People argue to this day whether that every debt is not good debt.

Lending money from someone or taking can also solve major problems like purchasing a house or a luxury car.

It is the only way that most people can afford to purchase. Now and then we take debt all every time in the shape of a credit card.

But that is yet to be decided that not browning money is not a bad debt, it requires a deeper analysis of a particular and specific circumstance.

Let me give you a hint between good and bad debt which will I later explain it in detail but for now, remember these things.

Borrowing money from others or taking a loan from an individual or most probably banks with the intention of spending it in something useful,

Something that will help you in your future. In other words, having the potential of increasing your net worth.

Again, everything has its dark side, it has negativity and disadvantages. With that being said, the same statement as the previous.

“Borrowing money from others or taking a loan from an individual or most probably banks” but with a twist here,

In the intentions of purchasing a devaluing benefit. See how the last phrase of seven words changed the meaning of it.

Devaluing assets means that having to purchase something cheaper rather than its actual cost.

Contents

Secured And Unsecured

A secured loan is elaborate by the need for security.

What it means that the person who borrowed money will pay the moneylender on them or else they will not lose the collateral place.

While unsecured loans mean that the borrower will not have a risk in losing the security but inside he will pay his debt at a higher rate.

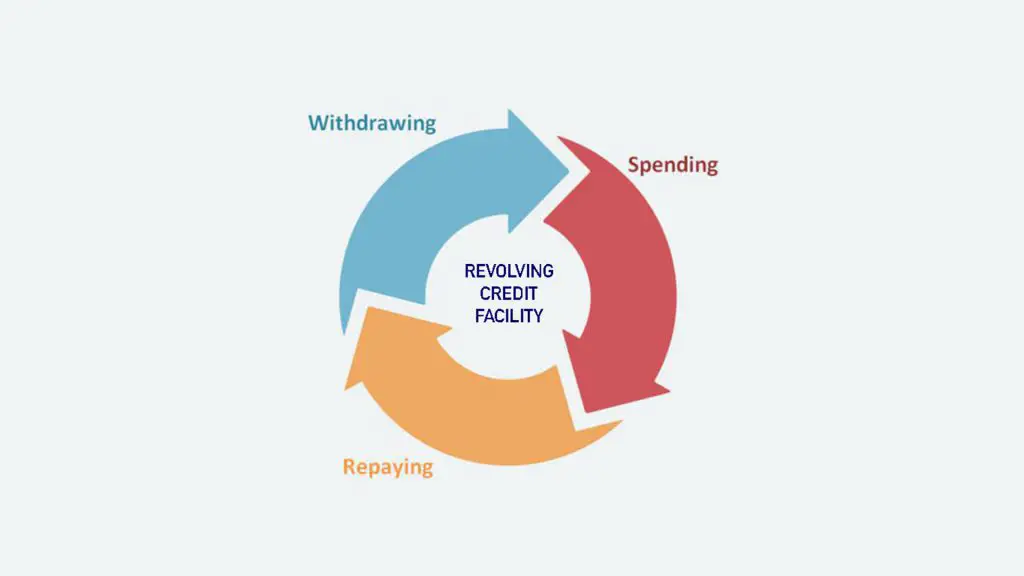

Revolving And Non-Revolving

This one is simple, revolving loan means that you will not have a fixed number or amount of debt you have to pay every month.

Sometime it may be more than the previous one like in the case of a credit card.

Non-revolving means that you will have a fixed amount to pay every month whether the interest rate is high.

The amount of your debt will remain the same.

Good Debt

According to history, good debt can be defined or be elaborated by “It takes money to make money”.

So if you make some money or borrow some money, to make it sound good in order to increase your income and net worth.

Then this might be considered positive. It is truly a good debt, there is nothing fishy about it. Let’s look at some situations where debt is worth taking;

Technical or Education: Having an education is the key to success. Having an education doesn’t mean that you are superior to others.

There are many people who are now a successful person and yet they don’t have a degree.

Now I am not saying that you don’t need education like if you want to be a doctor you need to learn about it. It is just a thing that I wanted to get out of my chest.

The reason for it to be is that many people say that you will have no future because of the grades you have, you are a failure but guess what that failure made me a millionaire.

Anyway back to the main topic, having an education is important. Education has a positive relationship with the ability to find a job.

People with better education have a high chance of getting employed with good pay. Thow much debt you need, you much choose the line of your field very wisely.

Choosing the program that will give a bright future is worthwhile rather than choosing a field that has no career path whatsoever and that will be considered as bad debt.

Business Ownership: Having your own business is one of the great things that happen to a person. You will be the boss of your business.

You will not have to rely on others to hire you and give you a paycheck. You know the third party.

