There are some scenarios in which a person could fall short of even as low as 100 dollars and they may need a quick loan. Luckily for such people, all hope is not lost.

National Small loan happens to be an emergency lender which can offer its customers personal loans of as low as $100.

These $100 can come in extremely handy if you are falling short of money to cover a short-term emergency.

If you need a loan and you may not have the best credit score, you should check out:

Contents

Everything that you need to know about taking a Personal Loan from National Small Loan:

Just like many other options, a National small loan happens to be an online tribal lender that only deals in smaller loans that can start from $100 and go up to $1200.

However, they have this policy due to which if it is going to be your first time borrowing the money from a National Small loan, you will not be able to take more than $500.

This Online tribal lender provides its services to people all around the United States, except for the mentioned states: Arkansas, Connecticut, New York, Pennsylvania, Virginia, Washington, West Virginia, and Wisconsin.

According to National Small Loan, they do not make use of the Three Major Credit bureaus that go under the name of Equifax, Experian, and TransUnion to consider the application.

However, this tribal money lender does use other national databases to check whether or not people are eligible for applying for a personal loan.

Let’s get into some more details about this tribal Money lender. Keep in mind that these things are important to be caught up on if you are considering taking a personal loan from National Small Loan.

National Small Loan Does not disclose its Potentially High-Interest Rates:

National Small Loan does not add the potential interest rates on its website. Instead of mentioning the potential interest rate, this tribal money lender discloses on its website that the users are going to know about the loan agreement once your loans are approved.

However, this happens to be a common phenomenon of lenders offering short-term loans and it also includes tribal lenders whose APRs go into triple digits.

Nevertheless, National small loans do mention upfront that they are “an expensive form of Borrowing” and should not be considered as a long-term financial solution.

This online money lender clearly states that your interest rate and fees are going to be decided considering a few different factors which include your credit and payment transaction history, debts, income, and employment status.

However, since there is no process for prequalification, there is no possible way for you to know about your interest rates unless after you have applied to get a personal loan from National Small Loan.

Having a Good Credit is Not Necessary for Qualifying:

