their heads.

He has helped them to find the way out in a very responsible way. But his advice requires hard work and if you are afraid of the hard work then you may look somewhere else for the advice.

He’s one of America’s most “trusted voices on money and business”.

Dave Ramsey’s Baby Steps:

- Baby Step 1: $1000 in an emergency fund

- Baby Step 2: Pay off all non-mortgage debts using the debt snowball method

- Baby Step 3: a fully-funded emergency fund of 3 to 6 months of expenses

- Baby Step 4: Invest 15% of your household income to a retirement

- Baby Step 5: Start saving for your children’s college expenses

- Baby Step 6: Pay off your home early

- Baby Step 7: Build wealth and give generously

Decide to Change:

I think it’s important to make some decisions before even going to head on the road of exploring the 7 baby steps.

It is very important to sit down with someone significant and trustworthy and discuss with him or her to make a decision that you want to change yourself. Many people talk about changing their financial lives.

But they never touch the fact that if they or their spouse isn’t going to change themselves, then they cannot change their financial life. You have to decide to change yourself.

For many people, there isn’t any moment where they decide that they want to change but it comes as a gradual realization that they are not spending their money as wisely as they should.

They realize that they are accepting too much debt which is damaging their financial plan. It is then when they try to crave freedom from any kind of debt. It is the time they wanted to be free.

Making things simple, if you have the feeling of deciding to change, it is the time that you have hit your bottom. It might also mean that you have become sick of not saving anything for your retirement.

This situation differs for everyone. but believe me when you get this feeling you must not waste it and make a decision and be responsible and honest to it.

Decide Taking No More Debt:

If you have made up your mind to change yourself then you must begin with making a strong decision as a family that you are not going to take any more debt.

You must make a strong decision that if you want to buy new kitchen countertops or a new TV then you have to save money to buy them.

You must get rid of the store credit cards with which you buy the clothing at ridiculous interest rates.

You must draw a permanent line which you must not cross when buying something so that there is no need of taking debt when you are finished with your money.

So you must always try to save as much money as you can. According to Dave Ramsey, he and his wife used their credit cards in many ways. They used to pay for vacations and save for them in advance.

They used their credit card as a safety net for the household. And if you wanted to buy something like new furniture then they would just finance it at the store.

If you have decided to change then you have to stick to it.

Each Baby Step Summarized & Explained:

I’m going to walk you through each of Dave Ramsey’s 7 Baby Steps which he covers in his Total Money Makeover book.

If any of these steps sounds intriguing, I would definitely encourage you to buy a copy of his book and read it from cover to cover.

These 7 steps are fundamental to achieving financial independence.

1. Save $1000 in an Emergency Fund:

When getting your financial life in order, the first step is to make sure you have what Ramsey calls a “baby emergency fund”.

You never know what life will throw at you. Based on past experiences, however, money emergencies tend to happen when they’re least convenient – like when you’re trying to pay off debt as fast as possible.

The logic behind having a small emergency fund instead of putting that $1000 directly towards your debt is that $1000 is enough to cover most small money emergencies.

This means when (not if) an emergency happens, you won’t have to get into more debt.

It would be mighty demotivating if all the progress you made on your debt the month before was eliminated because your car broke down and needed repairs.

Having a small emergency fund protects your progress!

If you do end up using your emergency fund, just funnel some money from your debt payments towards building your emergency fund back to $1000.

Take action: Create a new checking account to keep your emergency fund nice and safe.

2. Get Debt Free with The Debt Snowball Method:

The next step is to eliminate your debt. Dave Ramsey’s probably most well-known for his debt reduction strategy called the “Debt Snowball Method”.

Unlike the more conventional “avalanche method” in which you pay your highest interest debts first to save you the most money, Ramsey advocates for paying your smallest debt first and working your way to your largest debt last.

By paying your smallest debts first and then rolling your payments into a bigger and bigger payment “snowball”, you gain momentum and are less likely to become demotivated.

This “baby step” is quite daunting. Paying off debt and staying debt free is hard.

Take action: Download Ramsey’s debt snowball form to keep track of your progress towards becoming debt-free

3. Build a Bigger Emergency Fund:

Debt-free at last! Now it’s time to make some money moves to guarantee that you stay that way.

First up, you need a bigger emergency fund. $1,000 is not nearly enough to cover anything but the smallest emergencies.

What would happen if you lost your job? Your car breaks down for good? A loved one gets into an accident and needs thousands of dollars in medical care?

The purpose of an emergency fund is to cover you in those situations so that you don’t need to get back into debt.

Ramsey suggests that once you are debt-free, you should put all the money you had previously used to pay off your debt into your emergency fund.

Ramsey says everyone should have a 3 to the 6-month emergency fund which means that you should save up 3 to 6 times your average monthly expenses.

It may seem like a lot, but 3 months will fly by if you’re laid off and struggling to find another job. You’ll be happy that your emergency fund to fall back on during hard times.

4. Invest for your Retirement:

Once you’re debt-free and have a fully-funded emergency fund, it’s time to look towards the future. Your retirement.

Too many people put off saving for their retirement until their late 30’s or 40’s, which means they’re missing out on years of compounding interest gains.

Ramsey suggests that you should put 15% of your income towards your retirement savings. While a 15% savings rate is well above the American average, it’s not nearly enough if you’re starting late in the game.

Take action: Not sure how to get started investing? Learn how to invest $100.

5. Save for your Children’s College:

Next on the list is securing your children’s futures.

Something which I found very reassuring in the Total Money Makeover is that Dave Ramsey makes a point of saying that a college degree doesn’t guarantee a successful future.

He suggests that you should make sure that a college education is worth the cost of admission. Even if you don’t think your children will be attending college, having a “Future Fund” will help them get a head start in life!

How much you want to put towards saving for your children is up to you and your spouse.

Take action: Read about how to use tax-advantaged 529 plans for college savings.

6. Fully Own your Home

Once you get to this step, there’s only one more debt that stands between you and financial freedom: your mortgage.

Putting all your extra money – after putting away at least 15% towards your retirement – towards your mortgage will save you thousands of dollars in interest.

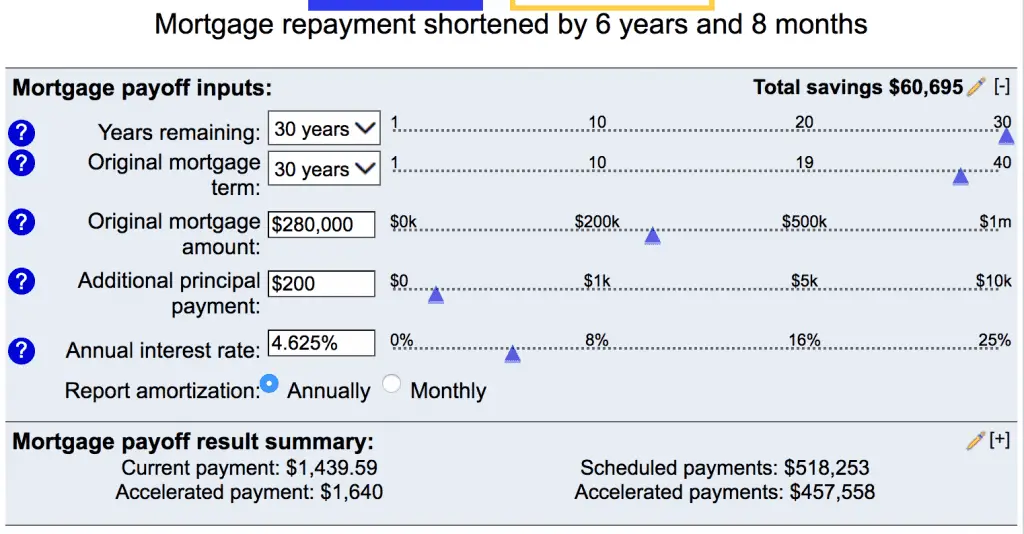

You may want to consider refinancing to a 15-year fixed mortgage to pay your house off faster. Even an extra $200 a month can save you thousands.

In the example below, if you paid an extra $200 a month towards the principal of the loan, you’d pay off the loan 6 years early and save over $60,000 in interest!

Take action: See how much you can save if you increased your mortgage payments

7. Build Wealth and Be Generous:

This is, of course, the best step. You’re debt-free

and have set up all the systems required to have a secure financial future!

Now it’s time to build wealth, be generous, and build your legacy!

Whether you want to spend money traveling or save towards buying a retirement home in Florida, the future is yours because you spent years being disciplined and working towards your money goals.

Have you tried Dave Ramsey’s 7 Baby Steps? Have you read Total Money Makeover? Let me know in the comments below!

For less than 5 minutes of your time, earn yourself a random stock whose value is anywhere between $5.00 and $200. It is possible through an investing app called Robinhood.