Kraken and Coinbase are two cryptocurrency exchanges that provide investors with market access to the most popular cryptocurrencies.

Both platforms meet the stringent criteria of knowledge of your customer (KYC) to let consumers access, acquire and trade their bitcoin safely.

Jesse Powell established Kraken in 2011 to aid Mt. Gox trading hack displaced consumers drained by investors more than $450 million in Bitcoin.

Kraken became one of the leading Bitcoin trade exchanges in 2013, and since then, it has added more than 50 cryptocurrencies.

Brian Armstrong and Fred Ehrsam established Coinbase in 2012. It is now the most popular U.S.-centered exchange to support the world’s most important cryptocurrencies.

The simple software and credit card capabilities to acquire crypto facilitate new investors to start up.

Its trade ability is the significant distinction between the platforms. While Coinbase is an easy exchange of cash for bitcoin, it offers numerous complex alternatives for trade.

On the contrary, Kraken is a “crypto-first” exchange offering a wide array of trading kinds, including margin trading, futures trading, and limits.

Contents

Kraken vs. Coinbase: Which Should You Choose?

The two major crypto-exchange platforms in the world are Kraken and Coin Base.

Each one allows you to buy different currencies with fiat cash (U.S. dollars or Euro).

Moreover, they designed it for skilled and new investors.

Kraken provides low-cost services and significant trading limits, both for huge volumes and smaller volumes.

The convenient use of Coinbase’s digital wallet and financing alternatives encourage new investors situated in the USA.

Unlike Kraken, Coinbase offers U.S. traders, and you can read this article to understand more about this platform.

This essay weighs Kraken vs. Coinbase’s advantages and disadvantages and looks at their characteristics, safety, fees, easy usage, and more.

Every platform has benefits that appreciate confident investors while both provide attractive aspects, such as mobile apps and customer assistance 24/7.

Kraken provides flat buying costs, which is a good advantage for smaller traders.

Coinbase is readily available for U.S. traders using financing alternatives like PayPal and debit cards.

Both platforms we have assessed based on their supported currencies, security, fees, features, and more to choose the ideal option for you.

Kraken:

PROS

- Low commercial charges.

- 24/7 live chat assistance for many sorts of trade.

- Safe and confident.

- Small fees.

- High restriction on trading.

- Accept certain fiat currencies.

CONS

- Many possibilities U.S. users not open to.

- Long check periods.

- A challenging interface for users.

Coinbase:

PROS

- FDIC insured up to 250K dollars.

- Offered in 100 countries.

- Library of free user learning.

- Great experience for users.

- Easy possibilities for fundraising.

- Accepted Fiat currency.

CONS

- In all countries not accessible.

- Certain coins are not accepted.

- High buying and trading costs.

- 2 $ minimum order.

Kraken vs. Coinbase: Ease of Use

Kraken is intended for more active trades and offers sophisticated customers more choices than Coinbase to purchase and trade cryptography.

The Kraken U.I. feels a bit archaic, and beginners in crypto may feel bewildered while their first deal is running.

Kraken provides sophisticated users with choices for trading, future trade, and access to margin trading.

You may establish a free account with your email address and password to join up for Kraken.

Moreover, you need to acquire a two-factor authentication for your account after your email address is verified.

Furthermore, you must pass advanced checks, including a photo I.D., a residence proving and your social security numbers, to deposit funds.

From there, you may use your digital wallet, ACH, or wire transfer to finance your account.

With an email address and password, users may register with Coinbase.

You will need to check your I.D. using a governmental photo I.D. by uploading a photograph to the application or the website before purchasing or selling crypto.

Once reviewed, you may link to a bank account or payment card to start shopping for bitcoin instantly.

Kraken and Coinbase have a great user experience. They give both a trustworthy desktop and mobile device experience.

The strict safeguards of Kraken are a plus for big amount investors, but additional precautions might help customers who wish to start trading fast.

Coinbase offers a fast start-up and keeps trading and financing choices simple, enabling novice investors to trade immediately.

Coinbase allows new customers to trade up to $9,000 with simply a verification of telephone numbers.

Kraken vs. Coinbase: Features:

Each trade of bitcoin provides investors and initial investors alike.

