What is financial independence?

I want you to take a second and imagine what your life would be like if you didn’t have to work.

If all your financial worries didn’t exist. You’re not rich to the point where you could buy all your relatives houses, but you have enough to never have to worry about not being able to feed yourself or pay those pesky bills.

Many people just assume that they can never achieve this state of financial independence.

That’s sad. Because, with some patience and hard work, financial independence is achievable by everyone.

Before I show you how you never have to worry about money problems ever again, let’s talk about what financial independence is.

Contents

What is Financial Independence?

Ask three different people what financial independence means to them and you’re likely to receive three different answers.

In the financial industry, however, the common definition of financial independence is owning enough cash-flow positive assets or having enough wealth to live off of without having to work. The income generated from the interest on your money must be at least equal to your expenses to be considered financially independent.

Since financial independence depends on your expenses, the amount of wealth you need to save varies from person to person.

A good rule of thumb is to have a net worth that is 25x your annual expenses. If you use the 4% rule (the maximum safe withdrawal rate) to withdraw your money, having 25x your annual expenses means that you’re very unlikely to run out of money before you die.

Not running out of money before dying, to put it bluntly, is the goal of retirement.

Financial independence is often shortened to FI and very often associated with early retirement. When someone has achieved financial independence and retired early it’s referred to as FIRE (Financial Independence Retire Early).

There is a large online community based around striving for FIRE.

To understand the importance and value of being financially independent, you only need to ask yourself one question:

What would I do with my life if I didn’t have to work for money?

Unless you absolutely love your job, answering this question truthfully will make you rethink the many hours you spend working.

I won’t blame you if you’re next question is: how do I become financially independent?

Continue reading for the answer.

The Key to Becoming Financial Independent

Your savings rate is the number one factor that affects your retirement date.

Increasing your saving rate by 5% allows you to retire 6 years earlier!

Your savings rate is calculated by taking your current annual savings, dividing it by your annual gross income and multiplying it by 100.

You can play around with this early retirement calculator to see how long it will take you to save up enough wealth to retire.

But keep in mind that the calculator makes the assumption that you will have the same monthly expenses in retirement as you do while you’re working which isn’t true for most people.

There are only two factors that can increase your savings rate: your annual expenses and your annual gross income. You can play with these variables to change your financial independence date.

Many members of the FIRE community are extremely frugal and are proud of their savings rate. They will tell you that decreasing your expenses is the best way to shorten the path to FI.

Don’t get me wrong, reducing your monthly expenses will always be beneficial towards your financial health. But to me, it’s much easier and better for everyone’s happiness to strive for a higher income.

I’ll tell you why:

There’s a limit to how many expenses you can cut out of your life before you drive yourself and everyone around you crazy. But there is no limit on how much money you can make.

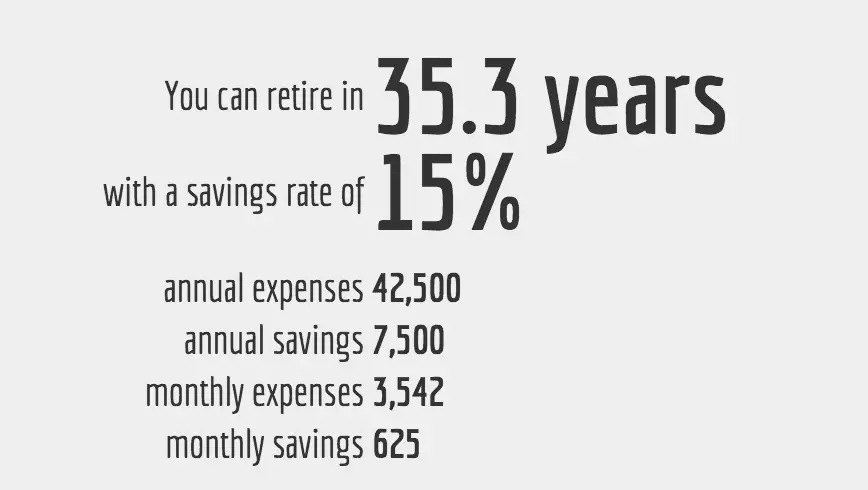

Let’s say that I make $50,000 a year at my job. With a savings rate of 15% (the U.S. personal savings rate for Jan 2018 was a measly 3.2%) it would take me around 35.3 years to reach financial independence. I would be saving $7,500 annually and have $42,500 in disposable income (minus taxes).

If I bump that savings rate up to 50% by reducing my expenses, I would now be retiring in 15 years instead of 35. However, since my annual savings jumped up to $25,000, my disposable income dropped to $25,000.

While you can live off that amount, you’ll be hard-pressed to enjoy any luxuries. Especially if you plan on supporting a family.

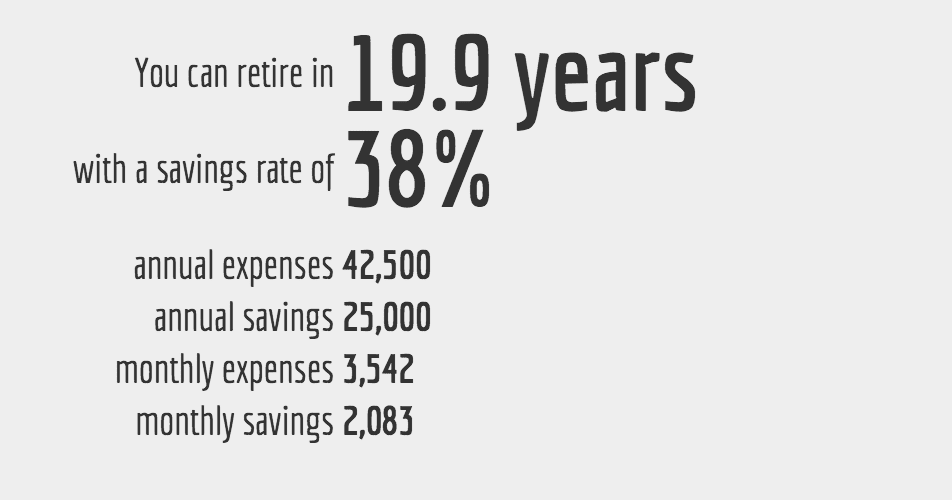

If, however, you increase your income by $17,500 and put that all towards your savings, your savings rate would be around 37%.

You would still be saving $25,000 a year and also still have $42,500 in disposable income. It would no take you 20 years to retire. 5 more years than if you reduced your income, BUT you would have nearly double your disposable income before and during retirement.

And, of course, if you could survive off $25,000 a year, then you would be able to retire in 10 years.

I’m always going to advocate the route of increasing your income over cutting your expenses.

The 4 Cornerstones of Achieving Financial Independence

Achieving financial independence is simple but not easy.

There are really only four key concepts that you have to follow to quickly grow your wealth:

- Do some lifestyle design and cut unnecessary expenses. You can have anything you want, but not everything. No matter what your income level is at, spending less is powerful. We’ve all heard of athletes making millions of dollars a year going bankrupt. Don’t be like that.

- Work to increase your income. There are hundreds of ways to increase your income. Whether it’s asking for a raise, moving jobs, or even changing your career path. You can also have multiple income streams [LINK] by working on side hustles, side-gigs, and projects.

- Increasing your savings rate to accelerate FI. By increasing your income and cutting expenses, you give yourself the potential to skyrocket your savings rate. But you actually have to save that extra money. It’s all too easy to fall into the trap of spending that money on vacations or a bigger TV.

- Investing wisely to make your money work for you. All that extra money you have now needs to be invested. Compound interest is the name of the game here. It’s what makes retirement possible.

How long will it take you to reach financial independence?

Is financial independence realistic for the average person?

Absolutely. While it’s true that the lower your income, the harder it will be, everybody has the potential to be financially independent.

If you have a low income, that can be changed; if you have a low savings rate, that can be fixed; if you’re up to your eyeballs in debt, that can be remedied. It will take discipline and hard work, but it’s possible.

To figure out how long it will take you to retire with the same amount of annual expenses you have now, take a look at this chart.

Savings Rate Percentage | Years Until Retirement |

5 | 66 |

10 | 51 |

15 | 43 |

20 | 37 |

25 | 32 |

30 | 28 |

35 | 25 |

40 | 22 |

45 | 19 |

50 | 17 |

55 | 14.5 |

60 | 12.5 |

65 | 10.5 |

70 | 8.5 |

75 | 7 |

80 | 5.5 |

85 | 4 |

90 | <3 |

95 | <2 |

100 | 0 |

Your savings rate has a direct impact on how many years you have to work your job.

What Do You Want Financial Independence to Do for You?

Once you have got the financial independence, then you need to do some productive and constructive things with it. There are a few of the important aspects that we can guide you about that!

And with the help of these suggestions, you can well transform your financial independence state all into a healthy mode.

Converting Your Financial Independence Definitions All Into Action Plans:

The first thing that you have to do is to convert and transform all of your financial independence definitions into action plans. You should create a series and a bunch of workable plans so that all of them can get entered into reality mode.

If you have got limited resources, then it will be these your actionable plans that are going to tell you how to better utilize these limited resources of yours.

Hunt and search for the goals that are doable. You need to pour all your efforts and time to make these goals workable.

Get Started off with Your Action Plans as Soon as Possible:

When you decide and finalize your action plans, then you have to start working on them as soon as possible without wasting any time. When accomplishing and completing any goal, speed is the most important factor.

You have to remain excited and passionate enough about all of your financial independence prospects. Moreover, if you keep on making delayed plans, then you will not get success.

Hence, you have to quickly and speedily implement your plans. In other words, the sooner you are going to get started to work on your plans, the better it will be for you.

Keep on Changing and Revising Your Spending Habits:

This is one of the hardest parts while implementing the concept of financial independence and you have to dedicatedly work on it.

If you want to reach your goals, then you have to change and a little bit modify your spending habits. This is the financial diet approach that you have to implement and work on!

You should not spend excessively on unnecessary things that you do not need and still you buy them. Like, you have to take a healthy dose of this self-denial concept.

In addition, you should have an idea when to say no to those unwanted things that you do not require in your life.

Save More and More

Another way of reaching the zone of financial independence is to save more and more.

Like, if you have set your heavy goals related to early retirement, then make sure to save extensively for this phase.

By saving more and more, it can become easy for you to reach your financial independence phase in just a few of years.

This is not a painful step that you cannot implement and if you are serious about your goals, then you can easily work on this tip.

You should work both on the aspects of saving money as well as spending cuts. Keep in mind that this is an on-going process that can surely give you financial independence.

So, it is recommended to make such a kind of plan that can help and guide you in maintaining and retaining your saving levels.

Come up with a Workable and Practical Investment Plan:

The last suggestion and healthy tip that you can follow to get enter into the financial independence phase, it is to make a workable and all practical investment plan.

You should make such plans and schemes that can make you attain long-term financial security.

It is highly critical for you to save money each day and then to apply more and more ways to earn and save further money.

Furthermore, it is all because of these strategies that your attempts and efforts are going to be complemented.

You can share with us how you increase and boost your financial strength. We have shared you these dramatic suggestions and we are sure that they will work for you.

If you want to pour your feedback on financial independence and ways to achieve and acquire it, then share with us your comments and views on this concept.

So hopefully this article has got you all fired up to reach financial independence. If you’re not sure what to do next, check out the following resources.

Increase your income:

- How to get free money: 19 easy ways to get free cash fast

- How to Make $100 Fast: 25 Legit Money-Making Methods

- Grow your income

Cut your expenses:

Increase your savings:

For less than 5 minutes of your time, earn yourself a random stock whose value is anywhere between $5.00 and $200. It is possible through an investing app called Robinhood.