We get that saving money is not something that comes easy to anyone. However, if you want to make some big savings, then nothing helps better than taking on some challenges! Fortunately for you, you are in the perfect place.

Make sure that you go through these money saving challenges as it will allow you to choose the best one for you.

Moreover, through these ideas, you will also be able to invite your friends and family to these plans.

If you do a money saving challenge with your friends and family, your chances to be successful increase significantly.

Without further ado, let’s get going!

Contents

1. No-Spend Money saving challenge:

This happens to be a fairly popular money saving challenge. Basically in this challenge, you set an amount of time in which you don’t spend any additional money.

However, this excludes basic needs such as food and other similar expenses.

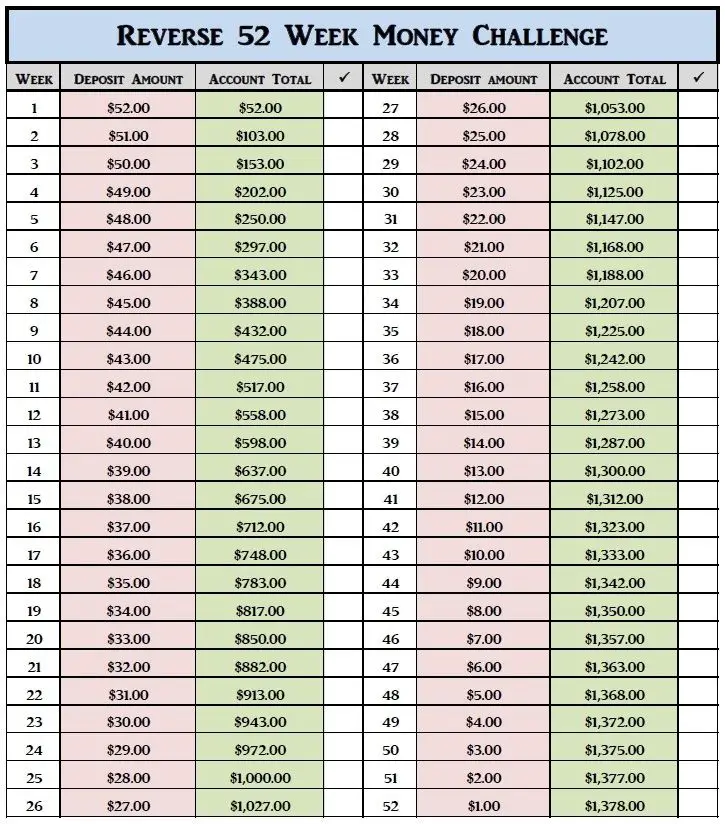

2. 52- Week Backwards Money saving challenge:

This is one of the most typical options on the list. In this money saving challenge, you save $1 in the first week, in the second week, you will be saving $2 and the list goes on. We’re sure you get the idea.

However, turn this challenge around and do it backward. This will allow you to have more savings in the holiday seasons!

3. 8-Week Vacation Money saving challenge:

This money saving challenge can be completed in two months only! Talk about instant results. This challenge will allow you to save $1000 in 8 weeks only.

Make sure to check out The Soccer Mom Blog for all the thorough details.

4. Holiday Helper Fund Money saving challenge:

Following this money saving challenge, you will be able to stay a step ahead of the huge expenses of your holidays. From First January, keep $20 Aside from each week’s budget and add it to your savings.

You can use this saved amount to buy gifts on holiday or save the amount to use it at a vacation.

5. 52-Week Money saving challenge:

This happens to be one of the most famed money saving challenges to be listed. If you go about this plan precisely, then at the end of the year, you will have saved about $1378.

Here is how it works:

- Add a single dollar for a week.

- Then for the next week, increase a dollar.

- In the third week, make it three dollars.

- Increase a dollar in the fourth week.

6. 26-Week Bi-Weekly Money saving challenge:

Instead of following a weekly challenge, this challenge pushes you to save money every week.

This happens to be the perfect option if you prefer to deposit money into savings aligning with the schedule of your paycheck.

By the time you are through with this challenge, you will have saved $1404. This challenge can go on for a year, very much like the 52-week challenge.

In this challenge, you will basically be increasing the amount by $4 every two weeks.

7. 365-Day Nickel Money saving challenge:

If you feel overwhelmed by making deposits on a weekly or bi-weekly basis, then this is a money-saving challenge for you. As a matter of fact, you will be able to save even more money with it.

This is how this challenge works:

- On your first day, you deposit $0.05 in your savings account.

- Following the first day, you deposit $0.10 in your savings account.

- On the third day, you are going to be depositing $0.15 in your savings.

To simply put, with every passing day, you keep adding a nickel to the last day’s savings. By the final day, you will have deposited $18.40.

Considering the numbers, you will be able to save up to $3300 at the end of the year!

8. $1 Bill Money saving challenge

This money saving challenge is pretty self-explanatory though. Every time that you receive a one-dollar bill as change, add it to your savings.

This challenge is likely to prove effective if you are already acquainted with using the envelope system. If your envelope starts to become too large, then shift all of your $1 bills to a jar.

Count all the saved $1 at the end of the year and spend it on something that is fun! You will be shocked considering how much you have saved!

9. Weather Savings Money saving challenge

A little fun can offer no harm, right? This money saving challenge happens to be one of the most fun options, and the story behind its origin is really interesting too!

A blogger located in Arizona had an idea that once a week, you will be depositing money into savings. Although, the money that you deposit in your savings must match the high temperature that day.

If you live in a mild area, this challenge is going to prove easy. For example, Residing in Arizona, the said blogger was able to deposit as much as $105 in the same week.

10. 31-Days To Improve Your Financial Life Money saving challenge:

If you are someone that doesn’t like to do things the easy way, this is a money saving challenge for you.