Kraken still offers perfect features for investors globally or U.S. traders who don’t care how they may give convenient service at reduced rates.

The digital choices of Coinbase enhance U.S. investment processes.

You are going to receive both with Kraken and Coinbase.

Availability:

In more than 100 countries, Coinbase provides trade, and in 176, Kraken. Both services offer different location-based functionality.

For example, It provides the Hawaiin people with Coinbase, and in New York or Washington, Kraken is not available.

Customer Service:

It provides global services via live chat 24 hours a day on both platforms.

During heavy traffic trading periods, the availability of support might reduce and wait times rise.

Both provide guidance centers, as well as Q&A centers.

Margin Trading:

Kraken provides up to five times the industry’s typical margin trading. In early 2020, Coinbase implemented the functionality, giving three-fold accessibility.

Mobile Apps:

A highly-rated mobile application provides all the capabilities offered in an Internet browser in every trade.

However, in seven countries, including Japan and the U.S., the Kraken App is not available.

Kraken offers Cryptowatch, an analyzer and data generator for over 8,000 crypto-currency marketplaces.

The free service enables traders to monitor price movements and trends across several platforms and provide price warnings.

By paying one cent each sign, investors may improve this service more promptly.

Coinbase also offers an additional function. They provide customers the ability to deposit, save or remove money with a hot wallet.

You don’t want to utilize the wallet as a Coinbase user. Thus it is suitable for traders who move between fiat and cryptocurrencies.

Related Post: 21 Money-Saving Challenges to Try in 2021

Kraken Unique Features:

Huge variety of trade options: Kraken offers a large selection of trade types for advanced users.

Here is a quick list of just some of the trade options available:

- Limit order.

- Market order.

- Settle position order.

- Stop limit order.

- Stop market order.

- Trailing stop order.

- Time in Force Limit orders.

- Margin trading.

- Futures trading.

Progressive Chart:

Kraken enables customers to enable “Advanced Markets Monitor” to view book transactions on live orders, a chart with numerous overlays of indicators, and construct a watch list.

API Keys:

Kraken provides user access to its API keys to link third-party applications with Kraken.

Users may also monitor and secure their account access to these API keys at a comprehensive level.

Service For OTC Investors:

Kraken serves high-dollar investors that enter the crypt area.

They provide a 1-1 white-glove service for clients to make significant investments outside the leading exchange in Bitcoin and other cryptocurrencies.

It offers market expert advice and reporting and helps to ensure that multiple crypto buys are traded and safely stored.

Coinbase Unique Features:

Educational Resources (+ Bonus):

Coinbase provides user training to assist start-ups in learning about bitcoin.

These short films teach viewers about different cryptocurrency projects, and some of them reward users that finish extra test cryptography.

Newsfeed:

The website and the mobile application of Coinbase provide up-to-date news stories from different places.

If you click any coin, your news stories for that currency are particular.

Alert:

You may establish a watch list to track whether there are significant price fluctuations if you want to be up-to-date with current price changes.

Kraken vs. Coinbase: Currencies:

The USD, EUR, CAD, AUD, GBP, CHF, and the JPY Fiat supports both exchanges.

Coinbase is accessible to trade for 50 coins, whereas Kraken is open for trade for 56.

Investors desire more monetary possibilities, but the broader range of Kraken is essential for each provider, so consumers may explore both to discover what they want.

Kraken provides, for example, flow (FLOW) and Icon (ICX) but does not support the ADA or Band Protocol of Cardano Network.

You can trade in coin bases but not introns (TRXs) or six coins (S.C.).

Both sites enable you to buy cryptocurrencies in dollar quantities to purchase fractions of coins—minimum order of $2 Coinbase.

Kraken, on the other hand, measures in the native token its minimum buying amount. The minimal buying quantity of Bitcoin is, for example, 0.0002 Bitcoin (BTC).

Also, if the price of Bitcoin is 60,000 dollars, you may buy 12 dollars of Bitcoin.

The main currencies like bitcoin, Ethereum, the universe, Cardano, chain link, and compounds supported by both platforms.

Furthermore, the most popular cryptocurrencies supported by Kraken and Coinbase include:

- Cardano (ADA)

- Bitcoin Cash (BCH)

- Chainlink (LINK)

- Ethereum (ETH)

- Litecoin (LTC)

Kraken vs. Coinbase: Pro Fees

The cost of purchasing bitcoin is relatively high both in Kraken and Coinbase. Every exchange charges the transaction fee and with a price dependent on the payment type.

