Finding reliable yet affordable ways to invest your money can be challenging. Sure, you can take your money and your investments to a traditional brokerage firm.

They’re reliable and have years and years of experience. But, you’ll pay a chunk of change in fees, and commissions and they aren’t a great fit for folks that want to play the market and make quick changes.

If you’re that person that likes to control their investments, make quick adjustments, and play the market daily, you might want to use an online brokerage firm.

However, these businesses, like traditional brokerage firms, tend to hit you hard with fees and commissions, and honestly, there can be questions about their safety and reliability.

In 2013 a new investing option hit the market, with Robinhood.

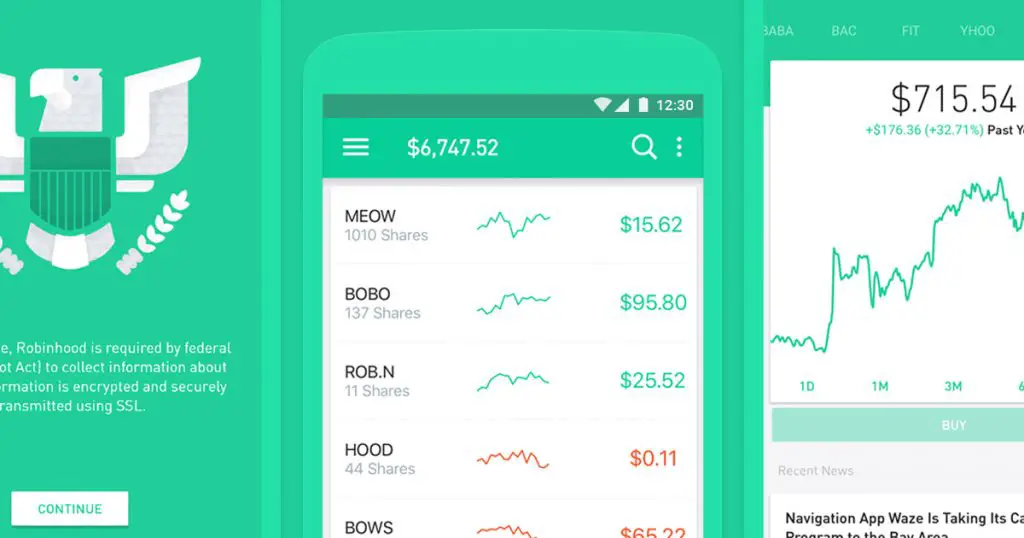

A mobile-app focused, investing platform that has sold itself as the newest way to invest, with no fees, and no commissions charged on trades.

It gives the facility of both mobile and web trading. Some investors find many tradable securities but fewer account options. Because the platforms are bare-bones purposely.

RobinHood seems like a great option for the new investor, or the investor that doesn’t want to spend a ton of money on trades.

However, because it is new, and because it focuses its business on the mobile-savvy user, it can seem like an unknown entity.

Moreover, it offers investors to trade cryptocurrency.

People of any age and with any salary can invest through Robinhood because investing has been democratized by it.

It also forces multiple discount brokers to make trading free just like it offers stock trading without any cost. The average age of Robinhood users is 31 and has almost 13 million active users.

Due to its free trading services, many youngsters take interest in trading to earn money.

Besides many benefits, Robinhood is surrounded by many controversies.

In this review, we’ll breakdown all you need to know about RobinHood, how it works, and what makes it good and bad.

Our three picks that you should try:

RobinHood – Get a free stock between $5 to $200

Coinbase – Earn up to $167 worth of Crypto while learning about Crypto

BlockFi – Get up to a $250 bonus in Bitcoin with a deposit

Contents

What exactly is RobinHood?

RobinHood is the latest offering in the world of online and mobile trading brokerage firms.

It has marketed itself as the ideal trading option for the newest generation of investors. The creators of Robinhood have focused their attention on creating an investment tool that appeals to millennial investors.

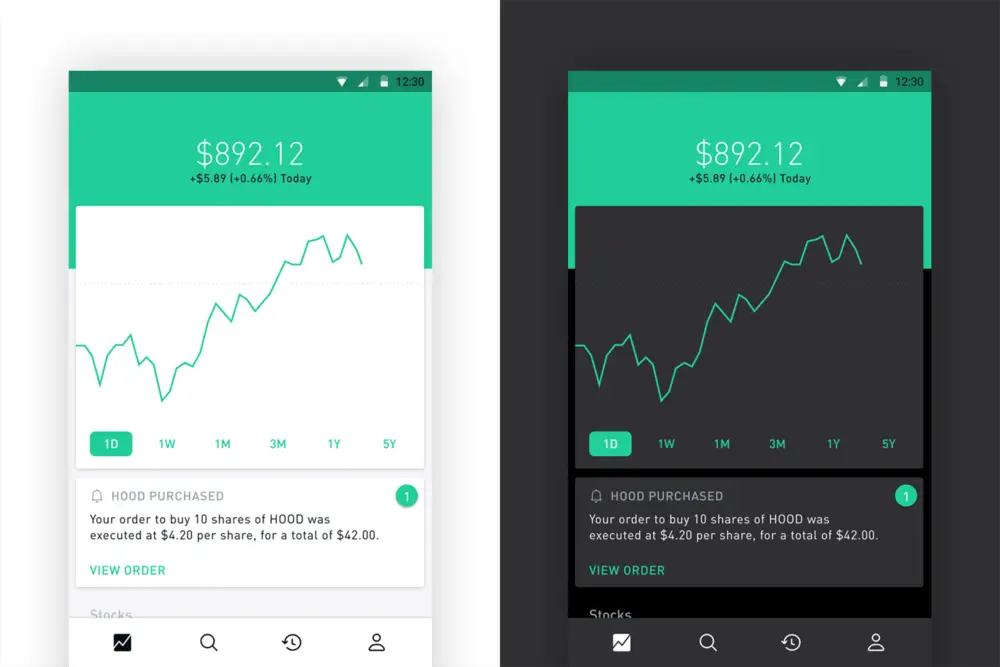

While they have online investing options, it really is the most user friendly when accessed through the mobile app.

As a matter of fact, Robinhood started as a mobile-only app in 2013.

It has only recently developed its website as an alternative method of interaction. For investors that don’t want to spend their time trading on their phones, the online option is fine. However, most investors will find that the mobile app is far more user friendly, and frankly more intuitive than the online site.

The real appeal of RobinHood is it’s fee-free investing.

Free-trading makes RobinHood a great option for young and new investors. It gives you the ability to learn and make trades in a manner that won’t cost you an arm and a leg. When you use RobinHood, you will quickly learn that they have committed to never charging trading fees, broker commissions and other fees that other brokerage firms are known for.

This in itself makes RobinHood attractive for many traders, both the individual new to the market and experienced traders. It remains to be seen if they can stick with this model, but for now, it is a great way for investors to trade and learn with minimal impact on their pocket book.

RobinHood offers a variety of services, which we’ll cover in more depth later in this article, but for the millennial trader, one of the most appealing offerings is the ability to trade and invest in cryptocurrency.

This new market, is a great selling point for many millennial investors that want to have choices that don’t feel like their parent’s investment options.

Is RobinHood safe?

Recently, RobinHood made the news for some issues with their trading practices.

While they’ve done nothing wrong, this recent negative press, makes smart investors ask the question, “Is RobinHood a safe place to invest?” This is a fair question, and one that should be looked at closely.

When it comes to safety and security in investments and trading. RobinHood is bound by the regulations set by the Securities and Exchange Commission (SEC).

The SEC has numerous regulations that all brokerage firms, whether store-front based, online or mobile, are required to follow.

RobinHood is no different, and is bound by these federally based trading regulations. Investors’ money is further protected by the Securities Investor Protection Corporation (SPIC), for up to $500,000 in securities and $250,000 for cash.

While regulations and insurance make RobinHood a safe place to put your money, and as an investor, you can rest assured that your dollars are protected from fraudulent activities by RobinHood, these regulations and insurance don’t necessarily make RobinHood, “safe”.

The fact that RobinHood markets to the newest of investors in the market, the millennial generation, is one of the biggest safety concerns with this investment product. The Millennial generation is one that is known for being driven by instant gratification.

The fee-free model of RobinHood, makes it easy for this generation to quickly buy and sell, but can put inexperienced investors in difficult financial positions.

Additionally, RobinHood makes a point of pushing high risk products like flashy stocks and cryptocurrency, to a relatively uninformed customer base. Stocks such as Microsoft, Apple, Amazon and other popular options appeal to the younger investor, but aren’t always a low-risk or safe investment option.

Additionally, cryptocurrency, while a popular investment product with millennials, is incredibly high risk.

For young investors, a limited amount of high risk products can pay off, but RobinHood does a poor job of marketing safer, low-risk funds and ETFs which can give new investors a safer, more reliable place to put money, and to learn the ins and outs of trading.

Finally, one of the biggest safety concerns regarding RobinHood, is its lack of quality research tools. Many other online and app-based investment programs (think E*Trade, TD Ameritrade or similar) have extensive information on each product or stock available, so that investors can learn, while also trading.

RobinHood’s resources for research are minimal, leaving the user to search out other sites to learn about each product. For the experienced investor, this might not be a problem, but for the targeted market, RobinHood enables less than informed decisions in trading and investment.

So, is RobinHood safe? If you’re only concerned about regulations and the safety of your money, yes, consider RobinHood safe.

They generally follow the rules, and you can feel confident that they are taking care of your money. Is it a safe investment tool for every investor? No, the targeted market of millennial investors, aren’t necessarily safe from bad investment choices when they use this app, unless they choose to do their own research.

How does RobinHood make money?

Traditionally, brokerage firms, even those found on-line use fees and commissions on trades and investments to generate revenue for their business.

The current rates are as follows: 5% APY for Robinhood Gold Members – 1.5% for non-Gold members and 8% for Margin Investing for Gold members and 12% for non-Gold users.

Most of these firms also have extensive research and educational resources, to help investors make good choices. There are plenty of other ways that brokers generate revenue, but in general, activity on your account from trades and such, as well as broker commissions on investments, is the traditional way a brokerage firm makes money.

RobinHood escapes from this model, which seems attractive to new investors, but it certainly does raise the question of how they make money, since they certainly aren’t providing the service just to feel good. There seems to be three basic ways that RobinHood makes money off of their customers.

- Interest – RobinHood takes a small portion of the interest that is generated from your stocks. While you may not notice this tiny diversion of interest in your bottom line, they are taking a small amount of money from your investments.

- Margin Interest – RobinHood purchases many of its products on a margin. They use the difference between what they acquire the product for and what you pay for it, as revenue. This practice is not new to RobinHood, and is actually a fairly common, behind the scenes way for a brokerage firm to make money.

- Premium Accounts – Just like many other apps on the market, you can get the base product for free, but for better resources or ad free use, you can pay a small fee for a “Premium Account” RobinHood is no different in this respect. You can get more from the app for a $6 per month fee, however, it isn’t a ton more, so while it’s a money maker for RobinHood, it might not be a great way to spend your $5.

Services Provided

RobinHood provides service in three different categories.

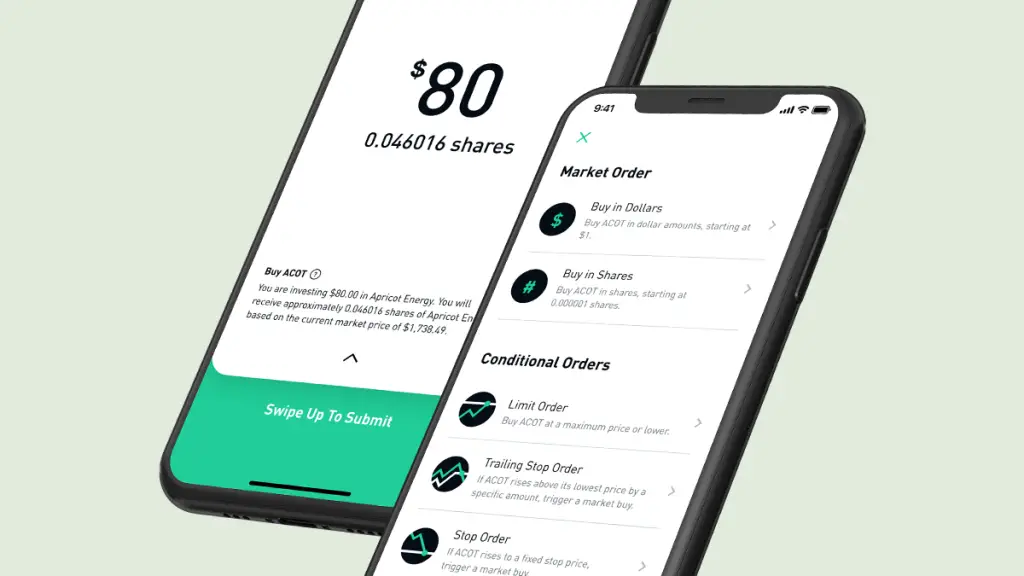

- Mobile Trading – This service is just like what you would receive from any other online or mobile brokerage. RobinHood allows investors to trade stocks, ETFs and options, for no fees or commissions. RobinHood does advertise, and heavily push trading in popular stocks which can be a risky investment. They do have access to other investment options such as EFTs, but you may have to look hard for these options.

- Cryptocurrency Trading – A popular trading and investment option for Millennials, RobinHood offers options for trading a variety of cryptocurrency options. For new investors, this is a very high risk investment option, but it can be highly profitable if done correctly.

- Cash Management – Think checking and savings accounts. This is an option that is not yet available to investors with RobinHood. However, they are currently accepting names for the waitlist for this product. The website advertises better interest rates that other banks, fee-free access to your cash, at any time. Information on this product is incredibly limited. However, it appears that one of the early concerns about this product, the lack of FDIC backing, has been resolved and at this time RobinHood is advertising on their site that all cash in their cash management program is protected, up to $1.25 million, by the FDIC.

Pros and Cons

Just like any other business and product, RobinHood has good things and features that are less than desirable. Depending on your needs as an investor, these can make or break RobinHood as a service that you want to use.

Pros

- Fee-Free: Who doesn’t love a product that they can use for free. This is one of the biggest selling points for RobinHood. Trade as often as you like, without the risk of racking up a bunch of fees, or diminishing the value of your account from commissions.

- User Friendly App: There are plenty of other brokerage firms on the internet and using mobile apps today. RobinHood has one of the most user friendly and intuitive apps and websites. Starting as a mobile based trading app, they have fine-tuned their platform to be easy to use, simple and no-fuss.

- No Account Minimum – Some other online brokerage firms demand an account This can be as little as $25, but it can still be irksome for some investors. RobinHood allows investors to create an account, and trade as frequently as you wish, with no account minimum.

- Cryptocurrency Trading – Cryptocurrency trading is kind of a market niche for RobinHood. While other brokerage firms can, and have limited access to cryptocurrency trading, RobinHood is the market leader in this investment tool. Also a favorite of Millennials, the availability of this option is a huge selling point for younger investors.

Cons

- Order Flow Routing – Keep in mind that margin interest and order flow routing are ways that RobinHood makes their money. While it keeps them from charging you fees up front, it may mean that you aren’t getting the best possible market price for your stock purchases.

- Delayed Stock Quotes – Today’s markets are very volatile. Any delays in stock quotes can be a huge problem for serious investors. RobinHood seems to have a bit of a delay when it comes to the quotes on their app and online. For the best rates, and trading prices, you’ll probably want to use another site that provides real-time, streaming quotes.

- Minimal Educational Resources – If you’re new to the market and investing game, you should have plenty of educational resources at your fingertips, to help you make good decisions. Unfortunately, RobinHood just doesn’t have a lot of educational tools.

- Difficult Customer Support – Don’t expect to make a phone call and get instantaneous assistance. If you have issues, you’ll have to email or message. Both are tedious, time consuming, and just not terribly easy to use.

RobinHood vs. Other Similar Sites

In reality, when you look at RobinHood, versus other brokerage sites, you get what you pay for.

Sure, fee and commission free are a great selling point for RobinHood, and if you are on a budget, but still want to invest, RobinHood might be a great place to start.

However, when it comes to variety in investment options, and access to educational resources, RobinHood really falls short, compared to other investment sites.

With that said, if you want a simple, easy to use investment tool, RobinHood is a great option, and it does offer options that other investment sites don’t – specifically the access to cryptocurrency trading.

While RobinHood sells themselves as a great place for millennial investors, and it truly is a simple app and website, we think that it is actually a better market for experienced investors.

The lack of research and educational materials on RobinHood, really make it a less than ideal tool for the new investor.

New investors may find a safer place to learn and grow, by using one of the more traditional brokerage companies.

Is RobinHood legit? Yes, we think it is legit. However, it remains to be seen if it can remain a fee-free option on the market, and it can be a risk for new and inexperienced investors.

However, it is a competitor in the market and has the potential to be a great product for a variety of investors.

Who Should Use Robinhood?

In 2012, a self-directed platform for investment is introduced called Robinhood. Here are conditions that make you eligible to use Robinhood if you fulfill them.

- The first condition is that you must be older than 18 years.

- You should have a valid number of Social Security

- It is necessary to be a permanent resident of the U.S or at least have a visa that must be valid

- You should have a legal address as a U.S address

With the help of Robinhood, you can also manage your cash account as it can become your go-to investment platform.

To set financial goals for the long term, Robinhood is a good idea.

Because it introduces the investing concept to different people that are related to the stock market.

Without jumping through many hoops, it allows you to buy small quantities and fractional shares.

Robinhood app has a simple user interface that a novice can easily use it.

It also helps many users to learn more about investments and trading.

Robinhood is the best platform for people who use mobile phones frequently to check their investment.

People with margin and individual taxable accounts also prefer Robinhood for trading. If you have an interest in Cryptography then you can also prefer it.

But many people do not use the Robinhood app. As to resist the temptation they need to have discipline.

Robinhood Features:

The best thing about Robinhood is that it makes the process of trading very convenient and easy for everyone. Also, due to its facility of free trading, many people can start their earnings with small investments.

Besides that, there are some more features of Robinhood that are worth mentioning. So let’s discuss them in detail.

1. Robinhood Margin:

Among U.S citizens Robinhood’s margin trading feature is very popular. Because it allows you to invest more than the amount that you have in your bank account.

Some of its users say that you can trade with the exact double account that you have in the account. For Example, if you have $ 2000 in the account then you can trade with $4000.

This is one of the best features that help you a lot in earning more. But this feature has a side effect. If your trading goes the other way then there are high chances that you will get liquidated.

2. Interest and Banking Card:

You can apply for a saving account with the help of the Robinhood app. You will get a Master card with this account so that you can use it to purchase things online.

You are also allowed to make quick deposits into your brokerage account of Robinhood. Moreover, you can earn an interest of 1.5% APY on your funds through a Cash Management Account.

3. Fractional Stock:

As the name says, you can buy a fraction share. In this way, you can invest more than you afford. The fractional stock also allows you to start your investment with small amounts. In getting exposure to high-level stocks like Amazon, Tesla, and Apple this feature helps a lot.

Frequently Asked Questions About Robinhood:

There are many things that you should know about the Robinhood app before using it. But here are some important questions that generally help you a lot.

So that you can easily decide whether you want to use this platform or not. Without wasting your precious time let’s jump to these questions.

Q. Who Are Robinhood’s Competitors?

Ans: Few companies give strong competition to Robinhood. One company that offers all the same facilities is named eToro. eToro allows you to easily copy experienced traders to make money fast..

Also, with the help of traditional other discount brokers, you can have almost the same services.

The best thing about these discount brokers is that they allow free trading now.

Moreover, they work to provide better platforms for trading, high-level research, product access, and customer service.

Q. Do Any of Robinhood’s Competitors Offer $0 Trades?

Ans: Yes, there are two Robinhood’s competitors that offer $0 trades. These companies are Fidelity Investments and Charles Schwab.

Now, more companies offer the same facility includes in this list. E*TRADE, TD Ameritrade, and TradeStation are these latest companies.

Q. Is Robinhood Completely Free?

Ans: Yes, at a specific access level Robinhood is free. It does not cost a single penny for a stock, cryptocurrency trade, and options.

However, after a 30 days trial, Robinhood Gold per month costs $5. Also, on margin, you can not trade without Robinhood gold.

Payment for order flow is also accepted by a Robinhood platform.

So that you can make money from trades. To transfer the portfolio to another brokerage you have to pay a charge of $75 as a fee.

Q. How Do I Contact Robinhood Customer Support?

Ans: By writing an email to [email protected] you can contact Robinhood customer support. Through their official social media sites, you can also get some help.

Email and social media sites are the only sources of getting help because it does not provide the facility of live chat.

Q. Can I Trade Immediately After I Open My Robinhood Account?

Ans: Yes, in some way you can trade within a short time after opening your Robinhood account. You will get a notification in a short time if your application is approved.

You can start a bank transfer after getting an approval notification from Robinhood.

Q. Can I Day Trade Stocks on Robinhood?

Ans; Yes, you can day trade stocks on Robinhood but it is not the best idea.

Because there are high chances that knowledgeable veterans of the stock market in minutes can lose a large amount of money.

Moreover, you can lose your profit by gaining taxes on short term capital. To make more than 3 days of trading you should at least have more than $25000 in your account.

Conclusion!

Robinhood is the best platform if you want to start trading. As it comes with a good user interface that is made according to the human ergonomics that helps people to do their tasks easily.

When you get some knowledge about investing and trading then move to another platform.

So that you can continue to trade easily without any restriction.

Due to the many controversies that are associated with it, most people do not prefer this trading platform.

But if you want to trade cryptocurrency then using the Robinhood platform is the best choice.