If you’re just taking off with your investment career, or if you’re a professional investor and are in search of a comprehensive no commission investing platform, then M1 Finance and Robinhood can be your viable picks.

M1 finance and Robinhood are two completely different brokerage platforms that provide investors to perform trading with ease without even worrying about the commission.

While Robinhood comes within a no commission trading policy and solely prioritizes people’s needs and requirements by giving them full control over their investments.

M1 Finance also comprises the same policies just like Robinhood but comes powered with the portfolio-based technology-aided approach.

As many brokerage apps provide traders with premium benefits, differentiating between both of these apps on your own can prove to be a hurdle.

Hence a comprehensive comparison is being provided to you below that will help you make your concepts clear about these best platforms.

M1 Finance and Robinhood are both based on a policy of having no no-commission. To differentiate between M1 Finance vs Robinhood effectively, read out the comparison below.

Contents

About M1 Finance:

M1 Finance came into being in 2015 and was launched to serve people with its ultimate features. M1 Finance helps people to develop a productive investing strategy for them that suits best with their needs and automates their strategies productively.

The company doesn’t charge a single commission from the users upon the trades they do via this app, but still, you will need to pay the typical regulatory fees that come with your investments.

What counts as its best feature is that, while signing up to this platform, there is no need for any signup or ongoing fees to be paid to use the basic services of this brokerage app.

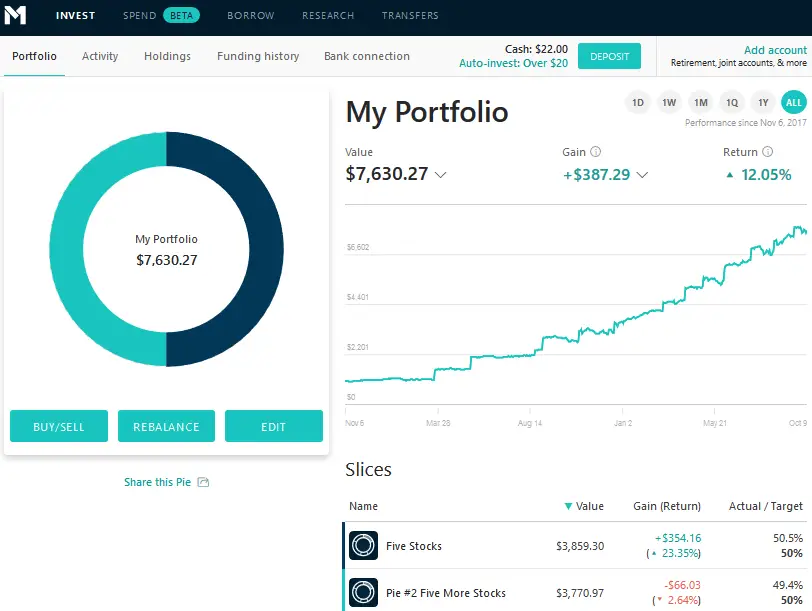

M1 Finance allows users to invest their money in the custom portfolio’s of the exchange-traded fund, as well as in the stocks that you’ve to build. In addition, it gives clients an opportunity to select their wanted portfolio from the 80 custom-built portfolios.

Investing in this company is relatively easier than the other companies as you don’t need a ton of money to go through the process of investment because this company enables users to invest in shares and stocks on a fractional basis.

While going with M1 finance, you’ll be able to automate your investments according to the investing schedules.

Moreover, this company comes in handy with a technology that helps you to achieve the target of your portfolio allocation along with dynamic rebalancing.

About Robinhood:

Robinhood was launched in 2016, and as soon as it came into being it made big waves and became instantly popular among the stock folks.

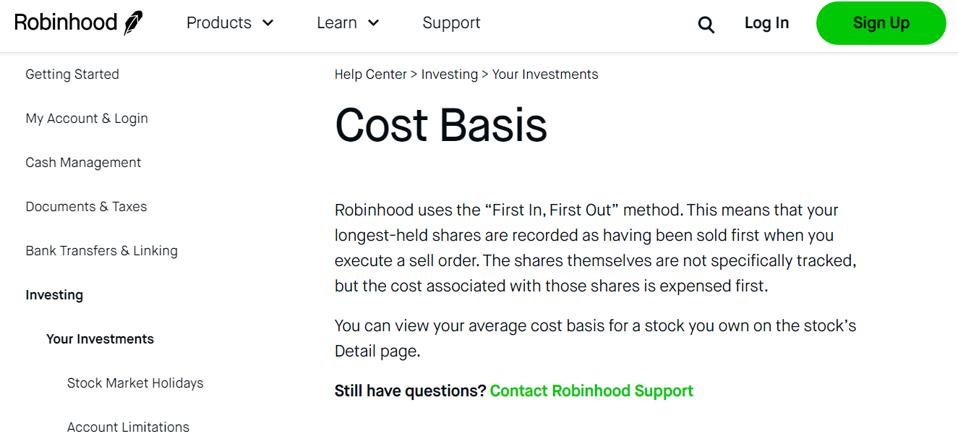

Robinhood is a broker app that charges zero commission and zeroes trade fees while buying or selling stocks from the traders.

By no minimum balance policy of the Robinhood, users can start selling or buying their stocks or shares without even being worried about a specific amount to be leftover in the app.

Though you still are paying SEC and FINRA fees, all over, not a single penny is charged from you. Via Robinhood, users can trade their stocks, ETFs, and if we talk about recent events, cryptocurrency too can be traded with ease.

The owner of the apps claims that they have prevented the users from paying up to S1 billion in commission since this broker app was launched.

As the competition of the broker apps has been stepped up to the next level, Robinhood is determined to stick to their easy to use platform strictly and provide users with essential trading options for free.

Though this app lacks to provide traders with advanced features, if you’re fresh to the stock market, this app would be your viable consideration.

M1 Finance Investment Options:

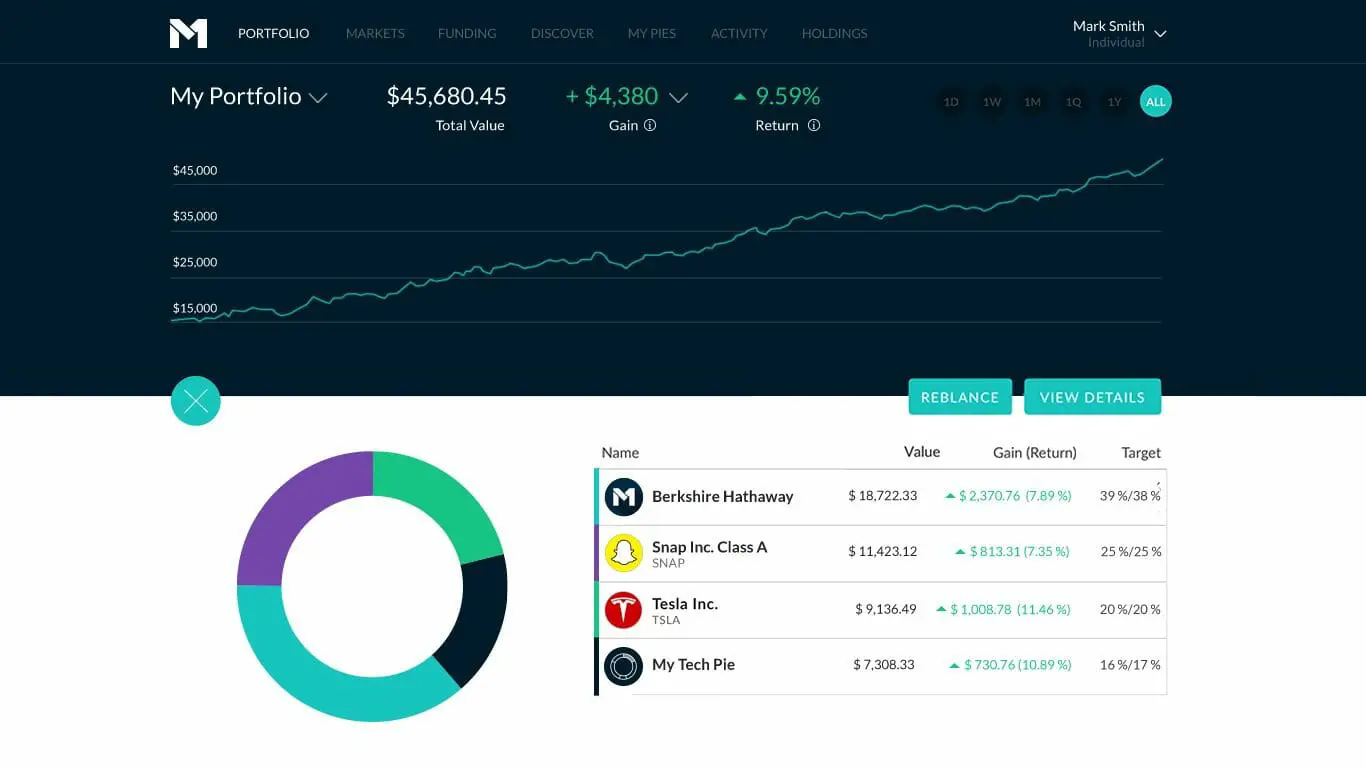

M1 Finance revolves around the concept of building up the portfolios of the traders. Once you come up with an ultimate portfolio set up, the money that you will be investing in trading will automatically balance your portfolio.

M1 finance comes in handy with a wide type of accounts that can be used to invest in trades efficiently. The accounts include taxable accounts, joint accounts, trusts, and IRAs.

It’s essential to consider the fact that the portfolio you build should consist of the stocks and ETFs that M1 Finance supports.

All over, there are around 6000 exchange-listed security options that the user can choose according to their personnel preference.

If you don’t want to start from the initial step, M1 finance comes with over 80 custom-built portfolios that are designed by experts, and hence can make things simpler for you to start with.

This company doesn’t offer users to invest in cryptocurrency or mutual funds options. Moreover, you won’t be able to perform day trading with your Investments at this company.

If you opt for the free version of this app, you’ll be limited to buy and sell your assets with a single daily trade window, whereas if you opt for this premium account of this app, you’ll receive two daily windows for trading.

Robinhood Investment Options:

If we talk about the recent progress of Robinhood, this app’s chief advantage over M1 finance is obvious and that is Robinhood offers all the options along with the trading of cryptocurrency to the users.

With Robinhood, you’ll be able to receive a much better margin trading fee for smaller amounts, hence for a margin of 1000 dollars, Robinhood will charge only 5 percent on the actual amount, which will be 5 dollars per month.

Moreover, M1 Finance charges up to 6.99 percent on the margins up to under 25000, which is more expensive than the charges of Robinhood.

Having said that, Robinhood is compatible when it comes to buying or selling fractional shares, which means that you don’t have to plunk a whole of 800 dollars to obtain a share of TSLA, whereas M1 Finance doesn’t offer users to buy fractional shares.

Summary of M1 Finance vs Robinhood:

M1 Finance and Robinhood are the two options that provide brokerage services. They both feature a smartphone app. For being able to use these platforms, having a smartphone is a basic need. Using the application, however, is not difficult at all.

Both of these brokerage apps are considered to be regulated companies that come in handy with SIPC insurance on your insurable assets.

M1 Finance vs Robinhood Investment Performance:

M1 Finance and Robinhood, both platforms come with their specifications and offer users to invest according to their personal preference, without demanding any commissions.

Your returns will solely depend upon the investment plan you choose and how you proceed with your trade, within your account.

Both of these platforms come with approximately the same regulatory fees, so the charges aren’t an issue in these platforms anymore.

However, if you decide to go for their premium versions, then the fees will solely be based upon the set of features their premium accounts come in handy with.

M1 Finance vs Robinhood Investment Performance Summary:

You can’t compare these two services apples to apples because they work in different ways.

The sole focus of M1 Finance is to provide its services to the people who want to automate their investments while picking up a comprehensive portfolio, Meanwhile, on the other hand, Robinhood prioritizes people who want to perform trade efficiently.

While going for M1 Finance vs Robinhood, your decision must be based upon your personnel preference, It’s advised to go for one that suits best with your taste and make your operations easier.

M1 Finance vs Robinhood Pros:

M1 Finance Pros:

Rebalance is Done Innovatively: M1 Finance assists you as it balances out your portfolio by keeping your purchases effectively.

Many Portfolio Options: If you don’t want to start from the initial step, M1 finance comes with over 80 custom-built portfolios that are designed by experts, and hence can make things simpler for you to start with.

Several Account Types Available: By providing people with an opportunity to access several types of accounts within the package, the M1 Finance allows you to invest in a taxable account, joint account, IRA, or trust.

Robinhood Pros:

Provide users with premium options and trade cryptocurrency efficiently: Besides providing you with the services to trade your stocks and ETFs productively, This platform will also allow you to trade cryptocurrency.

Robinhood proves to be easy for new investors: Robinhood solely focuses on the investors that are new to this field as it offers a way to effectively operate this app. This is easy to do as the interface is pretty simple to grasp.

Robinhood has no policy of minimum balance requirements: The best feature of this brokerage app is that you don’t need to save up tons of dollars to get started with this brokerage app. This app comes with no least adjustment necessity, you’ll contribute your cash to purchase fragmentary offers.

M1 Finance vs Robinhood Cons:

M1 Finance Cons:

Provide users with limited investment options: M1 Finance comes with around 6,000 constrained securities and holds back its clients from exchanging cryptocurrency.

Limited amounts of Trading Windows offered: Depending on the type of account you choose for your trading purposes, You might be able to gain access to either one or two accounts. This is a limitation when it comes to trading stocks.

Won’t suit best with people that like to have full control: If you are looking forward to investing your money in individual positions rather than in a portfolio, then there are better options available for you.

Robinhood Cons:

This platform supports and promotes short-term exchanges rather than long-term exchanges: The benefits of this platform revolve around the users making trade exchanges that will end up being low when compared with the long-term list trading conception.

Useless with regards to Re-balancing and in scenarios of Pre-built portfolios: This platform relies on you making your trades but will not work as a Robo-Advisor.

Provides support on only taxable Investment accounts: This platform strips you of the ability to open an IRA account. It doesn’t also give you a Robinhood doesn’t let you open an IRA or create any trust account to invest in.

Why Choose M1 Finance?

Proves to be a Great Platform to Start With Investments.

If you want to get some knowledge without having to step into the puzzling statistics of Separate stocks and ETFs, you would be better off choosing M! Finance.

When it comes to offering features, M1 finance provides users with pre-built portfolios. The portfolios are designed by professionals.

These portfolios can be utilized at the time when you will be ready to enter the world of trading. Additionally, fractional sharing allows you to buy out positions that you are suitable for regardless of the share prices of the investments.

Reduces Your Investment Times.

If you Are interested in long-term investment options, M1 Fund can prove useful for you as it will reduce the total time you need to spend investing. As it offers assistance to diminish the sum of time you have got to spend contributing.

The scheduled purchasing tool and rebalancing will allow your investment to go fully automated. However, it’s always wise to monitor the investment manually.

These tools are fairly effective as these tools may end up buying underweight positions that will align your portfolio percentages with the goals that you are seeking. In scenarios that don’t include the presence of this tool, you will have to opt for a position after every recent purchase.

Fairly Low Amounts to Keep the Money Invested:

When you buy shares through M1 Finance, you would not have to be concerned about paying commissions. This aspect can allow you to reach the conclusion that all of your money stays invested.

However, there is an exception for regulatory fees and expense proportions. Nevertheless, this factor alone can allow you to retain big returns in long-term investments.

Why Choose Robinhood?

Is Friendly Towards New Investors:

Robinhood is completely geared to benefit the youngsters that are starting with their careers as young traders. Comprising a comprehensive, simple and streamlined platform, it’s easy to use this brokerage app.

Thanks to the instant verification technology Robinhood comes with, you’ll be able to sign up, transfer funds, and make trades instantly.

Hence. Robinhood includes all the basic options, but features a fairly simpler interface, as compared to Weibull which has a difficult interface.

Also Read: What Is Liquid Net Worth?

Provide Users With a Solid Cryptocurrency Platform:

In spite of the fact that Coinbase could be a prevalent choice for crypto dealers, Robinhood allows its users to trade assets other than cryptocurrency at any week of the day and at any time.

Moreover, this service does not charge any commissions as well. Although the cryptocurrency has no active regulatory body that insures it, Robinhood is a better choice in terms of being able to trade such a volatile asset.

Conclusion!

Personally, the difference between both of the brokerage apps is crystal clear and even a trader that is fresh in the stock market would be able to differentiate between these two apps with ease.

Although the information provided above is enough to enable you to make the right choice for yourself still there’s a thing or two that you’re unclear about, you should review the summary below.

Being powered with a clean interface and limited options, Robinhood clearly emphasizes the investors that are starting with their careers. Moreover, coming with a robust toolkit and enhanced features, M1 Finance is for sure a much bigger playground for trade fanatics.

Similar Articles: