We get asked this question a lot: Should I claim 0 or 1 on my W4 allowance?

So let’s go through if it is better to claim 1 or 0 on your W4 tax form this year?

Contents

Do I Claim 0 Or 1 Allowance On My W4?

So should I claim 0 or 1 allowance? As I mentioned earlier in this article, depending on your specific situation, it may be beneficial to claim fewer allowances as you’re entitled.

The more allowances you claim, the less tax is withheld. This is a good situation to be in if you’re in good financial health and just have one job (having multiple jobs can make taxes more complicated)– as long as you don’t end up owing too much tax.

But, if you’re living paycheck to paycheck and don’t have any kind of emergency fund, then claiming fewer allowances than you’re entitled to may be a good option.

This means you’ll be receiving less each paycheck but at the end of the year, you’ll receive all the extra money that was withheld as a lump sum.

You can use your tax return to build up your emergency fund or to pay off any consumer debt.

You’re basically forcing yourself to save money from each paycheck. Just don’t treat it as a “bonus”.

You have to decide for yourself whether you want to “fool” yourself into savings or not by claiming extra allowances.

If You Had to Choose Between Claiming 1 and 0, Which One Should You Do?

To what extent you are eligible to make a claim depends on your personal circumstances and manner of living.

As was previously indicated, your marital status, number of children, number of employees, and other factors might inform which deductions you are eligible to take.

Consultation with an accountant or contact with an IRS representative can help you determine the answer.

Don’t stress yourself over marking the incorrect boxes on your W-4 form. You may revise your W-4 online or by using IRS-provided worksheets.

Changes are constantly made by individuals for a variety of reasons, including:

Working Two Jobs:

The most typical need for a W-4 form change is due to this. You should update your W-4 if you start a home company or earn second full-time employment.

One Partner Enters the Workforce or Switches Occupations:

Allowance tax brackets must be adjusted if a household’s income changes.

If one spouse’s income increases relative to the other, then that spouse may benefit by claiming the allowances.

A Jobless Person for A Period of Time:

With too much tax being deducted from your paycheck if you lose your job and are out of work for the rest of the year.

However, you will have to make up for the time off if you are rehired during the same calendar year.

You Tie the Knot or Split It Apart:

Your tax bracket may shift if you marry or divorce, particularly if both partners earn a living.

Divorce nullifies the tax savings and other deductions that come with filing jointly. If you don’t alter your withholdings, they could not be correct.

Your Partner and You Decide to Start a Family:

A child’s birth is a major tax event because of the additional dependant allowance it provides.

Adoptions also provide an additional tax credit. If any of these apply to you, you may wish to change your withholding amount to take advantage of the tax savings.

What Is A W-4 Form Anyways?

