You spend money cautiously. You trim all the luxuries out of your budget. In fact, you’re a great budgeter.

But it’s not enough. You still just barely scrape by every month.

That’s the situation I was in a few years ago.

I ended up getting the cheapest plans for all the necessities (phone plan, car insurance, etc). Because, in the end, those are things you HAVE to have.

Back then, I had to do most of the comparison shopping by hand. Nowadays, there are tons of online resources to help you find the best rate out there.

Today, I’m going to show you one of the easiest way to save on your auto insurance rates (car, home, renters, etc) using a tool called Gabi. This is such a better deal than having to call each insurance carrier separately to get a quote.

I tested the website out and here’s my full Gabi insurance review:

Contents

What is Gabi?

Gabi is an insurance comparison shopper, based in San Francisco, California, that never stops trying to find the best deals for you. It was founded by Hanno Fichtner and has an A rating from the Better Business Bureau.

They will help you find the cheapest car, home, renters, condo or life insurance. What makes them unique is that every time your policy renews, they’ll automatically check if they can find you a cheaper insurance provider to get a better rate.

They claim to find better (and cheaper) insurance policies for 70% of their customers resulting in an average savings of $460 a year.

Is Gabi.com safe to use? Legit?

Yes, Gabi is completely safe to use. They don’t sell your data to third parties. They claim that they don’t call you unless you request it and so far, that has held true to my experience.

Since Gabi is an insurance broker, there is nothing sketchy about using them to get your car, home or renters insurance. The actual policy will be coming from one of the big-name insurance companies and insurance agencies.

Gabi compares insurance coverage and insurance products from auto insurance companies such as:

- State Farm

- Geico

- Nationwide

- Safeco

- Allstate

- Clearcover

- and many more smaller insurance agencies

How does Gabi make money if it’s free?

Gabi is an insurance broker. What that means is that they’ll get a commission from the individual insurance companies every time they sell a policy.

This is a pretty standard business model for insurance comparison shopping sites.

My experience with Gabi: a comprehensive review

I haven’t shopped around for car insurance for a while. I had a feeling that I was probably paying too much. So I wanted to see if Gabi could really find me a cheaper policy that had the same coverage.

Signing up to use Gabi was a breeze. Also, completely free!

It asked for my name, email, phone number, birth date and address. All the usual things an insurance company needs to give you a quote.

Next, you’ll have to upload your current policy’s “declarations page”. Gabi needs this so they can find cheaper insurance for you with similar coverage. You don’t want a cheaper policy if it doesn’t cover everything you want.

I went to my current car insurance company’s site (Allstate) and downloaded the coverage pdf which I then uploaded to Gabi.

Unfortunately, my provider wasn’t one that Gabi could automatically process. So I had to wait 48 hours for them to manually process the details of my current policy. Normally, they can automatically process your coverage pdf which takes just a few minutes.

Luckily it took less than 24 hours for them to process my coverage.

Lastly, I had to input a few more details like my drivers license number, car mileage, etc. This took less than 3 minutes. They need this type of personal information to check your driving record.

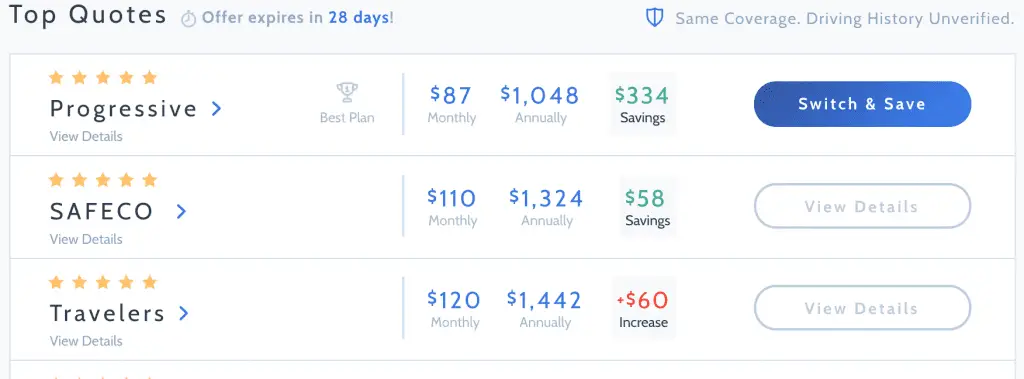

At the end of it, I got a list of quotes from a bunch of different car insurance providers that looked like this:

Woohoo, if I switched to Progressive, that’s $334 a year that I’m saving!

Of course, that’s exactly what I did. Switching plans using Gabi was just as simple. The insurance agent that emailed me was very friendly and helpful.

Finding the best car insurance for your situation is dead simple.

Even if you’re not looking to switch, you can get a large list of auto insurance quotes that you can take back to your own insurance service and try to negotiate a better rate.

Try out Gabi for free to see how much you can save on your insurance plan. 👈

Have questions? Check out Gabi’s own FAQ which might have the answer. Or leave a comment below and I can try and answer it as well as I can.

Gabi Review Summary: would I recommend Gabi?

Hands down, yes. Not only is the process dead simple, Gabi works for me and saved me $334.

I’m going to see if I can use Gabi to save money on my renters insurance also.

Use this link to get started and find out how much you can save on insurance. 🚗

For less than 5 minutes of your time, earn yourself a random stock whose value is anywhere between $5.00 and $200. It is possible through an investing app called Robinhood.