The earnings you get from your business can be improved by hard work and determination. With that, you can raise the level of your enterprise.

Here is the twit though just like education where you have to chose the program that will give a bright future is worthwhile rather than choosing a field that has no career path whatsoever.

So by judging at this you need to be good at the knowledge of the business you are doing.

If you don’t then your business will be no more than an empty cage.

Real Estate, Including Homeownership: One of the ways that you can make money is by running a real estate.

Simply you can buy a house, stay in it for a couple of decades and then sell with a higher profit.

With a residential real estate, you can also get income by renting out the entire residence, and also commercial real estate will also be the best choice in earning some greens.

Bad Debt

The bad debt can be described as the complete opposite of the good debt because that’s what it means.

To increase the net worth buy borrowing money is a good debt while taking money for the purpose of not to increase in your net worth or to generate some cash is not the path you want to go on to.

Let’s look at some situations that is will lead you to bad debt.

Cars: Buying the car of your own dream is one of the best choices he or she can have.

Nowadays owning a car is mandatory, well that’s the case if you are eligible enough. In other words, if you can afford to buy it.

Cars, particularly today, are expensive. Having a car for work so that you don’t need to take buses and trains is a good choice. ‘

So paying interest on a car is not worthwhile. As soon as you get out of a car lot the price of the car you just bought will go down.

The best option for you is to spend some money on a used car rather than going for a brand new.

Again if you can afford it, if not you might take a loan, but be careful because you don’t want to buy a car that is too expensive because sooner or later you need to pay the loan back.

So go for the least expensive car and try to pay off the loan as quickly as possible.

Clothes, Jewelry, and Vacations: If you are not having the type of where you can go for a vacation or buy expensive things right away than I suggest you don’t do it.

Buying something expensive that you can’t afford is useless although you will get a loan but what difference would it make.

You will still have to pay the debt back and that will cause an even bigger problem because not only you have to pay it off but you need to have a better income.

Also Read: Capital Gains Taxes on Stocks | When to Pay & How to Pay Less

Which you clearly don’t have it or there won’t be a point of taking a loan.

Be patient save some money for your vacation or other expensive things that you want. It is a great option than borrowing money.

Credit Card: Credit card is hands down the best example of bad debt. We use a credit card to buy things we want rather than we need.

Because of that balance keeps getting piled up. It is so easy to think that we can buy things using a credit card rather than paying cash.

But in reality, it is worse. The interest rate becomes so high by the time we pay our debt.

Like the minimum payment of a $100 item can drastically turn it into a $200 item. Look how much that is. Though it gives a service it also has a drawback.

Types Of Debt

There are many debts that you can go for but to save time, I will b discussing 12 of them. In these types, there would be both good debt and bad debt.

I have explained it with full detail so you may easily spot the kind of debt that I am about to describe.

Debts To Friends And Family

There are many people who take money from there friends or family. It is common after taking a loan from the bank.

Also, you want to pay them back or else it causes a huge effect on your relationship.

Now, these types of personal debts are usually non-priority debts and you can deal the way it should such as overdrafts, loans and credit cards.

Another way is called priority debt, in which you give an authentic reason or a genuine reason for the cause of getting a loan.

Because you may have a good reason to make a higher payment and for that, a solid reason is required.

Rent Arrears

Another reason for you to pay your debt is by renting housing.

Many people don’t have there own house and therefore they rent a house where they sign an agreement for a certain amount they need to pay every month.

It is necessary for an individual to fulfil his or her duty to make the payments at the given time. I have seen many people who do this the right way but there are some who don’t do it.

May they have a genuine reason like having a problem with his or her job which can be sorted out.

But I am talking about those who don’t pay their debt in the given for no reason or maybe don’t pay them at all.

So know they are in the danger zone of getting kicked out of the house and the owner has every right to do it.

Because there was an agreement signed at the beginning and if they don’t fulfil it they will kick them out of the house.

So rent arrears are a priority debt.

Payday Loans

A short term loan is basically a payday loan. It usually takes a small amount of money.

The process can be very simple but the interest rate, that could be a headache as it is very high.

A payday loan can be quite difficult to handle because you have given permission called a ‘continuous payment authority’ to a company.

Wha does continuous payment exactly means? You must be wondering right.

Well, it where the company can take your debt directly from your bank account because you have the permission to do so.

Payday loans are typically non-priority debts and you can deal the way it should such as overdrafts, loans, and credit cards.

Parking Penalty Charges

Everyone has faced this problem once in there driving career. It really made people lose there mind.

Because if a person is having a bad day and they want to go somewhere to clear there thought and then they come and see this on their car’s windshield.