This challenge is going to take you step-by-step through the whole month of financial habits. These habits are totally going to swap the methods of saving and spending your money.

This Challenge depends on receiving a new task or a challenge on a daily basis. Moreover, you also get tools and resources to ensure that you are able to follow through.

11. 3-Month Money saving challenge:

If you have an issue with long term commitments, then this is the perfect option for you! This money saving challenge only lasts for three months. If you were looking for something that doesn’t go on for a whole year. You have found your pick.

Following this challenge, you will be able to save up to $1000 easily.

To do this, you will have to be saving $84 approximately. Now, this may sound a little tough, but following saving money tips, this can be considerably easy.

12. Spare Change Money saving challenge:

This Money saving challenge has bore a positive result for many people. Who knows, it just might work for you as well? As a matter of fact, we will do you one better.

Do you remember the movie “Up?” Even in that movie, it worked for them.

As soon as you get some loose change, make sure to put that money in a jar or in a piggy bank. Once you see that jar has filled up, take the jar to the bank and then add it into your savings account.

If you haven’t given this idea much though in the past, then this is the perfect reminder for you. Following this, you would be surprised how much you can save. However, if you

13. Expense Tracking Money saving challenge:

![]()

A lot of people don’t really track their expenses. Do you count yourself to be one of those people?

If yes, then we suggest that you start tracking your expenses. Tracking your expenses can be a great way to see wherever your money is headed and how you can cut down costs as you save more.

If you haven’t started doing this yet, then consider this as a perfect opportunity to start. Push yourself to write and categorize every single purchase that you make for the entire month.

14. 26-Paycheck Challenge for Smaller Budget:

If you are someone that is interested in budgeting every paycheck, this is the best money saving challenge for you!

In this challenge, you will be increasing the amount that you put into your savings by $10 every week. In the very first week, you deposit $10. However, in the second week, you will deposit $20.

However, this challenge caps at $60. Meaning that this channel is the perfect option if you have a smaller budget.

15. No Eating out Money saving challenge:

If you want something that works very quickly, then this money-saving challenge is the perfect option for you!

If you find the whole idea of saving money too intimidating, then just try stopping out for an entire month! Only by putting barriers to this habit, you might be surprised considering how much money you have saved.

However, depending on your needs, you can choose the period by yourself. For some people, three months work. Yet there are some people who save for a whole year.

Nevertheless, we are sure that you are going to be surprised seeing how much you have saved just by not going to the restaurants.

16. The Penny Money saving challenge:

This Money Saving challenge is going to sound very much like the Spare Change Challenge mentioned above.

However, there is a very prominent difference between the two of them. In the Penny Challenge, you are going to be saving only your pennies. In the challenge discussed above, you were saving all of your loose change.

It can get really surprising when you take a large jar of pennies to the bank and find out how much you have actually saved. Make sure that you add all of this money directly into your saving as soon as your jar fills up.

17. Cancellation Money saving challenge:

As demanding as it may sound, this money saving challenge is just as simple as the “no eating out” challenge discussed above.

Sit down and review and look at all of your subscriptions. Start canceling them out as much as you can. After that’s done with, go a step farther in the same direction.

Consider the places in which you spend money. Consider the apps in which you find yourself spending. Remove such things as much as possible.

18. Little Vices Money saving challenge:

This Money Saving Challenge is going to require some time and effort. So better make sure you are up for it.

This challenge is one of the toughest as you have to think about every single purchase you make. You will also have to ponder whether it’s a vice or it’s a necessity.

To simply put, Vice Purchases are the items and the services without which you can live. Vice Purchases include impulse buys at the register or having coffee while you are out doing errands.

However, this challenge is going to give you some options. You will have the option to either cut out all of the vices for the whole month.

Depending on how much money you need to save, you might also decide to shut out vices for a considerably larger period.

However, make sure that you end up picking a method that works the best for you. However, you should also make sure that you will be able to follow it through.

19. Round-up Money saving challenge:

There are some banks out there that let their users round up purchases to the nearest possible dollar. After that, they deposit the change into a joint savings account.

However, there is a chance that your bank does not offer this feature. Considering that, if you are interested in this money saving challenge, you should check out some banks that allow you to do it.

20. 1% Money saving challenge:

Another money-saving challenge that a person can take out without having to do a lot. Go to your workplace and increase your contribution by 1% to your 401(K).

Then after two months, you have to do the same process.

If you lack a retirement account or want to do this challenge without using one, all you have to do is calculate 1% of your gross pay.

After you have done that, divide the resulting amount by the total paychecks of that year. After that, put the amount into a savings account after receiving your first paycheck.

21. Money Throwdown Challenge:

You may not believe us, but this happens to be one of the most fun money-saving challenges on the list!

In this Challenge, you will basically be challenging a friend or a family member. In this challenge, you will see who is going to save the most money at the end of the month.

However, it would be wise to work out the rules and it would be a great idea if you came up with a method to help you evaluate how much money you have saved.

How to Stay Motivated Throughout a Money Saving Challenge?

When you take up smaller and quicker challenges, you are likely to make progress quicker.

It is also more likely that you won’t lose motivation. But, let’s talk about the challenges that last throughout the whole year.

Now, the best way to keep yourself motivated throughout a money-saving challenge is to keep track of your progress.

Get yourself a printable to keep track of your progress. On that printable, make sure to color in a box for every time that you save $100.

Keep this printable page in such a place where you see it more often. This will ensure that you stay motivated.

Conclusion

Most of the time, doing a challenge can prove to be one of the best ways to kickstart a new lifestyle. This lifestyle is usually better as it is made from budgeting and saving money.

Make sure to choose some of these money challenges and challenge yourself about how much you can save!