Stocks can be a fantastic investment. If you’re willing to risk the volatile market and play the stock game to make some extra money, you can do very well.

Find the right stock, watch it soar, and you can make a killing as long as you don’t venture more than you can afford to lose on unstable stocks.

While this is great, it’s not immune to the whims of Uncle Sam.

You will still need to deal with taxes on any income you make by investing in the stock market. A lot of people don’t know this, and even those that understand have only a vague notion about how taxes on stocks work.

It can get a bit complicated when trying to figure out how to calculate taxes for your stocks and it can take a long time to figure out how much is owed.

After all, there are more factors to stock gains than just amount and payout.

The amount of money you owe will be determined by a lot of different things – the type of stock or capital gain you invested in, how long you’ve owned the stock when you earned the income, and how much you earned. Your annual income also factors into the taxes. Depending on your stock options these may or may not apply – read this article on box 12 for more information if you have stock options with your employer.

This article is going to break down how taxes work in the stock market. Let’s take a look at the different types of taxes with stocks. By the end, you will be able to invest with confidence, knowing everything you need to know about what will and won’t be taxed.

Contents

When do I owe taxes?

You will not have to pay taxes simply for having stock.

However, if you sell any of your investments and make a profit, you will be taxed. This tax is called a capital gain. These have a special tax rate based on how long you’ve held the asset.

Why do they use so many things to determine how much you owe in capital gains taxes?

Let’s look at the different ways you get taxed on your stocks. There are capital gains, which apply when you sell your stock and assets.

These are going to be less money than a regular tax rate most of the time. These taxes come due when you sell the stock for more than what you paid. They are taxed based on how much money you earned above what you paid.

The other type of tax is taken based on dividends. If your stock holdings pay you money when the company succeeds, then you can earn this dividend income by owning the stock, rather than by selling it. The taxes you owe will be determined by the type of dividend.

Regular dividends are taxed just like income tax. There are some different things that qualify a dividend for this rate, like whether you’ve owned them for at least 60 days and whether it’s a US corporation.

Selling Your Stocks

When you try to figure out what you’re earning and paying from the sale of a stock, you need to understand an investment formula and what each variable means.

There are special circumstances that can reduce your taxes when you sell as long as you track the factors and subtract your basis.

These can prevent you from being required to pay taxes on the entire amount of the check you receive when you sell.

Here’s the formula: Sales Proceeds – Basis = Taxable Profit (Or Deductible Loss)

Sales Proceeds

This is the check cost. This can be adjusted to reduce your taxes. For instance, if you have invested through a broker or a site that takes a commission for access to their platform, this cost can be deducted from your sales proceeds.

Basis

The basis is what you paid for your stock. If you received dividends that got reinvested back into the stock, then you’re allowed to factor that into the cost as well.

If you paid commissions out to receive the stock, the commission can also be added to this area.

Inheritance

This is also where inheritance can make it tricky.

Sometimes, people inherit their stock portfolios.

If you’ve inherited the stock, then your basis will be the fair market value of the stock for the date of the person’s death, when they were legally transferred to you.

You can also use an alternate valuation date in some circumstances.

Gifts

If someone decided to give you some stock as a gift, then you determine the basis from the date the stock was given to you.

The basis is the lower of the fair market value or the basis of the donor when the gift was made.

Essentially, if the fair market value when the stock is gifted is $12 and the basis when the gift giver bought it was $15, then your basis is $12.

If, however, the numbers are reversed and your acquisition date’s value is $15 and the gift giver’s acquisition was $12, then you go with their basis instead.

Taxable Profit or Deductible Loss

When you calculate the sales proceeds and the basis, you will end up with either a positive or negative number.

If the number is positive, congratulations! You’ve earned money on the stock market. This is what you will be taxed on when your taxes are due for the year.

If the number is negative, then you’ve lost money in the stock market. The bad news is that you’ve lost money.

The good news is that this is deductible from your total owed taxes.

Since you’ve lost the money, you can take this number and count it as a tax deduction for your normal rate, reducing the number of taxes you owe for the year.

Capital Gains Taxes

When you sell off an asset or holding and make a profit, rather than a loss, you will be taxed.

This category is called a capital gain tax. These are taxed at different rates based on the length of time you’ve held the asset.

There are other things that determine whether something qualifies for this special tax rate, too.

What qualifies as capital gain?

The special tax rate for capital gains is a really nice perk because it is usually much more forgiving than other taxes.

This means a lot of people want to claim what they can. A lot of people will try to claim all of their capital holdings at this special tax rate, but very few items are allowed to do so.

Obviously, stocks, jewelry, bonds, coin collections, and your property are all considered capital assets.

Unfortunately, not all of them qualify for the special capital gains treatment. Business inventory and depreciable business property are excluded.

You also can’t claim certain things that have been created for you. Copyright property (like books, music, and art) is not included.

Neither are patents, designs, models, or secret formulas sold after 2017.

Is my capital gain short term or long term?

Even with something that qualifies for capital gains, the tax rates vary greatly.

There are short term and long term capital gains, and it is important to know which one you qualify for when selling.

If you have had your asset for less than (or equal to) a year, then your asset is considered a short term capital and will be taxed at the short term capital gains tax rate.

These rates are the same as your tax bracket.

Long term capital gains tax is the rate given to people who sell an asset they’ve held for over a year.

These tax rates vary between 0%, 15%, or 20% based on your taxable income and filing status. Long term capital gain tax rates are usually much lower than short term capital gains rates.

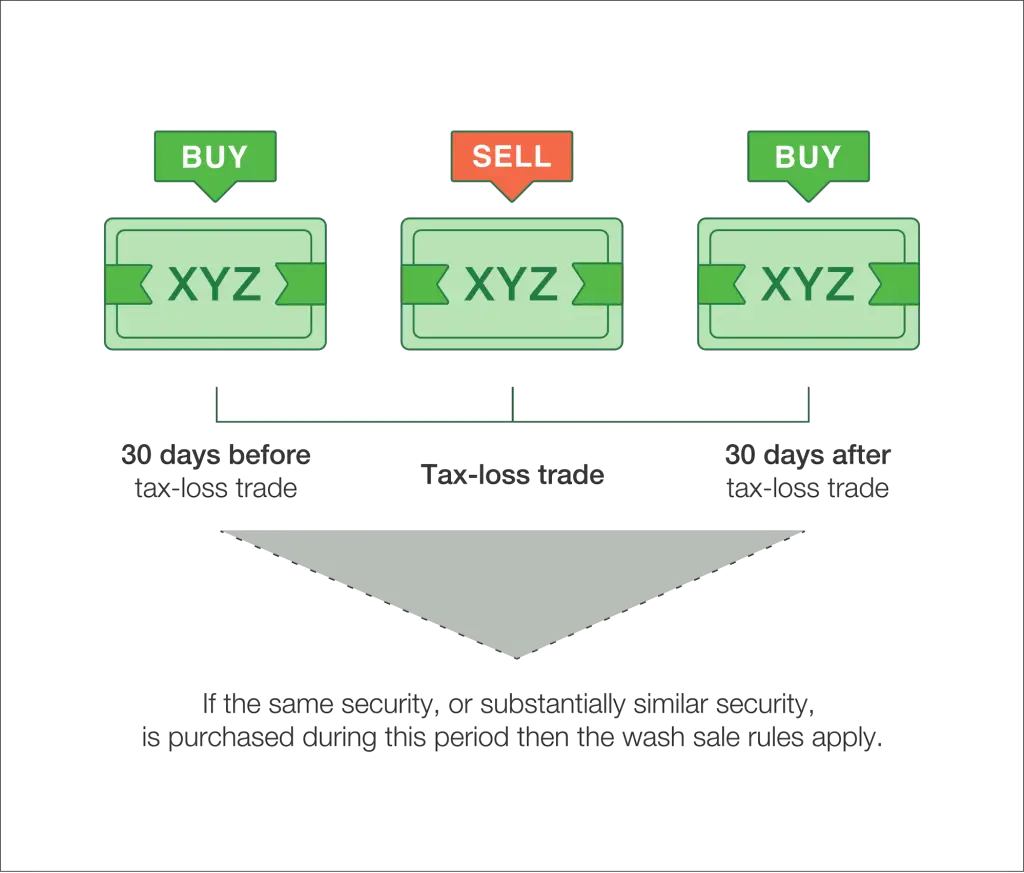

The Wash Rule

A lot of savvy investors have taken advantage of some of the leniency in the tax codes on stocks and capital gains.

They would decrease the amount they owe by selling a stock at a loss to offset the profit they make from another sale.

Once this happens, they will turn around and buy the stock back, leaving that money invested and thus not being taxed.

To prevent this from happening and make sure people were paying the taxes they owed, the IRS introduces new legislation.

If you sell a stock but repurchase it within 30 days, the IRS will not allow you to claim it as a capital loss.

This ensures that you can’t just go offset all your gains through losses you know very well you don’t plan to actually lose.

Capital Gains Tax Rates

We have mentioned that tax rates vary for these assets. Let’s take a look at the differentiation process for you.

This way, you should have an idea of how much you will owe in taxes on the sale and where you fall in the varying rates.

No Taxes Owed If…

Traditionally, investment has belonged to people who had significant amounts of disposable income to drop into the stock market.

However, this is no longer the case.

The government has tried to make the market friendlier towards investment, and more and more young people are finding easier access to the stock market thanks to apps that make investing quick and easy and don’t take much commission off the top.

An initiative to encourage investment laid out a specific exemption form capital gain taxes for certain people.

If your annual income is lower than $39,375 as an individual, or $78,750 as a married couple, then you are not required to pay anything in capital gains taxes.

The 15% and 20% Capital Gains Tax Rates

Like federal income tax brackets, this tax on capital gains increases with your earned income and ability to pay.

Taxes are built on a system that ensures everyone pays into the system their fair share of the burden.

Because of this, those with an income of $39,376 to $434,550 your capital gain tax rate is 15% instead of nothing.

If you are making $434,551 or more per year, then you will pay capital gains taxes at a rate of 20%, which is still much lower than the short term tax rate.

This is the current cap on capital gains tax, so you will never pay more than 20% unless new legislation is introduced and passed that provides for higher tax rates on these gains.

Is there a way to lower the capital gains taxes I owe?

One of the methods for reducing the amount you owe in taxes is by ensuring that you deduct as much as possible. Take away all of the fees you pay.

Remember, if you pay a brokerage fee then you will be allowed to deduct that. If your platform takes a commission as well or charges a service fee for use, you can deduct it.

If you’ve lost any money on stocks, it’s considered a capital loss. Sometimes, it can be strategic to sell at a loss in order to reduce the amount of taxes you owe.

These losses can offset some of your gains. For example, if you sell a stock that earns you $2,000 but also sells a stock that costs you $1,000 in losses, you will be taxed on $1,000 profit, not $2,000.

Just remember, the IRS introduced the Wash Rule to prevent people from taking advantage of this strategy to sell and immediately repurchase junk stock.

Make sure that if you want to claim a loss, you wait 31 days before repurchasing the stock.

The stock market is meant to be a long term investment, which is why they lower tax rates on long term assets and holdings and enact these types of laws.

Taxes on Dividends

Now that you understand capital gains taxes, let’s take a look at the other side of the stock taxing system – dividends.

If you retain a large number of your holdings, instead of selling them, you may still owe taxes.

With stocks, index funds, and mutual funds, you will receive payments from the company on a somewhat regular basis. These payments are what we call dividends, and you will be taxed on your dividends.

Furthermore, even if you own bonds, you will have to pay taxes on any interest you earn from them.

These taxes will vary based on what sort of bond you own. Mutual funds require you to pay taxes on your dividends plus additional taxes upon the sale of these managers.

Dividends are also qualified into separate categories.

For nonqualified dividends, you will pay the same tax rates as your income tax bracket.

For qualified dividends, you will pay 0%, 15%, or 20% depending upon your filing status and taxable income.

In this way, they work much like capital gains brackets.

Qualified Dividends

Qualified dividends come with an advantageous reduction in the tax rate. There are a few things that determine whether or not your dividends qualify, or whether they are “ordinary” dividends.

US Corporation

Qualified dividends are paid by a US corporation or a qualifying foreign entity. This one is the easiest qualification requirement to meet because many investors will invest in American stocks rather than foreign ones.

IRS Guidelines

It also needs to qualify as a dividend according to the IRS regulations.

Some things won’t make this qualification.

For example, insurance premiums and company kickbacks are not qualifying dividends.

Annual distributions from credit unions to their members are not qualifying dividends.

If you are receiving a “dividend” from a co-op or a tax-exempt organization, then you are not receiving a qualifying dividend.

Long Term Holding

If your dividend meets the first requirement and doesn’t fall into one of the second categories, then there’s another test.

Investments are all about the long term.

The market was designed to be a long term investment in the company and economy, so you only get these massive perks and bonuses for long term investments.

Therefore, in order to qualify for a lower dividend tax rate, you must hold the security for a long enough period of time.

This is where the final requirement gets a bit difficult.

Typically, if you own the security long enough to make dividends, you are usually qualified under this time requirement.

There is a 121 day period of time that starts 60 days before the ex-dividend date (or the date that you need to own the stock to gain dividends), so holding them this long qualifies you.

The exception is preferred stock, which has its own set of rules.

For example, if you own stock in ABC Corp., and that stock pays you a dividend on September 1, with an ex-dividend date of July 20, then you will need to hold shares in their stock for a minimum of 61 days between May 21 and September 19th to qualify.

For the count, including the day you sold the shares but do not include the day you purchased them.

If you haven’t owned the shares for long enough, then the IRS will not consider them qualified.

You will have to pay the higher tax rate instead. Remember, that there are a lot of unusual exceptions.

Reporting Dividends

At the end of the year, if you have made over $10 in dividends, the IRS will send you a Form 1099-DIV.

It may also be a Schedule K-1 instead.

This form lets you know what you’ve paid and whether your dividends are qualified or ordinary (nonqualified).

If you’ve received over $1500 in dividends over the year, you will also need to fill out a Schedule B form.

If you haven’t received cash dividends because you’ve automatically reinvested them in more shares of the stock (like dividend reinvestment plans or DRIPs), you will still need to report the reinvestment; it just won’t get taxed as a profit at that moment.

You also need to report any dividends earned from investments sold during the year.