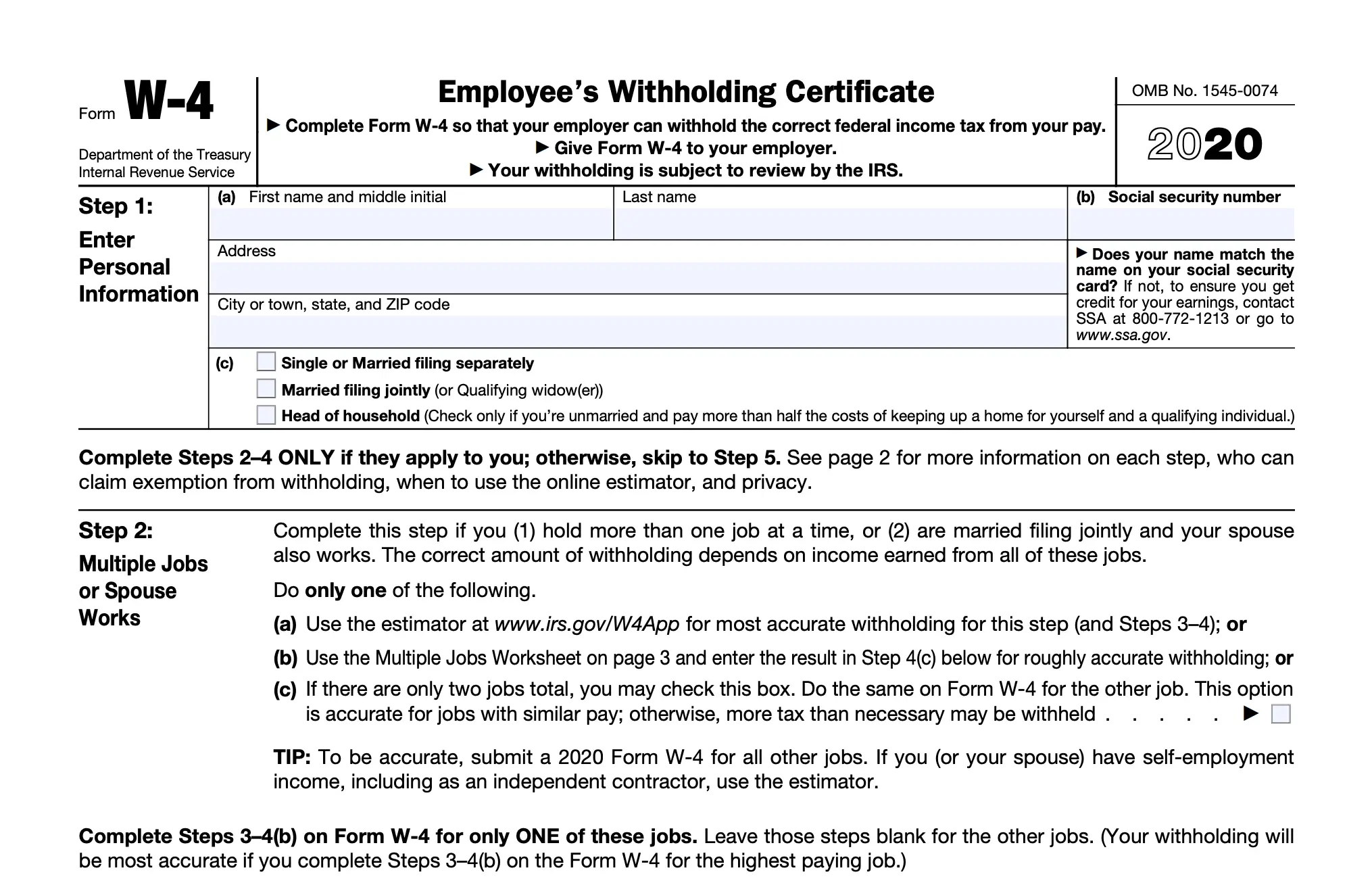

Formally known as the Employee Withholding Allowance Certificate, a W-4 form tells your employer how much federal income tax they need to deduct from your income. Deductions are also based on your earnings.

The more allowances you claim, the less money withheld from each payback but, in return, you’ll receive a lower refund, if any, at the end of the year.

The number you claim affects your take-home amount and your refund on tax day so it’s important not to write down just any number but to assess your situation and make a smart financial decision.

This is what a W-4 form looks like:

It has the same due date as a W-2, which is on April 15th, unless it falls on a weekend. In that case, they are due on the first business day after.

Make sure to prepare your taxes ahead of time, as we know doing your taxes can take a while depending on the complexity.

Here is a simple YouTube video that explains the process.

How Many Allowances Can I Claim?

How many allowances you can claim is determined by your filing status, how many – if any – dependents you have, and how many jobs you have.

If you have software like Turbo Tax, H&R Block, or free software to file your taxes then it will help you fill this part out.

But keep in mind, that you don’t have to claim all the allowances you’re entitled to.

In fact, depending on your situation, it might be in your best interest to claim 0, 1, or more than 1.

Claiming 0 Allowances:

Claiming zero allowances means that the maximum amount of taxes will be withheld from your paycheck.

This means that come tax season, you’ll most likely get more money back.

When should you claim 0 allowances? There are only a few situations where I would recommend you claim zero allowances on your W-4 form.

- If someone is claiming you as a dependent. When someone claims you as a dependent, they get the benefit of your personal exemption.

- This means their tax burden will be lowered, but yours will be a little higher which is why you should claim zero allowances.

- This doesn’t necessarily mean you won’t get a refund during tax time, however.

- If you know you’re bad at saving and want to save on easy mode. Despite what some may believe, your refund isn’t “free money”.

- Getting one means you’re overpaying on your taxes every paycheck and at the end of the tax year, the IRS returns the extra money you paid.

- This means you can easily “trick” yourself into saving money by claiming 0 allowances and then have the IRS e-deposit the amount due into a savings account.

- Of course, this is not ideal, because you’re not earning interest on that money for that whole year. But it’s a great way to force yourself to save.

Claiming 1 Allowance:

Claiming 1 allowance means that a little less tax will be withheld from your paycheck than if you claimed 0 allowances.

Here’s when I would recommend you claim one allowance.

- If your filing status is single and you have one job then this is the safe choice.

- If you are just an individual and barring any complicated tax situations, you’ll most likely still receive a refund.

- Though it will be smaller than if you claim zero allowances.

- This is the most common number of allowances claimed.

Claiming 2 Allowances:

You probably know the drill by now. Claiming two allowances means even less tax withholding from every paycheck.

Here are the situations in which you should claim two allowances:

- If you’re not married and you want to get as close as possible to break-even as possible (getting a $0 tax refund).

- However, depending on your tax situation, you may end up owing a little bit.

- If your financial health is good, this is the number of tax allowances I recommend that you claim.

- If you have a second job and your filing status is single, you’ll end up filling out a W-4 for each job.

- You can claim 1 allowance on each form W-4 OR you can claim 2 allowances on one W-4 and 0 on the other.

- If you’re married with no kids. If you file jointly, you can claim two allowances. One for you and one for your spouse.

- Not sure if you should file jointly or file separately? Here’s a good primer by TurboTax.

Claiming 3 Or More Allowances:

You can claim more than 2 allowances with your spouse if you have one child or more.

Basically, you get one allowance per child so your child tax credit is as follows:

- Claim 3 allowances if you’re married and have 1 child.

- Claim 4 allowances if you’re married and have 2 children.

- You can guess the rest.

How Many Allowances Should I Claim?

There is no definitive answer when it comes to allowances. It depends on a few factors, such as your income and the lifestyle you lead.

However, here are some general guidelines that may help you figure out how many allowances to claim.

First, it’s important to understand that allowances are not taxes. They’re simply a way of reducing your taxable income.

Second, allowances should only be claimed if you’re actually using them. Keep on reading to find out the ideal total number of allowances you should claim.

One of the first things you do, when you start a new job, is to fill out your W-4.

Can I Claim 99 Allowances?

You technically can claim 99 allowances BUT you definitely shouldn’t.

According to the IRS, 10 million people underpaid their taxes in 2015 and ended up having to pay a hefty fine – they have to pay what they owed, plus interest, and a fine.

This has personally happened to me when I accidentally underreported my income (it was my first year doing taxes!) and therefore underpaid my federal income tax.

Income tax is a pay-as-you-go tax which means you can’t just wait until payment is due to give all your taxes as a lump sum.

You have to either withhold enough tax from each paycheck or make quarterly estimated tax payments.

Withholding your taxes by filling out a W-4 form with the correct amount of allowances is the easiest way to avoid underpaying.

Can I Change My W-4 Allowance?

You can change the number of allowances you claim at any time. Just fill out a new W-4 and give it to your employer.

There are some life events that happen that change the number of allowances you should claim.

Getting married and having a kid are the two most common of these life events.

Can I Claim 2 on my W4?

It certainly is appropriate to claim 2 on your W4 form in many cases.

If you are married and filing jointly and you both are employed, and you have kids to claim as a tax credit, the personal allowance worksheet may tell you that 2 is the right number of allowances for your situation.

Note: Tax credit actually reduces the amount you owe, while tax deductions affect how much is taken from you by your employer.

Two allowances are actually the recommended number of allowances for most couples.

However, just because the personal allowance worksheet tells you that 2 allowances are the right claim, you may want to claim more or even less, than what is recommended.

Keep in mind, and I mentioned earlier in this article, that there are some benefits and downfalls to claiming more or less.

If you need to keep a bit more money in your monthly paycheck, you may want to claim more, and this can be handy for those that are living paycheck to paycheck, but this is a potential tax liability if you are claiming too much.

Just keep in mind that claiming more allowances than you are actually entitled to, may mean a hefty tax bill at the end of the year.

If you don’t want to risk a tax bill, you may want to pay more taxes now, and claim fewer allowances.

This will likely result in a larger tax return, which can easily be deposited into a savings account or used for other expenses.

Keep in mind, however, that your tax contributions aren’t a good “savings account”, there are better ways to save money than to pay more each month in taxes.

Can I Claim Exempt?

If you are tax-exempt it means you are not subject to any withholdings and you will keep all of your paychecks. However, knowingly lying is tax fraud and you may be subject to a penalty.

Only claim tax-exempt if the government gave that status to you last year.

If you’re not sure, don’t claim an exception – there can be some dangerous financial ramifications.

What Is the Average Number of Claims on W4?

According to H&R Block, the average number of claims on a W4 is 2.5. However, we do know that 0 and 1 are really popular options for people with a variety of tax situations.

It seems that lots of people, though able to take more allowances on their income taxes, choose to take fewer than they should or could.

In fact, on average most people are eligible for an additional 1-2 claims. If you have a kid or are in an education program then you can put a higher number down.