Your day has gone even worse. The local council is in charge of issuing a parking ticket but they are not considered as criminal fines.

They are also referred to as PCN’s (penalty charge notices). These debts are known as priority debts

Education

Having an education is the key to success. Having an education doesn’t mean that you are superior to others.

There are many people who are now a successful person and yet they don’t have a degree.

Now I am not saying that you don’t need education like if you want to be a doctor you need to learn about it. It is just a thing that I wanted to get out of my chest.

The reason for it to be is that many people say that you will have no future because of the grades you have, you are a failure but guess what that failure made me a millionaire.

Anyway back to the main topic, having an education is important. Education has a positive relationship with the ability to find a job.

People with better education have a high chance of getting employed with good pay.

Thow much debt you need, you much choose the line of your field very wisely.

Choosing the program that will give a bright future is worthwhile rather than choosing a field that has no career path whatsoever and that will be considered as bad debt.

Also Read: How Long Does It Take to Do Your Taxes? | Filing Estimations

Buying Expensive Things And Planing On Vacation

If you are not having the type of where you can go for a vacation or buy expensive things right away than I suggest you don’t do it.

Buying something expensive that you can’t afford is useless although you will get a loan but what difference would it make.

You will still have to pay the debt back and that will cause an even bigger problem because not only you have to pay it off but you need to have a better income.

Which you clearly don’t have it or there won’t be a point of taking a loan.

Be patient save some money for your vacation or other expensive things that you want. It is a great option than borrowing money.

Energy Arrears

Paying your energy suppliers it what makes a man cautious, especially electrical bills.

Because everything you own in your house from kitchen appliances to your mobile charger, everything requires electricity.

So if you don’t pay your bills and hopefully your future bills then according to the law the energy suppliers have a full authority to cut off your electricity.

Not just electricity, they cut off your gas, water, and eve telephone bills all because you were late on your debt.

This debt is also an example of priority debt.

Credit Cards

A credit card is hands down the best example of bad debt. We use a credit card to buy things we want rather than we need.

Because of that balance keeps getting piled up. It is so easy to think that we can buy things using a credit card rather than paying cash.

But in reality, it is worse.

Business

When a person wants to start his or her business he needs cash to do it.

So they will take some loans and when you take a loan from others it is mandatory to pay them back.

So having your own business is one of the great things that happen to a person. You will be the boss of your business.

You will not have to rely on others to hire you and give you a paycheck. You know the third party.

The earnings you get from your business can be improved by hard work and determination. With that, you can raise the level of your enterprise.

Here is the twit though just like education where you have to chose the program that will give a bright future is worthwhile rather than choosing a field that has no career path whatsoever.

So by judging at this you need to be good at the knowledge of the business you are doing.

If you don’t then your business will be no more than an empty cage.

Automobile

Buying the car of your own dream is one of the best choices he or she can have.

Nowadays owning a car is mandatory, well that’s the case if you are eligible enough. In other words, if you can afford to buy it.

Cars, particularly today, are expensive. Having a car for work so that you don’t need to take buses and trains is a good choice.

So paying interest on a car is not worthwhile. As soon as you get out of a car lot the price of the car you just bought will go down.

The best option for you is to spend some money on a used car rather than going for a brand new.

Again if you can afford it, if not you might take a loan, but be careful because you don’t want to buy a car that is too expensive because sooner or later you need to pay the loan back.

So go for the least expensive car and try to pay off the loan as quickly as possible.

Maintenance

Maintenance can be in the form of anything like your home maintenance or giving it to your spouse once you have been divorced.

Let’s talk about home, why it is necessary to give maintenance.

The reason is simple, you have people who collect garbage from the house, then you have people who take care of society.

Whether it is renovation or other, then you have a person you at the reception who knows all the information but each house and most importantly the security.

The security guard is the one who protects the whole compound from danger and he gets paid through your maintenance.

Real Estate

When it comes to types of debts, real estate is also one of them. One of the ways that you can make money is by running a real estate.

Simply you can buy a house, stay in it for a couple of decades and then sell with a higher profit.

With a residential real estate, you can also get income by renting out the entire residence, and also commercial real estate will also be the best choice in earning some greens.

Debt Recovery

Debt recovery is basically when you hire someone to look and focus on collecting money. The third party you are hiring is actually called collection service.

Your loans continue to pile up like in the case of credit card and most likely electrical bills where the amount keeps on getting added to the new bills.

Conclusion!

So there was the complete detail and guide on the types of debt and debt recovery.

A key point to remember is that no matter what happens you need to pay your debt on time or it will cause you a heap of trouble.

I don’t recommend to take loans but if want to then try using it in a good way.