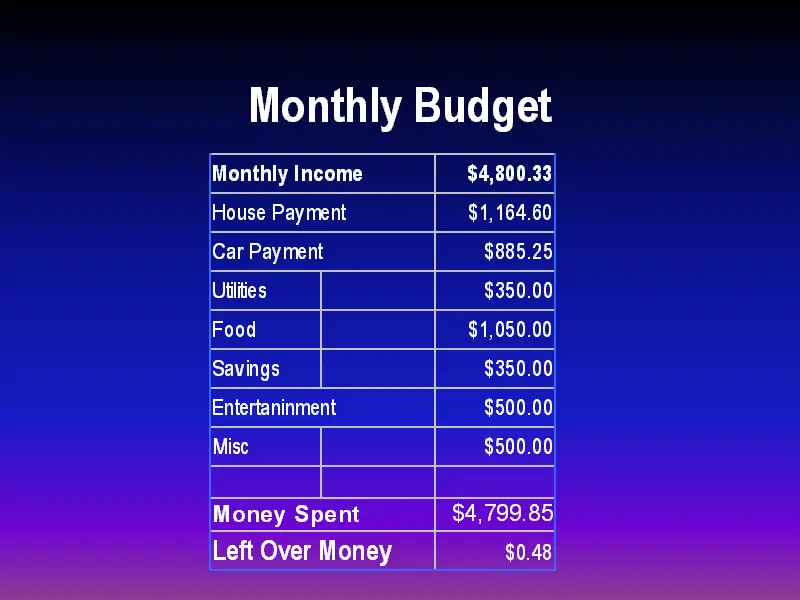

Let us have a look at some of the list of expenses that you need to be aware of to plan your monthly budget.

These are ideal worksheets that everyone should have. Furthermore, these highly recommended templates will let you handle and manage your finances in a professional manner.

No matter whether you are making and want to make a personal or household budget, these worksheets can help you immensely.

You will be given with itemized list where you can place and keep your expected income as well as the entire list of expenses.

Through these templates, you can have a clear idea of how much you have spent and saved.

Moreover, this habit will give you a clear understanding of your actual spending and saving habits.

It is only through making budget plans on a monthly basis that you can get a useful and better insight into all of your spending habits.

Even more, you get a true picture that how is your financial position going these days and how it will be likely in the future.

Hence, if you want to make informed financial decisions, then it is always suggested to you make monthly budget plans and use worksheets.

Through these details, you can well predict and make a forecast that how your financial situation is going to be changed in the coming up years.

It is high time to familiarize yourself with these budget planning worksheets and make it a habit of doing budget planning monthly.

Contents

What Is a Simple Budget Plan?

Many people, find this habit of making monthly budget planning a messy and tiring job for them.

But you can make a simple budget plan in order to make this job a piece of cake for you.

Talking about a simple spending plan needs a little effort from your side.

If you are manually tracking all of your savings and spending, then that is a pointless act. Do not ever think that making a monthly budget plan is useless.

You should not ever and ever underestimate your monthly spending and expenses.

If you will not take care of your expenses and keep on increasing your spending, then you will be in financial trouble.

While making a simple budget plan, you have to consider entering all expenses and spending that are related to housing, transportation and also utilities, and food, as well as debt payments of yours.

If during any month, you have gone for car repairs and home improvements or if you have gone on trips and vacations, then do add these expenses to your budget-making list.

Furthermore, if you have given any holiday gifts to your friends or you have opted for insurance payments,

Then these entire expenses should be included in your monthly budget planning phase.

Enter and pen down all possible predictable and unpredictable expenses in your budget planning stage.

If you will make a budget like this, then you will not ever be making any financial mistakes.

There is no need to keep on obsessing and keep on worrying about your excessive spending.

And there is no need to keep a thorough track of your every single penny budget. Just start making a simple spending plan monthly and make your life easy.

Hence, upon making a simple spending plan, you can manage your budget in a mess-free manner.

You will be able to save more and also reduce your excessive spending nature. If any person gives you this piece of advice regarding stopping budgeting,

Then do not listen to that person. If you want to decrease the level of your financial stress, then it is recommended to go for making a budget plan.

This planning will tell you when you have a tight money zone and when you do have savings at your end.

How do You Create a Simple Monthly Budget?

To create a simple monthly budget, you have to keep in mind a few of the important tips. It is not at all a daunting task to do.

You need to make a budget before your month starts. Moreover, you have to make a budget plan every single month.

It will always be better if you start thinking ahead. Upon making the first budget, you can then copy the format for the rest of the months.

This way, your job will become easier. Now comes the part of setting up your first budget.

Most importantly, you have to identify and know about your exact income. It is this income that you are going to spend and save as well.

So, get a complete understanding of it. As soon as you determine your income, then you have to put in and place your expenses.