There is certainly some concern about that unexpected tax bill at the end of the year, and if you’re living on a budget, it might be easier to take a reduction in your monthly income, that you plan around than try to figure out how to pay a tax bill come April 15th since in that case, you’ll have to pay out of pocket to pay your income taxes.

Getting a tax return is another reason that many people choose 0 or 1. The reality here is that paying too much in taxes is just as impractical as not paying enough.

However, many would much rather overpay, and get a refund, than try to save money each month or do the work to have neither a refund nor a tax bill at the end of the year.

Of course, this is the ideal situation, but so frequently taxpayers see the refund as a great savings opportunity.

When Should I Claim 1 on W-4?

If you file a tax return claiming either option (1 or 0), your refund will be larger either every pay period or all at once in the spring.

Your total taxable income will be reduced by the number of allowances you claim. If you have just one job, you may put either zero or one.

Understanding the significance of the allowance number will help you make the most tax-efficient choices. Learning the meaning of “withholding” can help you make sense of this situation.

Your company will deduct tax payments from your paycheck before giving them to you.

As a result, rather than having to come up with a huge amount at tax time, you may make little payments throughout the year to cover this.

When compared to saving up the money you owe in taxes on your own and making sure you pay the right amount at tax time, this option may be incredibly handy.

Workers who are self-employed or on contract, for instance, do not have money deducted from their income.

However, in the majority of jurisdictions, this is a legal need for businesses to comply with their staff.

Importance of Permitted Expenses and Their Quantity:

When you file for a tax exemption, you are essentially informing the government that you do not owe a certain amount of money.

Having the maximum amount of federal income tax deducted from your paycheck is the result of not claiming any allowances.

You will get a tax refund for the amount you paid since you failed to claim adequate exemptions.

The Internal Revenue Service will notify you that you owe them additional money if they find that you’ve claimed too many allowances.

If you’re being truthful about your circumstances, you may increase the amount of money you keep in your pocket by claiming extra allowances.

Skip looking for “number of allowances meaning” online and read on to find out how much you’re eligible to deduct.

You may be left wondering, “How many allowances should I claim?” after digesting the above information regarding allowances and their significance.

This is conditional on your marital status, the number of dependents, and the number of jobs you have.

It’s common for a family with numerous children to be eligible for more benefits than a single individual with a single income.

You are not entitled to any allowances if another person, such as a parent, claims you as a dependent.

It all depends on your individual situation, but you and your spouse may be able to file under a single allowance.

If you and your spouse do not have children, but both of you are employed, you may want to explore splitting the allowance.

Income Tax Deduction Claim 1:

Choosing option 1 on your tax return may be the best choice if you’d rather have your money distributed throughout the year rather than all at once as tax season rolls around.

When you file Form W-4, Line 1, you may minimize the amount of taxes taken from each paycheck and get more of your income in the present rather than waiting for a tax return.

If you claim 1, you may be able to increase your paycheck without giving up any return. It really simply depends on the particulars of the case at hand.

A claim of 1 might be appropriate if the individual is childless, has just one source of income, and is employed full-time but not by a spouse.

If you are a single person without any dependents and you have two jobs, you may put them both on one W-4 and leave the second one blank.

History of W-4 Before [year]:

You may take advantage of a tax loophole if you start a new job throughout the year but were not working at the beginning of the year.

Your employer must utilize the part-year approach to calculate your withholding if you will work for less than 245 days in a calendar year.

If you don’t use the part-year option, the usual withholding calculation will presume you worked a full year and you won’t receive your overpayment returned until you file your taxes.

You may tell your employer how much money to withhold from your paycheck for federal taxes by filling out a Form W-4, which is provided by the Internal Revenue Service.

If you don’t, you can end up overpaying or underpaying in taxes.

Filling out a W-4 is simple if you do not have any dependents, are not filing for any tax credits or deductions (other than the standard deduction), are not married to someone who works, and only have one job.

Complete the form by adding your name, address, Social Security number, and filing status, signing, and dating it.

The opposite is true if you have dependents, a spouse with income, or want to claim tax credits or deductions, all of which make your tax position more complicated and need extra documentation.

Also, if you were confused about “how many exemptions should I claim?” I hope you got your answer.

Depending on your personal circumstances, you may utilize Form W-4 to adjust your withholding amount.

If you had a high tax bill when you filed your return last year, for instance, you may want to consider raising your withholding.

If you follow these steps, you may be able to reduce your tax liability the next time you file.

If you received a large return last year and want to keep more of your salary in your pocket this year, you may wish to adjust your withholding accordingly.