You can pay a 2% fee for every purchase transaction on both platforms. They also impose additional charges dependent on the transaction account.

Moreover, the kracken fees and coinbase are not very high though.

Both sites charge more for the cryptocurrency than most other exchanges. However, Kraken offers a substantial reduction for cryptocurrencies in the trading process.

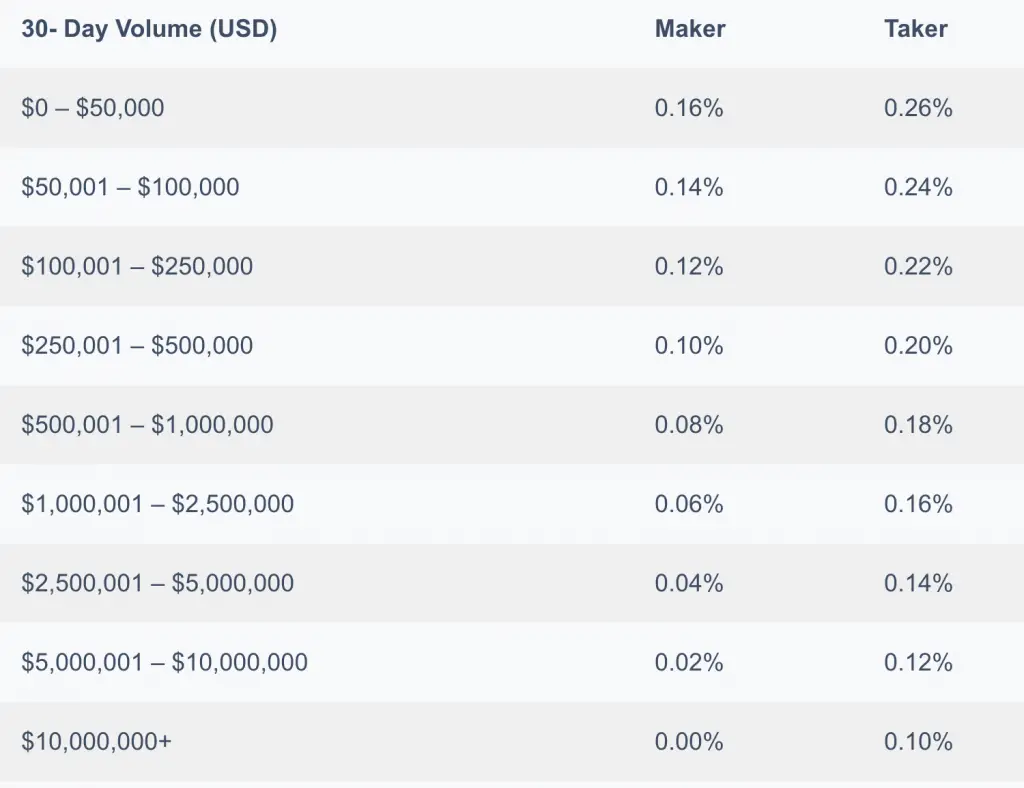

Kraken utilizes a pricing scheme depending on your volume of 30 days. When users place a command at the instant market price, they are a “taker,” and they charge the payer.

Users put an order which does not match instantly, and they deem them as the “maker,” they are assigned the manufacturer’s fee when the transaction executes until the match discovers. Then they enter it into the book.

In a 30-day rolling period, it determines transaction fees by volume.

The fee plan comprises:

- Transactions 0.16% of the maker charge or 0.26% of the takeover fee is paid from $0 to 50.000.

- 0,14% maker fee or a 0,24% take charge are charged in transactions from $50,001 to $100.00.

- $100,001 through $250,000 pay 0.12% bill or 0.12% bill. transactions are paid by a 0.22% bill.

- $250,001 to $500,000 transactions are charged with a 0.10% borrowing or 0.20% borrowing cost.

- Transactions between $500,001 and $1,000,000 pay a 0.08% bill or 0.18% bill.

- $1,000,001 through $2,500,000 transactions incur a 0.06% borrowing cost or a 0% borrowing fee.

