We all have a general idea of what “credit score” means but how many of you can define it in concrete terms?

Contents

Credit Score Definition:

Here’s the definition of a credit score:

Your credit score is a number that tells lenders your creditworthiness. It attempts to figure out the probability that you will repay your debts based on your credit history.

Your credit score ranges from an abysmal 300 to a lofty 850. The higher the score, the more financially trustworthy lenders assume you are.

Usually the lower your credit score, the harder it is to obtain a loan and the higher your interest rate will be.

The concept of credit is used by a variety of lenders to decide how much chance are there that they will be repaid at the exact time. If they lend some a loan or given a credit card.

One’s credit score is a credit based on the history of their credits. For the financial wellbeing of the individual, it is necessary to have a decent credit score.

The higher the credit score, the less credit risk you are going to face.

A Short History of the Credit Score:

The credit score is a recent invention of the modern economy (1950’s). Before then, when you needed a loan your fate was at the hands of the loan officer at your local bank.

Getting a loan was based on the loan officer’s subjective judgment.

There were many faults with this system, but the biggest two were (1) the inability of the loan officer to accurately assess the likelihood that you would pay your loan back and (2) discrimination based on the loan officer’s own biases towards race and gender.

Your loan application could be denied because the loan officer was having a bad day.

Two statisticians, Earl Issac and Bill Fair tried to solve this problem by finding patterns of behavior that predicted a good or bad credit risk.

Their model became popular during the ’70s but not until 1989 did the modern version of the FICO score come about.

This score is based on consumer credit files of the three national credit bureaus: Experian, Equifax, and TransUnion.

Types Of Credit Scores:

There are the following types of credit scores.

Generic Credit Score:

To determine general credit task risk many creditors and organizations use generic credit scores.

Custom Credit Score:

Credit scores that are related to credit reports and another piece of information are called custom credit scores.

Range:

The range of credit score lies between 300-850.

A credit score of 700 and more than this is generally coined as a sign of good credit score and an excellent credit score will be in the range of 800 and above.

But generally, most of the credit score is in the range of 600-750.

How is a Credit Score Calculated?

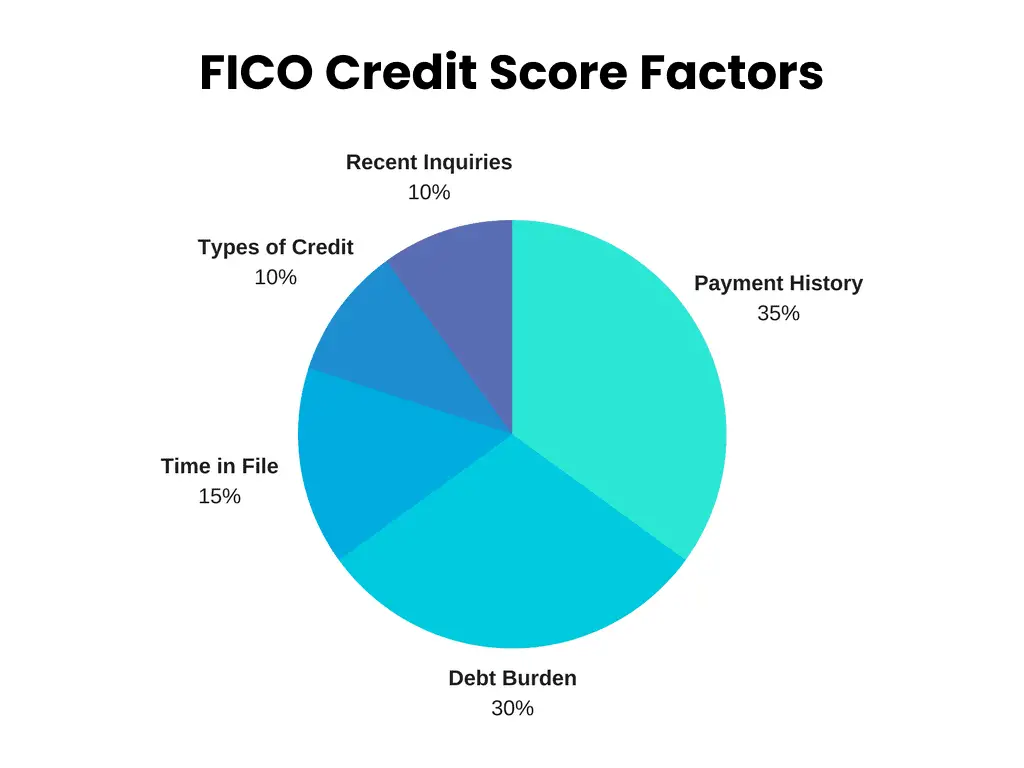

The exact makeup of a Credit Score is a secret, but FICO has disclosed some general information:

- 35% payment history: Any kind of negative information such as late payments, foreclosures, bankruptcy, settlements, liens, judgments, charge-offs, etc will have a negative effect on your credit score.

- 30% debt burden: There are 6 different measurements that make up this category. This includes your debt to limit ratio, the amount paid down on installment loans, the number of accounts with balances, and the amount owed across different types of accounts.

- 15% length of credit history: This is composed of the average age of your accounts and the age of the oldest account on your report. The older your accounts, the better.

- 10% type of credit used: Having different types of credit (mortgage, installment, revolving, consumer) can have a positive impact on your credit score.

- 10% recent credit searches: Hard credit inquiries have a negative effect on your credit score. These usually happen when you apply for a credit card or loan. Luckily, you can still “rate shop” around when looking for a home or car loan because FICO considers all credit inquiries within a certain time frame as one credit inquiry opposed to however many actually happen.

How do Credit Scores Work?

Credit codes are a three-digit number that determines whether individuals can do certain things like buying a vehicle, buying a gadget like a computer, or getting alone and how much these things are going to cost to you.

Does the question arise that how can these numbers be going to decide whether you should buy a car or not?

Before getting into more detail let me tell you,

By using credit a lender assesses how a borrower is likely to pay back lone on the specific time. The instant credits pay on electronic retailers are proffered by this method.

Likewise,

These credit scores that determine how much you reimburse for indemnification and important life essentials and for credit used to be confidential from consumers. The score is only assessed by the loan giver.

Incredible, isn’t it?

A lot of information about you a lender can attain through this three-digit credit score. Including info about the payment of your bills, how likely you pay the loan of your vehicle etc.

These scores also tell lenders about the debt of thousands of bucks that is due on your credit card and if you faced a bankruptcy.

Let me tell you something,

Whenever you strive for loans or credit card lenders look at these materials.

If the credit score is low in this regard one cannot meet the criteria for lone and even you qualify the bank or the loan giver will take high interest on a loan.

That’s why it is important to know about your credit scores and how your habits related to finance can cause a rise and fall in credit score.

What Factors do NOT Affect Your Credit Score?

Unlike what some people believe, your credit score never takes into account your race, age, gender, or marital status.

How To Improve Your Credit Score?

If you want to improve your credit score you should consider the following points.

Pay Bills On-time:

The payment of bills is an important factor when lender look at your report and request your credit score.

The reason behind that the past performance of payments plays a vital role in influencing future performance.

Apply For A New Credit Account When Needed:

Applying or opening a new credit account would not help you in creating the credit score so it is better to avoid to open redundant credit accounts.

Keep Old Accounts Open:

It is considered that the older your credit account is, the more impact it has on the mortgagee. The credit age means that for how long you have your account.

Credit Monitoring To Track Your Progress:

To have a check on your credit score i:e how it changes over the period credit monitoring service will join hands with you.

Check Mistake On File:

Even the slightest of mistake can affect your credit score so make sure that all things and information are correct and if there is an error regarding info then report it.

Moving Home A lot:

The lenders feel comfy when they come to know through your report that you have lived at the same address for a long period.

How Many Credit Scores Do You have?

Not many people know this but you actually have more than one credit score. Equifax, Experian, and TransUnion all create different credit reports.

These credit reports are used by credit scoring models such as FICO and VantageScore to come up with different credit scores.

When someone requests your credit score, they’ll receive a credit score from each bureau. It’s common that the scores you receive from the different bureau will vary from each other.

This happens if lenders don’t report to all three credit bureaus or if the bureaus update their reports at different times.

Did you know what a credit score was?

Also read:

What is tier 1, 2, 3 credit score?

Is a 750 credit score good or bad?

For less than 5 minutes of your time, earn yourself a random stock whose value is anywhere between $5.00 and $200. It is possible through an investing app called Robinhood.