Can I Change the Number of Allowances that I Claim on a W-4?

Complete and submit a new electronic W-4 form if you need to make any adjustments to your exemptions or allowances.

You’ll have the most federal taxes taken out of your salary if you declare zero on your taxes. You should claim zero exemptions if you want to maximize your tax refund.

Those that choose zero often desire a one-time cash payment to utilize whatever they choose, including:

- Put money toward debts.

- Take a trip.

- Invested in a loan.

Your refund cheque will be greater if you claim $0. If you increase the amount of money that is withheld from each paycheck, you will pay more in taxes than you will likely owe and get a refund for the difference.

This is similar to opening a savings account with the government each year. There are a few more scenarios in which you could have to claim zero:

If you are working and your parents still consider you a dependant, you may be required to list zero dependents on your taxes. This is true whether you are 16 or 20.

If you are self-employed, work on a contract basis, sell stocks or collect interest from your savings account, these sources of income may not be subject to federal income tax withholding.

Claiming zero for those years might help you avoid paying taxes.

Frequently Asked Questions

Should I Claim 1 or 0?

So, is it better to claim 1 or 0? It is better to claim 1 if you are good with your money and 0 if you aren’t.

This is because if you claim 1 you’ll get taxed less, but you may have to pay more taxes later.

If you do you’ll have to address this out of pocket and if you didn’t save up enough you may have to wait to take care of your tax bill.

If you put 0 you’ll be taxed more but are much more likely to get a refund.

Some people prefer putting 0 because they don’t have to worry about saving money for their tax bill and would rather get less money now and a tax-refund check later.

What Does It Mean to Claim an Allowance?

The more allowances you claim on your W4 the less income will be held back by your employer and the more money you will get in your paycheck.

The most common allowances to claim involve being a full-time student, a dependent (if someone claims you as a dependent, often children), or marital status.

While you can claim as many as you want there can be consequences to not paying enough taxes.

You may have to write a check to the US Treasury when it comes time to do your taxes, and if you owe $1000 or more you will be hit with an additional fee due to a “large misrepresentation of taxes“.

Waiting multiple years to pay it off can also result in you paying interest.

How Many Allowances Do I Claim on W4?

You want to claim the number of allowances on your W4 that is honest – the average is 2.5.

Don’t aim to claim a specific number. The more honest you are the fewer surprises you will have come tax day.

How Many Exemptions Should You Claim?

The simple answer is: You need to claim the correct number of exemptions for your situation.

The number of personal and business tax exemptions you’re allowed depends on the type of income you receive and whether your business has a qualifying profit from which to calculate its profits.

There are two types of personal tax exemption: dependent and independent. And there are two different types of business tax exemption: passive and active.

Each type has its own set of rules and restrictions, so it’s important to know which one applies to you.

Below, we explain what each type is, how many exemptions you should claim, and some common mistakes people make with their taxes.

Can I Claim More than 10 Allowances?

You certainly can claim more than 10 allowances, but if you are falsely claiming them then you will owe the US Treasury & Government money.

How much depends on the difference between how much you should actually claim.

The more false claims you make the more you’ll owe and you will likely have to additional taxes on April 15, in addition to fees.

What Is Claiming 2 on Taxes Mean?

Claiming 2 on taxes means you are claiming 2 allowances on taxes. The average number to claim is 2.5.

The higher the number you are claiming the less your employer withholds from your paycheck.

However, when you file your taxes if you claimed a higher number than you are supposed to you will have to pay taxes on that amount.

What Is the Maximum Tax Refund You Can Get?

There is no dollar amount when it comes to the maximum you can get. It is relative to how much you make and the number of allowances you didn’t claim.

The more you make and the fewer allowances you claim (minimum of 0) will enable you to have larger tax returns.

Do You Get a Bigger Tax Refund if You Make Less Money?

You do not necessarily get a bigger tax refund if you make less money.

The amount you get is directly proportionate to how much money you make and how many claims you could have but didn’t make.

If you make more money you are eligible for a larger tax refund (because it is proportionate to your income).

The fewer claims you make the more likely you are to get a higher proportion of your money back as a tax refund.

Will Tax Returns Be Bigger In [year]?

Tax returns will not change in [year]. However, there will be a slight change in income tax brackets which could affect the amount of money you get from a tax return, depending on your new bracket.

How many allowances do you claim? Are you planning on changing the amount soon?

For less than 5 minutes of your time, earn yourself a random stock whose value is anywhere between $5.00 and $200. It is possible through an investing app called Robinhood.