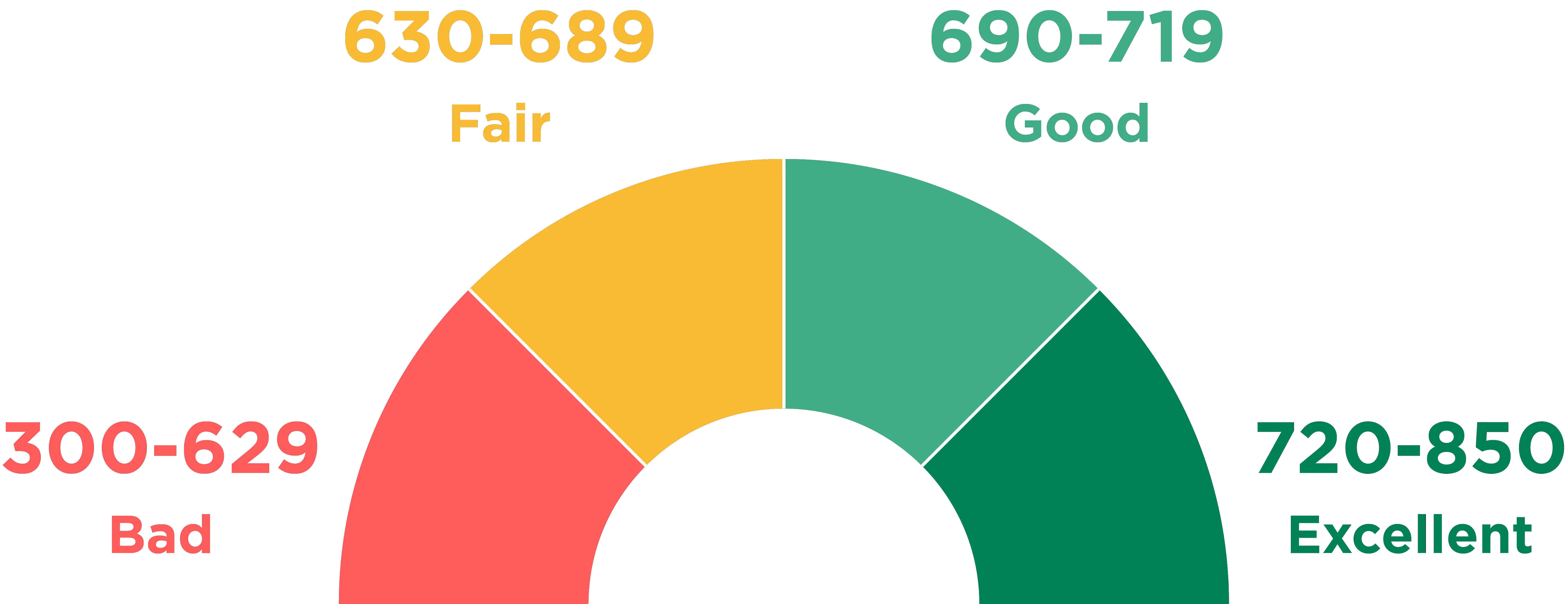

According to a national small loan, there is no need to have a good credit score in order to be eligible for signing up for a personal loan and it also states that it does not take credit reports from either of the three aforementioned major credit bureaus to check your credit.

However, National Small loan does check your credit through various other national databases.

However, we think that it is imperative that we mention that just because you do qualify for taking a personal loan, we don’t think that in any capacity, taking a loan from National Small Loan is a credible strategy.

Other than that, you will also need to do a thorough review of your budget so that you are able to calculate the total amount you will have to pay in return for your loan after paying its fees and interest.

Fee is Expensive:

When a person ends up repaying the loan, it mainly includes the major payment as well as the side charges such as charges incurred by interest or any of the fees for the loan.

However, if you are suffering from financial troubles, a National Small loan might end up charging you an extra fee for it.

Let’s say that Company Xyz is charging $25 in the form of an insufficient funds fee if the applicant fails to make due on their payment or somehow dishonors the terms of the contract.

If you take out a loan, you are going to be facing an additional charge of $30 on account of being late on the payment.

There is No Prepayment Penalty for Personal Loans:

This happens to be a slight advantage of considering national small loans.

When you take out a loan from National small loans, this online tribal money lender has no policy where it says that one cannot pay off their debt before the mentioned time.

This happens to be a common practice followed by many other online money lenders.

They end up incurring extra charges to the users on account if they pay off their loans before the date on which they are due.

Since this bank does not have any prepayment penalty for personal loans, we would suggest you consider that you pay off your loan before the dates are due, if it is possible for you to achieve that financially.

This will prevent you from any additional fees and different high APRs.

A Closer Look at A Personal Loan Granted by National Small Loan:

We have mentioned pretty much everything that there is to know about taking a personal loan from a National small loan.

However, there are some bases that are still left to cover.

We feel that since you may end up considering taking a personal loan through National Small Loan, you should have all the facts and figures so that you are able to make your decision for your betterment and it somehow does not end up being a trouble for you to cover up.

Here are some additional things that you must know:

When you take a Personal Loan from a National Small loan, it is highly likely that it will be fast funded:

This happens to be one of the biggest advantages of taking a loan from National Small loans.

They speed up the process of giving out the funds since the amount is not that big.

However, National Small loan has a policy that if a borrowing party is able to submit their documents within time and their request gets approved right before 2 PM, EST, Monday through Friday, a Small business loan is going to be giving out the funds within the next 24 business hours.

Small-Dollar Borrowing:

When you look for lenders on the market, there are many different lenders available.

However, there are many money lenders on the market that allow you to have loans of minimum of $1000 or more.

One good thing about National Small Loans is the fact that a National Small loan is going to offer you loans of as low as $100 dollars.

This allows you to take the loans that suit your need only and allow you to bite only that much that you can chew.

Vagueness of Repayment Terms:

There are no mentions of how long or how short the repayment terms of National Small loans may run.

This can get a little problematic for people as you will not be able to take an approximate of your loan payments until after you have applied and have been cleared for receiving a personal loan from a national small loan.

This plays at a disadvantage since this means that you will not be able to evaluate your options and the only way to back out from this loan will be to pay it all off.

Is it Worth Getting a National Small Loan Personal Loan?

National Small loan is very specific in that it offers personal loans only, which the online tribal lender refers to as “Installment Loans”, and not “Payday” loans.

However, this does not mean that their loans are affordable in any term. If anything, the company itself labels it’s loans as expensive.

As mentioned above, there is no possible way for you to have an estimate of your APR until after you have applied.

Seeing this fact, we suggest that you only consider a National small loan when there is no other viable option available.

How to Apply With a National Small Loan?

Since there are no storefronts or physical places for you to visit to register a loan with a National Small loan, you have the option to apply for a National SMall loan online.

However, there are a few things that you must know about submitting the application beforehand, that being that a National small loan has an age limit, a source of income, an active bank account required to grant people the loans.

Conclusion!

Here goes our review for the national small loan review. We have tried to be as detailed as possible so that you are able to evaluate whether or not if it’s a good option for you.