- Transactions between $2,500,001 and $5,000,000 pay 0.04% bills or 0.14% bills.

- Transactions of between $5000.001 and $10,000,000 pay 0.02% billing and 0.12% billing fees.

- $10 million in transactions pays a 0% bill of payment and 0.10% bill.

The updated Coinbase Pro saves on trading costs, but the cost of Kraken is still considerably cheaper.

For instance, trading for $1,000 will pay $5 (0.5%) to Coinbase Pro, $40 (4%) to Coinbase and $1,60% (0.16%) to Kraken, for instance.

Kraken vs. Coinbase: Security

When selecting which exchange to utilize, security precautions are essential.

Both platforms have good safety records and have no reports of serious violations.

Kraken keeps 95% of its assets in protected air-borne cold storage and has rigorous monitoring throughout the whole platform and several checkpoints during the registration process.

In the offline globally dispersed cold store, Coinbase maintains 98% of deposits.

The FDIC covers up to $250,000 in the USD cash amount for a particular individual, extra for U.S. traders.

Kraken and Coinbase, on the user side, offer these multi-layered security characteristics:

Coinbase Security Features:

Two-Factor Authentication:

Coinbase provides 2FA through SMS or the Google Authenticator app. Two-factor authentication:

It helps safeguard access to your account with a six-digit passcode that is time-sensitive.

Security Keys:

Use physical security keys to validate your login and create a one-time passcode when inserted into your computer disc.

You may build and keep many keys in safe places.

Authenticator Apps:

Coinbase offers extremely safe applications like Google Authenticator for logging in together with 2FA, while Kraken utilizes just the authenticator apps to connect to their system.

Cold And Crypto Vaults:

Coinbase holds in the “cold storage” 98% of all crypto balances, meaning that they keep assets on non-net-linking hardware.

Coinbase also offers a vault for bitcoin, which secures the digital assets held. Moreover, it creates multiple user permission before the withdrawal of monies.

They are also time-consuming. Therefore the retreat is canceled if you make all transaction permissions within 24 hours.

Built-In Wallet:

Coinbase gives your bitcoin storage Coinbase wallet. The password and biometric access controls are secured.

It also features a 12-word encrypted recovery phrase that protects your assets. The ERC-20 tokens can also be stored and exchanged by users.

FDIC (Up To 250K$) Insurance:

Coinbase provides USD (USD) deposits for FDIC insurance. This insurance is similar to a typical bank which ensures USD deposited cash for up to $250,000.

Kraken Security Features:

Whitelisting Of Allowed Addresses:

Kraken demands that the verification procedure conducts by all withdrawal addresses, which prohibits access to any non-approved foreign address.

Authentication With Two Factors:

Kraken needs authentication of two factors (2FA) through Google Authenticator. SMS recovery account is deactivated to prevent phone hacking.

U2F Hardware Critical Security:

Kraken offers users to safeguard their accounts and is a U2F hardware key to save their crypto access keys offline.

Global Lock Settings:

Kraken includes a global lock function to quickly freeze settings on your account for a duration of one to 29 days.

Further, it prevents access to your account or modifications from being removed from it.

The FDIC insurance does not insure your bitcoin money. Only your USD deposits are insured.

Frequently Asked Questions:

Also Read: Current balance vs. available balance: What’s the Difference?

How We Evaluated Kraken vs. Coinbase

We assessed each site based on ease of use, fee structure, safety, distinctive characteristics, and supported currency when we reviewed Kraken against Coinbase.

Furthermore, we also considered the varieties and their respective costs for each platform’s more broad bitcoin trading market.

Although Kraken and Coinbase are extremely comparable crypto exchanges, they have some distinct characteristics suitable for their optimal customers.

Since 2011, Kraken offers customers a safe option to trading their cryptography actively.

Kraken is well suited to experienced bitcoin traders with its low-cost trading structure and powerful trading tools.

Moreover, thanks to its straightforward design and user education component, Coinbase is most adapted to first-time crypto-investors.

However, both exchanges charge higher than usual costs for crypto shopping, so that investors who are aware of expenses might choose to seek elsewhere.

So, in this Kracken VS Coinbase, we conclude that make your choice wisely.

Similar Articles: