Do you want to know the secret to paying off your debt fast and achieving early retirement?

The answer is simple: building multiple streams of income – two, three, four – the more, the better.

Generating multiple income streams has a huge impact on your financial life. Even if your side hustle only earns you an extra $300 a month, that is a life-changing amount if you put it to good use. Your side project makes you 300 dollars instead of you make 300 dollars.

I’m going to start by explaining why everyone should strive for multiple streams of income. Next, I’m going to walk you through how to find the side hustle that’s perfect for you. Finally, I’m going to help you get started by giving you 7 great multiple streams of income ideas.

Contents

The Value of a Creating Multiple Streams of Income

We are going to conduct a little thought experiment:

What would your life look like if you earned an extra $1000 a month with your side hustle?

I chose $1000 a month for this example because everyone has the potential to make this much extra income a month. We’ll discover exactly how later in this article and in future articles. For now, think about how an extra $1000 a month would change your life.

Here are a few examples of what you can do with that extra income:

- Invest the money to become a millionaire in 26 years. If you put the $1000 into a retirement account every month that earned 8% interest, you’d be a millionaire ($1,036,209 to be exact) in 26 years. That’s the power of compound interest. This also means you could fund your retirement solely with the money from ONE of your multiple income streams. If you do this, you’ll reach financial independence and early retirement much quicker than your peers.

- Pay off your debts. If you have some credit card debt or even student loans, using your second income stream to pay those off faster is an amazing idea. You can avoid paying interest and increase your credit score. This extra income could also cover some, if not all, of your mortgage payment.

- Spoil yourself with a luxury vacation or a permanent one. If you decided to be a little less responsible with your extra income, you could go on a $12,000 vacation to an all-inclusive resort once a year. Or you could quit your day job and travel the world indefinitely on $1,000 a month.

But, the value of having multiple income streams goes well beyond what the extra money can buy you. Most importantly, having multiple streams of income gives you security, flexibility, and autonomy.

- Security comes from knowing that if you lost your job, you won’t lose ALL your income. $1000 a month will greatly extend how long your emergency fund will last.

- Flexibility is gained because having multiple income streams opens doors. With a bit of work, your side could easily become your main gig. New opportunities will always present themselves. By having an extra income stream or two, you can take advantage of them.

- Autonomy means being free from the politics and external influences of your 9-to-5 job. When you set your own schedule and work for yourself, you can say yes or no to whatever you want.

Why You Need Multiple Streams of Income

It’s common knowledge that you should diversify your investment portfolio. Fewer people realize that you also need to diversify your income streams. If you only had one stream of income and that stream suddenly and without warning dried up? For example, if you get laid off. How much trouble would you be in?

Without a source of income your investments won’t grow – excluding interest on investments. Even worse, you won’t be able to keep funding your lifestyle. You might have to go into debt until you find another source of income.

People like to say that entrepreneurship is risky. But they fail to realize that once you build multiple streams of income, entrepreneurship is less risky than a salaried job.

We can see this in action by considering the following:

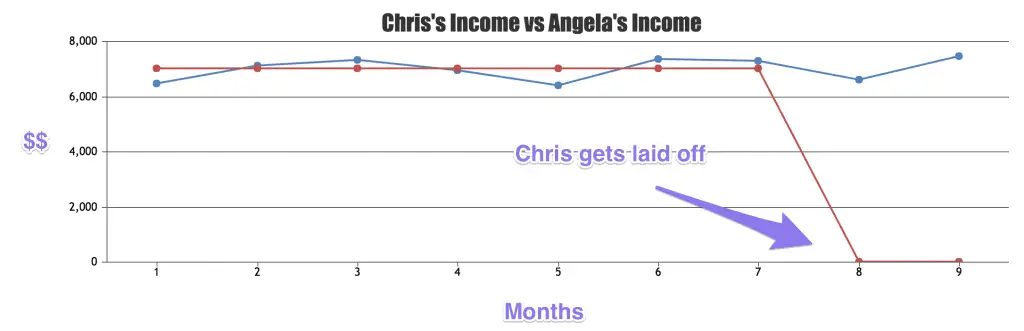

Let’s say Angela has built multiple streams of incomes. She runs a blog, sells crochet kitten-mittens on Etsy, and has a small dog-sitting business. All these sources of income add up to average around $7,000 a month.

Chris, on the other hand, works in middle-management at a grocery chain. He also takes home $7,000 a month – from his salaried position.

Who’s exposed to more risk?

Angela’s income will fluctuate month-to-month. The kitten-mittens industry is a competitive one after all. But the chances of her income going from $7,000 to $0 in one month are extremely low. Angela can always crochet more mittens or find more dog-sitting clients if she needs extra income.

Chris, however, is exposed to a large risk. If the company he works for has a bad year, are downsizing, or want to replace Chris with a younger cheaper college hire, Chris can go from a comfortable bi-weekly paycheck to $0 in a few hours. The worst part is that most of the time, there’s nothing Chris could have done to avoid being let go. He was lulled into a false sense of security.

Building multiple income streams outside of your 9-to-5 job mitigates the risk of going from hero to zero in seconds.

I don’t know about you, but the risk of losing my whole income in one fell swoop and leaving me helpless and vulnerable is not one I’d like to take on. That’s why I started creating multiple streams of income.

How to Find the Best Second Source of Income for You

Have I convinced you of the need for a second source of income yet?

Yes? Good.

The next step is to find the perfect side hustle. This is going to vary from person to person so I can’t give you a definite answer. But, whenever I assess a possible income stream here are the criteria I want it to meet.

The income source has to:

- Give you freedom. The whole point of creating extra income streams is to increase the amount of freedom you have. If your income stream isn’t flexible and doesn’t allow you create your own schedule, then you might as well get a second job.

- Have good earning potential. You won’t be working on your side hustle 8 hours a day so it has to have the potential to bring in a decent amount of money for the number of hours you put in. Ideally, you want the money you earn to not be tied to the amount hours you work.

- Be something you’re passionate about or at least something you’re semi-interested in. Working on your side hustle consistently is important. You won’t last long if you don’t actually enjoy doing the work.

- Have a low barrier to entry. You can’t start a real-estate empire if you don’t have the capital required to buy property. You can’t drive for Uber if you don’t own a car. You can’t start a travel blog if you’re stuck in the middle of nowhere Kansas. You get the point. Every side hustle has a barrier to entry, make sure you pick one where you meet the requirements. But remember, the lower the barrier to entry, the more competition there normally is.

Get Started with These 7 Multiple Streams of Income Ideas

Ready to start building your streams of income?

Here are 7 great ideas for a second, third or even fourth income stream. This list is by no means exhaustive. You can monetize nearly every hobby with enough creativity.

I’m just trying to get you thinking about potential side businesses.

1. Write for an online publication

Are you the type of person who enjoyed writing essays in school?

Then freelance writing may be the perfect extra income source for you. There are many blogs and publications out there that will pay you to write for them.

If you happen to have specialized knowledge in a niche then you can command an even higher price per word. It’s not uncommon for freelance writers to make upwards of 25 cents per word. That’s $250 for a well-written 1000 word article.

Take Action: Elna Cain has a great resource on how to get started with freelance writing.

2. Start a blog or website.

It’s crazy to think that there many people out there making a living by sharing their opinions online. It’s a wonderful time to be alive. If you have something to say or something you can teach others, then you should consider starting a blog.

You can be well-rewarded by providing value to other people. Pat Flynn, over at Smart Passive Income made $167k in December 2017 by helping other people start affiliate sites. Yes, you read that correctly. In one month he makes over double the annual U.S. household income.

Take Action: Interested in starting a blog? Learn more about blogging for a living.

3. Live-stream your game-play on Twitch

Didn’t I say you can monetize pretty much any hobby? If you’re a gamer at heart, then you’ve probably heard of Twitch. It’s a streaming site where you can watch people play video games. The more popular streamers on Twitch make thousands of dollars a month from fan donations. Fortnite player, Ninja, recently explained how he made $500,000 in ONE MONTH by streaming his gameplay. Of course, it helps if you’re the best of the best in your game and have Drake play with you.

But even if you’re not the best, if you’re funny or bring something exciting and new to the table, you can make good extra income by playing games and live-streaming it.

Take Action: Learn more about live-streaming games as a side hustle.

4. Create Youtube videos

If live-streaming isn’t your thing you can still create informative or entertaining videos and upload them to YouTube. There are YouTube channels dedicated to the weirdest topics. Ryan, a 5-year-old kid who reviews toys on his channel is one of the newest and youngest YouTube stars. With advertising revenue alone, his channel is estimated to make over $1 million a month.

You don’t have to be a cute 5-year old to make money on YouTube, however. There are plenty of people making lots of money creating fail compilations or uploading indie music mixes.

Take Action: Check out Shopify’s guide on how to make money on Youtube.

5. Build an ATM or Vending Machine Empire

Ever been short on cash in a pinch? Then I’m sure you’re familiar with the $3 or even $7 surcharges that ATM owners charge you to withdraw your money at a convenient location.

You could be the one who earns that money if you start an ATM business.

You can make anywhere between $150-$500 a month per ATM. Own a few of them and you have yourself a lucrative second income.

Vending machines make a little less per month but it’s easier to find good locations for vending machines than it is for ATMs. And location is key. A vending machine can make $10 a month if it’s in a terrible location while another one can make $500 a month if it’s in a prime spot.

This is a side hustle that requires some start-up capital. But it’s on the lower side. You can even lease an ATM for around $100 a month!

Take Action: Check out how to build an ATM empire. Compare this investment with available methods to earn the same money fast.

6. Sell Crafts on Etsy

Good with your hands? Enjoy crafting and being artistic?

Etsy has transformed artists into entrepreneurs. It’s a craft marketplace where artisans can create online stores to sell their hand-crafted goods. You can set-up your shop and start selling in under an hour if you already know what you’re going to sell.

You can make anywhere from a few dollars to over $100k a month selling your goods online.

Don’t believe me? Just go to any of the stores on Etsy and you can see how many sales that store has made. Multiply that by the average cost of their product and you can get a pretty good idea how much they’ve made.

Take Action: Read how one mom makes $70k a month on Etsy

7. Rent out that spare bedroom on Airbnb

Have a spare bedroom?

Spruce it up a little bit and rent that spare bedroom on Airbnb for a decent chunk of change. If having a different guest stay every night sounds like a hassle, look for a more permanent resident. Many people out there don’t mind having a roommate and are looking for a good place to rent.

You can check out the “rooms/shared” section of your local Craigslist to see how much extra income renting out your bedroom can bring in. In most cities, you can easily rent out a single room for $400 a month. Since you already live there and take care of the house, the rent is pure profit.

Take Action: Use this calculator to find out how much you can rent out your spare bedroom in your town.

There you go, these are 7 great multiple income stream ideas you can start today.

I hope after reading this article, you realize the importance of generating multiple streams of income. Building multiple income streams is the quickest path to wealth.

Do you have a side hustle? I’d love to hear about it in the comments below!

For less than 5 minutes of your time, earn yourself a random stock whose value is anywhere between $5.00 and $200. It is possible through an investing app called Robinhood.