Swell investing is a socially responsible platform to invest your money. When you invest in stocks or other mutual funds, you are investing in multiple companies simultaneously to reduce the chances of losing your money.

However, you are also investing in companies that you are not really comfortable with. This is why swell is a good and responsible option for you.

However, swell has stopped taking more investors for now. But since swell investing took this innovative step, many other sites followed its footsteps. So we have our top favorite investing platforms.

Contents

Alternative For Swell Investing:

These companies will work for you just as well as swell investing. The below socially responsible platforms will ensure that you invest your money in a safe and socially responsible company.

These are the best swell investing alternatives that I know. I’m gonna enlist only 2 for now. As, I don’t think that you would be needing any other platform after trying them.

The Betterment:

The Betterment is a perfect choice as a substitute of swell investing. The company ensures that you invest in the right place.

They don’t compromise on morals and principles. This is why the company actively participates and increase awareness regarding various environmental and social issues.

Another good thing about this company is that just like swell investing they don’t require you to invest a big sum of amount.

You can invest right now, they won’t ask you to bring a big amount of money, actually, they don’t even have an initial requirement. You can start with whatever money you have.

Moreover, the betterment also treats you with an SRI program, which basically is an investment management thingy. Just like swell investing, this app will look into your risk tolerance rate.

And invest your money in stocks or mutual funds, as per your requirement. They are like the perfect finance consultants.

The Personal Capital:

However, if you are still a little paranoid. Then our second favorite swell investing substitute is Personal capital. It is unarguably a wise choice since they are a very socially active and responsible company.

Moreover, if you are not comfortable taking advice from a Robo-advisor then you are at a perfect place. Since this company will allow you to have human advisors. Who will guide you best about investing your money at the right place?

If you have a large sum of money then it is better for your own peace of mind that you go for it. Due to its human touch, you will be more contented.

Moreover, this company ensures that your money doesn’t get invested in companies that support ethically wrong stuff. For instance, tobacco industries, adult industries, etc.

Now, since you have got an idea about what really these companies do. I would like to share my experience with swell investing. It really was an amazing app, it made me understand everything regarding my investments.

I was a little worried at the start though. However, after a few days, it became crystal clear to me that how beneficial it is for me.

To be frank, I would say that investing in the swell investing app is much better than investing in a local bank.

Introduction to Swell Investing:

As I said earlier, investing in stocks and mutual funds can be a bit uncomfortable. Since we have to invest in multiple companies simultaneously to reduce the risk of loss.

We don’t really see what we are actually investing it. No one wants to a part of any ethically questionable industry.

This is why Swell investing took a perfectly wise step and started this innovative program. Due to this app, we won’t have to go through a great loss of principles.

We won’t need to feel uncomfortable and morally weak by investing in such companies. This is the time when people have started to get woke.

This is why everybody desires to support and invest in socially responsible companies.

However, swell investing made it rather simpler with its team of robo-advisors. That will be just as good as human financial advisors.

Moreover, they try and make sure to do what’s best for us. They are a well-known organization, and they don’t compromise on their reputation.

Swell investing is a wise option. Moreover, it is safe, and they look after our money. For our peace of mind, they make sure that they do each and everything as per our choice.

This is the reason why this app has been a great success.

Swell Investing Features:

Impact Investing:

Swell investing has put a stop for taking any more investors for now. However, that app was a socially responsible platform that worked best on allowing you to see what’s worth more. They would look for hr bigger picture.

For instance, they wouldn’t just invest your money into broad indexes. Rather it would look for the organizations that had a rather smart plan. It would only invest your money in those companies that were trying to bring a change.

They had a policy of impact investing, not just investing in whatever looks like profit. They would never let you go in loss. But they didn’t use to make us compromise on our principles for profit.

Swell investing would make sure that the clientele was comfortable and satisfied with their investments. As the only reason, people chose this app was because of it being socially woke.

Tax Optimization:

Swell investing also ensured that they minimize your tax impact since it could be a headache for you.

They would work and made sure that they come up with a law that could make it easier for you to pay as few tax charges as possible.

Moreover, they offered tax optimization, which was very impressive since you would actually have to pay less tax.

They would do nothing illegal, however they would try and get something out of the loopholes. Which was pretty brilliant of swell investing. Locals bank are not really good at that.

Automatic Deposits:

Swell investing treats you with the option of Automatic investing. This is to ensure that you get familiar with the concept of investing on a daily basis. It is a great option since it allows you to understand the app more.

And the more you will understand and get used to of the app, the more peace of mind you will have. You can visit the swell investing app regularly and invest as per your convenience.

This is a great platform to enhance your account balance. As we know how off-putting the human element can be. This is why this app ensures that you don’t forget investing.

Dividend Reinvestment:

This is also a pretty good option since it allows you to put back your compounding returns in your investment portfolio.

The swelling investing would also offer you dividend reinvestment benefit, it was a wise option.

Since most people like to keep investing until they get what they want. So instead of going through a whole hectic process, you can just do it right on your couch.

The another reason of swell investing being popular was that they offered a lot of benefits to the consumers.

Also, they would make sure that everything is easy to operate and convenient. No one wants slow and complex procedures. This is what made this app a winner in the market.

What Types of Accounts Does the Swell Investing Offer?

The swell investing provides you an opportunity to choose from 4 different account options. You can easily make a choice based on your preferences. They make sure to provide you convenience and peace of mind.

Flexible Swell Investing:

This account is a basic swell investing account. Just like the name suggests, it is flexible, so you can invest any time you want. You are also offered convenience in the amount that you want to invest.

Moreover, you are given complete services and consultation. However, in this account, you don’t get any tax benefits.

This means that swell investing would not be responsible for minimizing your tax charges.

Traditional or Roth IRA Swell Investing:

Swell also worked for retirement accounts. The swell investing treats you with 3 types of different retirement accounts.

It is a great option for those who are employees of an organization. And they are not being treated with a self-employed plan then they can invest in swell investing.

Moreover, if you don’t own a small business, it would be a great opportunity for you as well. You have a choice from choosing between IRA and traditional investing.

You’ve got two forms of IRA to invest in, the conventional one or the Roth one. Any way, it’s very helpful to you, so you can spend your money according to your preference.

However, I’m going to encourage you to go for the Roth IRA because it’s tax-free and you’re able to draw money at any time you want. It’s a very smart strategy for the long term.

In comparison, the plan is very simple to get moving, they don’t need a minimum. You should start saving as little as you want.

However, make sure you spend enough a month to make the scheme expand quicker.Now that all this is going to be over, you just need to lay back and rest. Wait till you get older, and then there! Enjoy the savings.

If you have enrolled in a conventional retirement account, you are entitled to retire at the age of 59 1⁄2.

However, if you have gone with Roth, you are free to delete several at any time without any constraints. Although any method of income tax could be applicable.

SEP IRA Swell Investing:

SEP stands for Simplified Employee Pension. This is another one of the benefits that swells investing offers. For those of you who have the option of self-employment income.

Or those who run a small business, but need a plan for the future. Swell investing has got you covered.

This account is similar to traditional retirement accounts. However, you will be able to invest more money in them though.

There is a certain maximum requirement in a traditional IRA, however, you can invest more than that in this account.

What kinds of investment options does swell investing offer?

Swell is a smart investment option. Since they pick the most successful, socially responsible, and ethically applauding companies.

The companies that swell investing select go through a keen process, where they monitor their activities and omit out morally questionable companies.

And then come up with all the companies that work and spread awareness regarding environmental and social topics.

This is such a great thing. It is like killing two birds from one stone.

As with swell investing, you will get a variety of benefits. Moreover, you will not need to compromise on your principles. If this is not the perfect platform for investing then I don’t know what is.

Seven Portfolio Options:

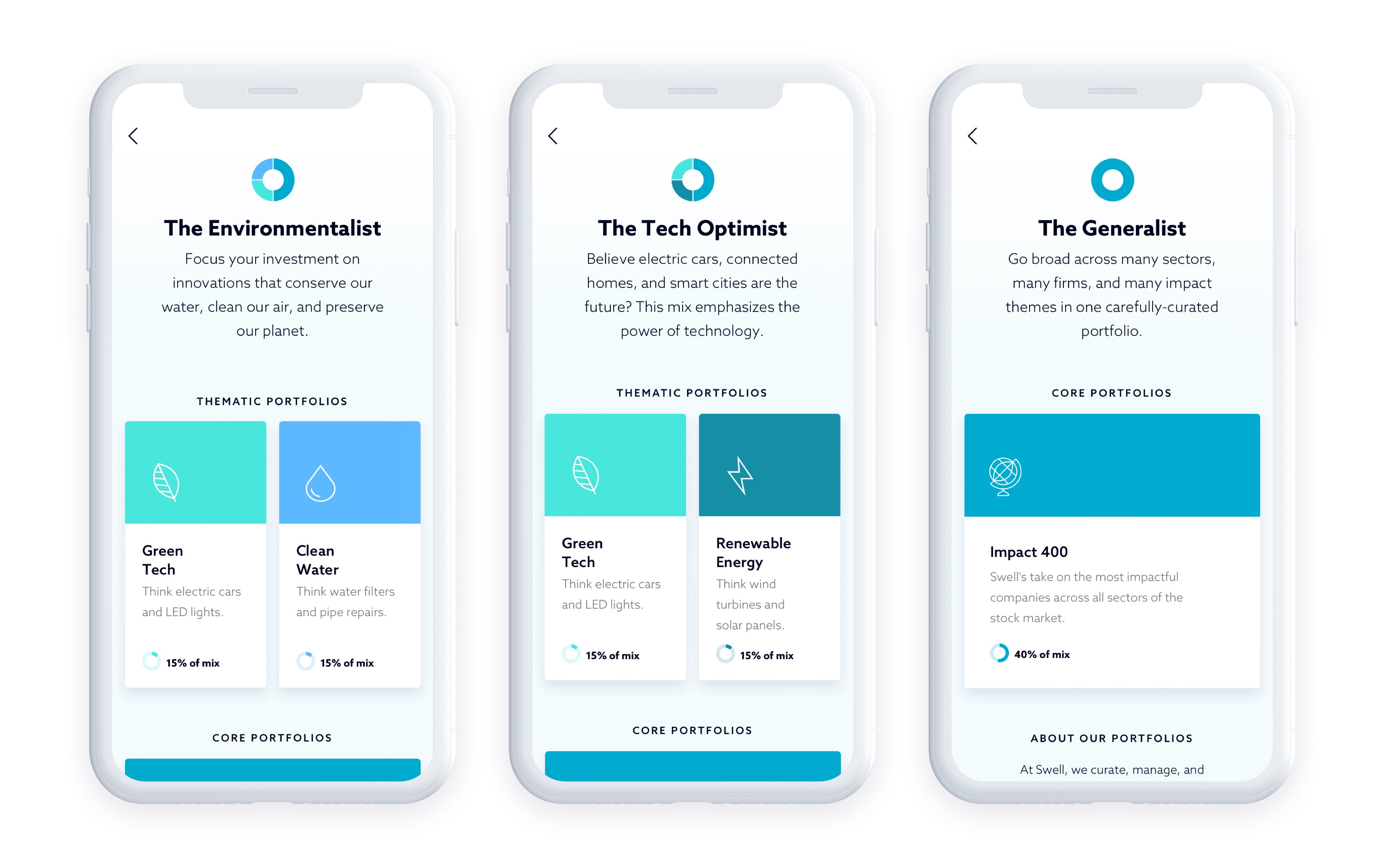

Swell investing follow a series of seven portfolio options that allow you to pick your perfect plan for you.

You have presented seven ways of approach, you can go with anything that sits well for you. I am going to enlist the 7 of them below.

- Impact 400 – A group of companies that Swell has considered to be the strongest on the share market.

- Green Tech – List of businesses focused on renewable, environmentally efficient technologies.

- Clean Water – List of businesses leading the way in the aspects of water protection.

- Zero Waste – Collection of businesses focused on recycling and reusability

- Renewable Energies – A group of businesses operating on/off wind farms, solar panels and other alternative fuels.

- Disease Eradication – A group of companies focused on immunization and research to help treat and eliminate disease

- Healthy Living – Collection of businesses providing wellness and wellness programs.

Socially Responsible Investing, simplified:

Another great option that swell offers is that if you want to invest in more than one portfolio. Then you don’t have to choose between them.

You can invest on both. It is like the more I talk about this app, the more I fall in love with it.

To make even simpler for your convenience, they made a mix of some portfolios.

The Environmentalist – For water conservation, clean air and the environment

The Tech Optimist – For clean technology

The Generalist – It means that you can split between all 7 of the portfolios.

You also get the option to create a customize portfolio for yourself that suits your liking. How great it that?

Companies Must follow UM Guidelines:

Moreover, swell has come up with certain guidelines that every company should follow. Otherwise, they don’t choose such companies.

- No poverty

- Zero hunger

- Good health and well-being

- Quality education

- Gender equality

- Clean water and hygiene

- Affordable and clean energy

- Economic growth

- Industry and infrastructure

- Climate action

- Marine life

- Peace, justice and equality

It is really important for swell that people feel comfortable and satisfied while investing.

How Much Swell Cost:

Swell is not a scam app, they let you know about their charges in the beginning. They won’t charge you any more than that. You don’t have to pay any trading, consultation or expense charges.

The monthly cost of swell investing will totally depend on how you invest. They would just charge 0.75% of assets under management annually. They won’t charge you monthly. And they won’t even ask for anything other than that.

So I believe, this is the most beneficial and wise choice that you could make.

The minimum account value of swell investing was $50. How great is that? You get all this benefits without paying a hefty amount.

If this is not something you are happy about. Then I don’t know what will make you happy.

My Experience Signing up for An Account with Swell:

I would like to share my experience with swell investing. It really was an amazing app, it made me understand everything regarding my investments.

I was a little worried at the start though. However, after a few days, it became crystal clear to me that how beneficial it is for me.

To be frank, I would say that investing in the swell investing app is much better than investing in a local bank.

If socially responsible investing is your thing then this is the perfect platform for you. I didn’t regret investing in this app, let me assure you, you won’t regret it either.

Step one: Complete your investment portfolio

The first step is pretty easy. Once you log in, you will have to confirm your email address. After that, there will be a whole page that would ask you about your personal info.

For instance, name, age, net worth, and stuff. Then you will need to fill what account you what to open. In the end, you will choose your investment plan.

Step Two: Create Your Mix:

After completing the first step, you will be allowed to create your own mix if you want. You can choose all socially responsible activities that you are passionate about. And then your portfolio is done.

Step Three: Add your Funding Source:

Now you will be asked about your bank details or the source from where you will be investing. And BOOM.

You can now easily invest and earn profits without having to pay a hefty amount of charges and taxes.

Pros:

- Easy to operate.

- Socially responsible platform.

- Tax benefits.

- No minimum requirement for investing.

- Low annual charges.

Cons:

- Limited companies to invest in.

Conclusion!

This was the whole guide about the swell investing. However, as they are not accepting any more investors, you won’t be needing this.

But you can go and try the alternatives of swell investing app. Since they are pretty beneficial too. And they work just as good as swell.