It will be great if you start off this job with your fixed expenses of yours. Enter those fixed expenses whose amount remains the same every single month.

Like it can be rent or it can also be mortgage payment. Furthermore, it can be insurance costs.

After adding and entering your fixed expenses, now you have to add all your common monthly expenses.

It means that now you need to start off with your variable expenses. These expenses usually and generally vary every single month.

Like it can be a bill for your electricity or a bill for gasoline. Finally, you need to add up the discretionary expenses.

Also Read: What is EncoreLoan?

It is the nonessential and not-so-important stuff. These expenses are commonly and mainly included with TV streaming services.

You have to be very much Month-by-Month Specific. Remain accurate and precise while making a monthly budget plan.

Before the next month is about to get started, then you need to make a budget for that upcoming month as soon as possible.

In addition, you can think of creative ways how to save more and more.

If some extra spending is coming on your way in the upcoming month, then do add them to your budget.

It can be buying an anniversary gift, purchasing school pictures, going on holiday or applying for some membership fees.

An effective budget planner, or always comes up with clear money goals.

You need to pre-decide regarding where you want to see your financial position. It is on this assumption that you need to craft and make your budget plan.

Besides, your money goals have to be very much clear. Through this planning, you can save up money. You can become debt-free.

More tips to make a monthly budget

You need to Track Your Spending. This is a great piece of advice that you can apply if you want to become a successful budget planner.

You have to be very attentive and concentrated while making a budget and then keeping a follow-up of it. To track all of your expenses and save a lot.

Keep on adjusting your budget plan Throughout the Month. You are free to adjust your budget and make sure that you do embrace this practice.

This is how you can easily become a successful budgeter. As an example, your electricity bill came more and it turns out to be the opposite likewise you have planned.

But your water bill comes out to be lower and you were expecting a high bill in this area.

So, what you can do is make needed adjustments in both of these budget bill zones.

Lastly, you have to save a lot for your Large expenses and also for your Semiannual Expenses.

Like, you never know you feel like going out to any resort during summer vacations.

Also Read: OfferUp vs Letgo Comparison Review

So, for such times you need to have enough funds to enjoy this vacation time of yours. Here the concept of a sinking fund comes in!

This is the budget that is meant to be saved for large expenses and too for semiannual expenses.

This is how you can make a monthly budget and it does not need much effort. You can follow these guidelines and see if this guide works for you.

Share with us your tips too and convey to us how they make you a successful budget planner.

How to Use Monthly Budget Worksheets:

You might be wondering how to use these monthly budget worksheets, here you are going to get an idea about that!

As we all know that every single person out there, his or her financial situation and condition is entirely and wholly different.

Here we have put up and attached different kinds of worksheets. You can have a look at them and see which of them suits you.

The kind of monthly budget planning that you do, is on this basis that you have to choose the worksheet template for yourself.

It is generally and commonly seen that when one goes to making and planning out his household budget, then he or she experiences the phase of this monthly budget cycle.

In this budget, you have to include and inject all sources and modes of income and expenses.

O matter, you receive a paycheck two times a month or three times a month, you need to pen down these entries.

In these monthly budget planning worksheets, you have to write in every single row and column.

It does not matter whether you are facing expected expenses or you are coming across some even recurring expenses, you need to enter the details and possible information about them.

If you have to pay car insurance monthly, then include this item in your worksheet. Note down that it will be considered as a “monthly” expense.

Pros of using Monthly Budget Worksheets

There are countless benefits that show why using these monthly budget planning worksheets is important for you.

These worksheets help and assist you in determining what can you do with your savings.

This budget planning gives you a clear and set path to save more and more.

You enter in a safe position and see your financial position in a crystal clear manner.

Furthermore, the purpose of using these worksheets is to keep an emergency fund on your side.

Using these worksheets is not at all tough. The more you will practice them, the more you are going to become used to them.

These worksheets will make sure that you remain there and stick to your budget line as much as you can.

Moreover, through these sheets, you can track your spending and be in a position to meet and fulfil your financial goals.

Lastly, these monthly budget preparation worksheets, are going to calculate the difference for you related to your savings and expenses.

Through this great piece of tool, you will have this idea of whether to spend less or whether to make more and more money.

Also Read: LetGo Review: Buy & Sell Used Stuff

How do I Prepare a Budget?

Coming towards the last section of this piece of writing, you will now know how to make and prepared a budget.

Making a personal budget, it always turns out to be an important financial planning phase for you.

Make sure that you never and ever neglect this phase. Moreover, it is in this budget that you need to show all of your individual and family incomes.

You have to show your spending and saving plan.

If you are eager to take control of each and every personal finance of yours, then start making a budget on monthly terms.

Through this approach, you can see and have an understanding of where your money is going and how much they are saved,

Furthermore, it is by making and preparing a budget that you can know in detail about your expenses and then you make a strategy to spend less.

Do Self-Assessment

While making a budget, you have to keenly and thoroughly assess and analyze your Personal and Financial situation.

You need to do a self-assessment of yours. This is an important and critical point that you have to keep in mind while preparing a personal budget.

Most importantly, you need to analyze your earning level and spending habits. You have to properly assess your financial net worth.

It is crucial for you to get an understanding that how your personal needs are taken care of.

If you are unaware of your current financial condition, then how you will be able to smartly and effectively make a budget plan?

Know about Personal Goals and Financial goals of Yours

Before you start off with the job of making a budget plan, you have to clearly differentiate right in between your personal and financial goals.

Only then, you will be able to prioritize your specific and particular goals.

Like, for making a personal budget, you need to keep this goal in your head that how much you will spend and save in a year.

You need to pre-decide regarding this fact that how much savings are required in a current and present year.

In addition, you can set Short term goals too. Hence, keep in mind that your financial goals have to be SMART,

By that, we mean to say that they should be Specific, Measurable and also Actionable, Realistic, and Time Framed.

Determine How Much You are Earning and Where the Income is Coming

The third important point to be considered by you!

It is so well and properly determines how much you are earning in a single month or in a year and from which of the sources this income is coming.

If you have the answers to these questions, then you can start off by making a monthly budget of yours.

Besides, you have to list down and pen down all of the sources and modes from where your income is coming.

We have generally seen that personal sources of income are linked to categories of salaries.

You get a stipend from sponsors or you may get an allowance from your parents.

Making a Budget of Your Fixed Expenses and Variable Expenses

It is in the monthly budget that you have to include every single item belonging to your fixed and variable expenses.

This is how you can come up with a real expense budget. Do list down all the items that show your personal financial situation.

Fixed expenses, include your house rent, loan repayment as well as your utility bills and salaries.

On the other hand, variable expenses, are usually and generally non-contractual expenses.

They are spendings on transport, food or any of your spending on entertainment, vacation or on of donations.

In your budget, you have to group all of these related incomes and these fixed and variable expenses.

Make Sure that You have a Surplus Budget at Your End

The purpose of making and doing monthly budget planning is to have a budget surplus at your end.

This is how your budgeted income is going to be more and greater than that your expenses.

In this preparation phase, you have to keep in mind this important point.

What you can do is, sum up, all of your income and also expenses and then you can seamlessly figure out regarding this fact whether you have got a surplus budget at your end or not.

Most importantly, the budget Surplus condition tells you that your budgeted income is more and far greater as compared to your expenses.

Through this budget planning phase, you will come to know whether your financial condition is at the safe end zone or not.

If your budget is in deficit, then you need to make suitable adjustments so that you can boost and increase your income.

Also Read: White Rock Loans Review: Personal Loans Up To $5,000

Do Keen and Close Eye Monitoring

When you are involved in the phase of making a budget, then you have to keep a close eye on your Actual Income and all kinds of Expenses.

Most probably, it is expected of you to keep a close eye on them.

Upon monitoring your personal budget, you will be in a position to make and carry out effective budget planning.

For doing this monitoring, you have to keep a proper record and all track of your expenses and income.

Make a recording of each and every single part of your income and expenses.

Hence, do not go for unplanned spending and make it a habit of making a budget plan for yourself regularly and monthly.

Do the Comparison of Your Actual Spending as Well as Budgeted Expenses

Lastly, you have to carry out a thorough comparison of your actual spending as well as budgeted expenses.

You need to trace and track down all possible changes.

Moreover, you have to look for the variances that are existing in between your actual spending and too-budgeted expenses.

Furthermore, it is with the help of this variance analysis that you can have an understanding of where you have to spend the most and where you have to spend the minimum!

You will get an idea of how you can see and gain success in meeting and accomplishing your financial goals.

Conclusion!

Now, you have come to know the real purpose and actual benefit offered by Basic Monthly Budget Worksheets.

So, what have you decided?

Are you going to use these worksheets?

You should be! If you want to become a great financial planner for your home, then do budget planning every single month.

We hope that this above-mentioned guide must have conveyed to you how to make a sound budget.

This guide is all about the tips for making a realistic budget.

Through this approach of making a monthly budget, you can well see where your income sources are utilized.

Like, as how much you are spending on alimony or child support ad also interest, dividends as well as on rental income. It will be easy for you to calculate your expenses.

Moreover, these worksheets will allow you to make break up all of your monthly spendings right into specific bucket lines.

It will be convenient for you to group and categorize your spending in modes like housing, transportation and also utilities and food.

You can share with us how you make your monthly budget plans. We are eager to hear from your side.

Keep connected with us, more ways of making budgets are coming up.

Also read: How to create medium-term goals?