Gemini and Coinbase are the most prominent US-based cryptocurrency exchanges.

Both platforms are available in more than 50 countries and feature a “first-security” trade strategy.

The renowned Winklevoss twins created Gemini. They invested significantly in Bitcoin and eventually started their own cryptocurrency exchange Gemini after a $60 million deal with Facebook founder Mark Zuckerberg.

Moreover, it is an exchange based in the USA following the US government’s stringent standards for your customer knowledge (KYC) and anti-money washing.

Brian Armstrong and Fred Ehrsam established Coinbase in 2012. They are the most popular centralized exchange in the USA and support the world’s leading cryptocurrencies.

The simple software and credit card capabilities to acquire crypto facilitate new investors to start up.

Its customer service offerings are the primary distinction between platforms.

For example, Coinbase offers help for email and chat but does not offer live support for telephones via social media (as of March 2021).

On the other hand, Gemini gives clients 24/7 phone and conversation assistance, allowing them to connect directly to someone if their account has problems.

Since crypto trading draws new seasoned investors, you can quickly and safely trade cryptocurrency through platforms like Gemini and Coinbase.

Both are well-known centralized exchanges that comply with strict US legislation and support extensive financial systems, including J.P. Morgan.

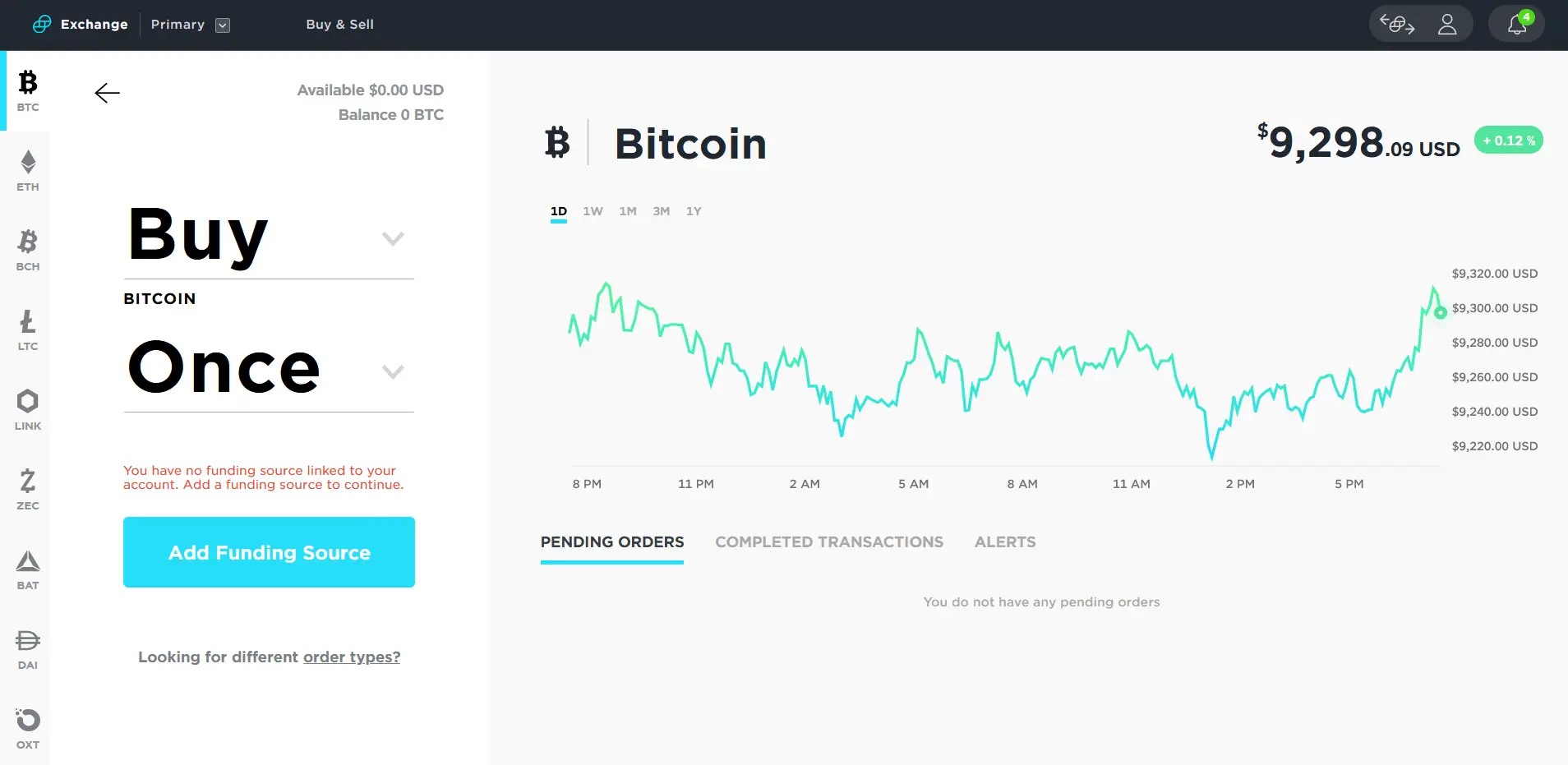

In addition, you may use the Coinbase Pro or Gemini’s ActiveTrader program to access sophisticated trading features on each platform.

Even though the trade is identical, there are variances. Gemini offers institutional investors assistance tools, while Coinbase enables you to earn bitcoin while learning about trading. Beginners will find both platforms comfortable.

Coinbase has a slight edge, though it is available and provides more currency kinds in more countries.

Contents

Analyzing Gemini Vs Coinbase:

We have analyzed Gemini and Coinbase to assess the total cost for various quantities and volumes of trading, accessible payment methods, and supported cryptocurrencies.

We also examined easy usage, highlights, and security measures. In addition, we examined customer support and the features of their mobile apps.

Based on their currencies, security, charges, features, and more, we have analyzed both platforms to help you choose the best solution.

Gemini vs. Coinbase: What would you like?

GEMINI:

PROS

- Simple UI.

- Can earn interest in your cryptography.

- Digital insurance Hot Wallet.

- Intuitive interface application.

- Cryptocurrency stored may be of interest.

- Gemini wallet insurance is available.

CONS

- You can support 34 coins.

- High commercial charges.

- Less supported trade pairings.

- Disposable in 50 countries.

COINBASE:

PROS

- FDIC insured up to 250K dollars.

- Offered in 100 countries.

- Library of free user learning.

- User-friendly interface for newcomers.

CONS

- Structure of complicated fees.

- Features limited.

- Fewer choices than Gemini for customer service.

- $2 minimum order quantity.

- High Trade Charges.

Gemini vs. Coinbase: At a Glance:

| GEMINI | COINBASE | |

| Features: |

|

|

| Fees: | Trades are fixed at or below $200, 1.49% for over $200, extra “convenience charge,” 3.49% for the debit card deposit, and 0.50% for each transaction. No ACH and wire transfers deposit or withdrawal charge (10 maximum per month) | 0.5% by trade; additional 1.49% for bank account or wallet transactions; additional 3.99% for debit or credit card purchases; Deposit of $10, wire transfers of $25 |

| Cryptocurrencies Supported: | 34 | 44 |

| Security Features: | 2FA through SMS or Authy application; user role management; U2F security via hardware key. FDIC guaranteed USD holdings up to $250k; Digital Asset Insurance for Gemini ‘Hot Wallet.’ | Cold storage and multi-contact carrycots, FDIC insured balances of up to $250,000 USD, KYC anti-money laundering protection, and the use of a 2FA through SMS or Google Authenticator app. |

| Types Of Transactions: | Buy, sell, trade, deposit, withdraw. | Buy, sell, exchange, send, receive |

Gemini vs. Coinbase: Features:

Both platforms are appropriate for beginners with basic UIs, easy-to-use mobile applications, and simple trading choices.

These are the right ones for beginners. You also get a digital hot wallet and a good range of knowledge materials from Gemini and Coinbase.

But there are some distinctive qualities in each trade.

The characteristics of Gemini include:

Gemini Earnings:

It offers customers in all 50 countries can earn interest at a variable interest rate on their net balance of various crypto coins.

Currently, the yearly performance of Dai (DAI) and Filecoin (FIL) is 7.4% (APY).

Third-Party Integrations:

Gemini offers public API keys to link other software tools and makes Gemini the perfect solution for managers of funds or other institutional traders.

Gemini Pay:

Furthermore, it has partnered with over 30,000 businesses to make purchases on your Gemini account payable and store bitcoin.

Beginner investors at Coinbase enjoy characteristics such as:

- Crypt-making skills while knowing how to invest through short films.

- A lookup function for price history or notifications when pricing increases or decreases.

- The integrated newsfeed with regular bitcoin market updates.

- To generate revenue on the assets, users can contribute to the Stake of Proof (PoS) network.

- Capacity to deposit money from PayPal altcoin sales.

Gemini vs. Coinbase: Ease of Use

Gemini is straightforward to use, and its spotless interface demonstrates this.

As a result, Gemini is arguably one of the finest user experiences for crypto-exchanging, with a detailed pricing list and the opportunity to buy, sell or trade crypto front and center.

Establish a free email address and password to register with Gemini. Once they confirm your email address, secure your two-factor authentication account and connect your bank account or debit card. You may start shopping for crypto immediately from there.

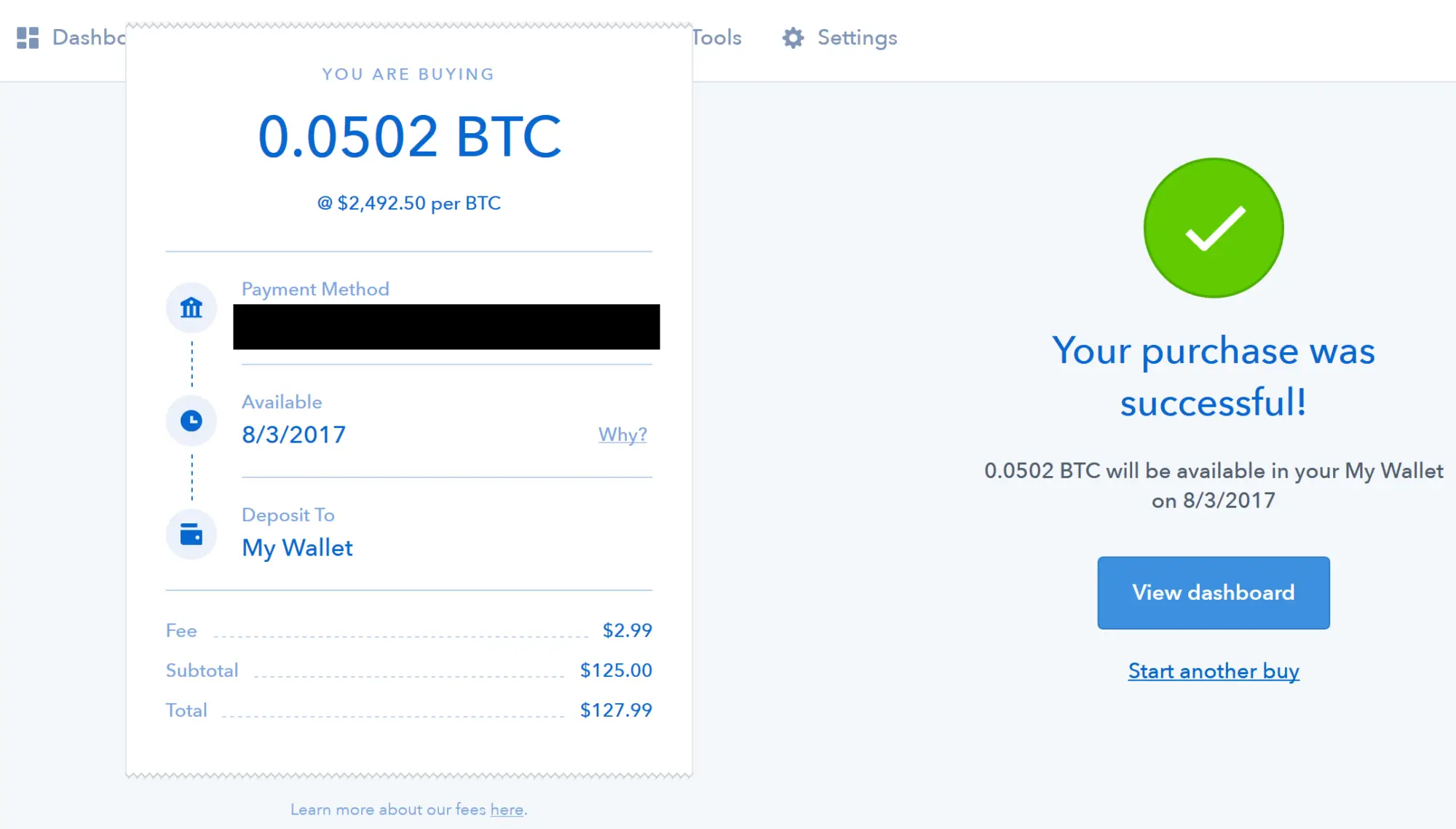

Likewise, Coinbase provides customers an easy method to register, connect and purchase bitcoin via their application.

You can register with coinbase with an email or password. Your identity may be verified by uploading an image of it to an app or website using a photo ID provided by the government.

Once checked, you may link to a bank account or payment card to start shopping for bitcoin instantly.

The United States KYC and the anti-money laundering requirements are complied with by both Gemini and Coinbase. Additionally, you may need to supply identity verification and proof of address.

Gemini vs. Coinbase: Supported Currencies

Currencies accepted by Gemini and Coinbase. Gemini has the following support kinds: USD, AUD, CAD, EUR, GBP, SGD, and HKD.

Coinbase, however, provides 18 cryptocurrencies more than Gemini.

So the Dash, EOS, Cardano (ADA), and Ethereum Classic (ETC) on Gemini, for instance, can’t be bought.

Both platforms are supportive of the common currency.

- ethnicity (ETH)

- Aave (AAVE)

- LiteCoin (LTC)

- Dai (DAI)

- Bitcoin cash (BCH)

- Chainlink (LINK)

- Uniswap (UNI)

Gemini and Coinbase continuously introduce new choices for cryptocurrencies.

Therefore there are different currencies available. Coinbase serves more than 100 nations, while Gemini restricts its traders to more than 50 countries.

Coinbase additionally provides 41 US citizens with trading pairs as against 33 Gemini trading pairs.

However, both sites remain top cryptographical exchanges with several alternatives for fiat currencies and foreign places.

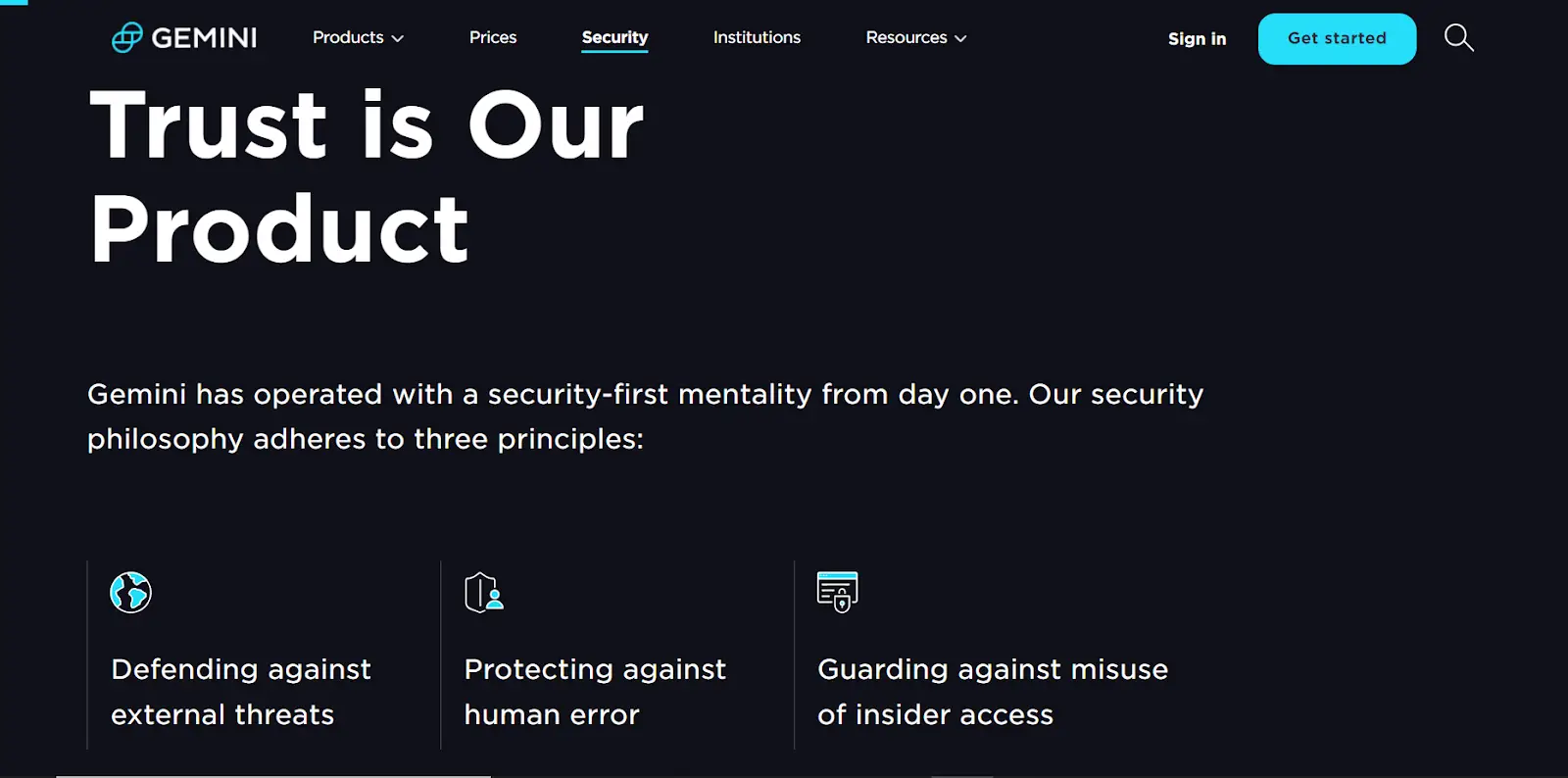

Gemini vs. Coinbase: Security

These prominent exchanges conform and are a favorite for investors to the highest safety precaution and the United States legislation.

After applying for a direct listing, J.P. Morgan supports the two platforms, and Coinbase will soon offer stocks to the entire public.

In addition, all Gemini and Coinbase balance sheets protect up to $250,000 per person under the Federal Deposit Insurance Corporation (FDIC).

You’ll also receive a two-factor authentication (2FA) procedure through the Gemini and Coinbase SMS or utilize the Gemini Authy app or the Coinbase Google Authenticator app.

Coinbase also states that 98 percent of client’s assets store in cold storage, which means that they are maintained in safe deposit boxes or vaults offline.

“The majority of your vault is kept in our offline cold storage system,” Gemini says. Gemini says.

In addition, Gemini gives institutional traders security features, for example, set permissibilities for user access to bitcoin trading or account access.

You may also view devices that utilize or sign in to your account.

Moreover, a whitelisting address with a seven-day holding procedure may be specified, after which you can use particular addresses to withdraw.

Gemini and Coinbase are both recognized for their safety features, enabling them to purchase, sell and keep their crypto assets in two of the safest locations.

Some of the security settings for each platform are accessible here:

Related Post: 21 Money-Saving Challenges to Try in 2021

Gemini Security Features:

“Hot wallet” insurance:

Gemini offers insurance on any Gemini wallet digital assets and will pay the customer for any resultant infringement or hacking of the security, fraudulent transfers, or theft by employees.

Furthermore, it provides clients comfort that Gemini safely stores their digital assets, even those that are regularly traded.

Whitelisting:

Gemini offers approved whitelisting, which means that it can limit access to addresses with which you can retract your bitcoin. Whitelist-approved addresses:

These addresses must be authorized seven days before they are allowed for transfer so that new lessons are examined and approved.

Authentication with two factors:

Gemini supports authentication with two factors (2FA) through SMS or the Authy application.

Management of user roles:

Gemini allows you to add multiple user roles to your account, restricts access and trading rights for some individuals.

Moreover, it is a good choice for institutional investors with crypto-investment management staff.

Device Management:

Gemini enables you to see and limit all the devices that your account has accessed.

Even from whatever device you presently log into the Gemini account, you may stop current sessions.

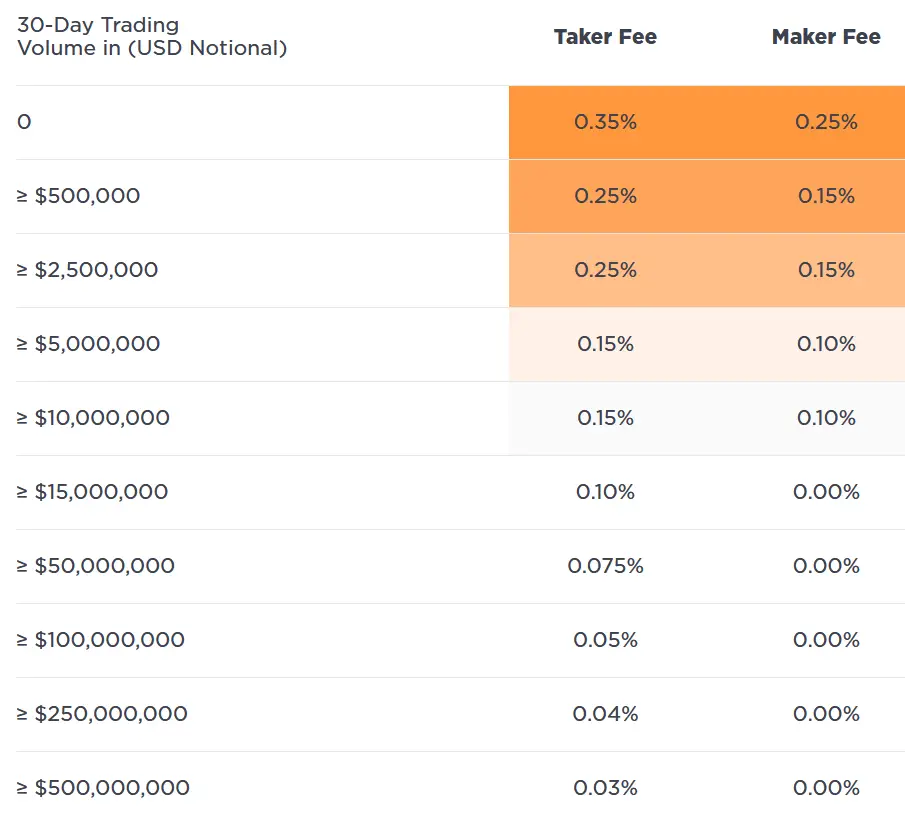

Gemini vs. Coinbase: Fees

Coinbase and Gemini charge more significant fees than other well-known exchanges. You’ll pay a fixed charge or convenience fee based on your method of payment.

However, the Coinbase Pro or Gemini ActiveTrader Plan can provide you with cheaper costs, both employing a Maker model, costing less than your primary platform.

Coinbase has a somewhat more complicated fee structure than the two platforms.

For example, if you buy 100 dollars of coin-free but pay by credit card, the flat price will drop, and you will pay 3.99% on the credit card transaction instead.

For instance, you can pay a flat cost of 2.99 dollars.

You can save a bit on Gemini when you always pay by wire transfer as the cost for wire transfers doesn’t apply, whereas Coinbase does.

The price of Gemini API users might also be lower than those used in web or apps.

Frequently Asked Questions!

Final Verdict!

Between Gemini and Coinbase, there are numerous similarities. Each, for instance, is user-friendly, provides several top-level cryptocurrencies and priority for safety.

Gemini is a popular alternative for investors wishing to acquire and keep digital assets on the most secure platform.

Furthermore, they are also a very transparent corporation with regular financial services audits by the State of New York (NYDFS).

The rigorous observance of US rules makes it one of the safest locations to buy cryptography, particularly for institutional investors.

Coinbase, owing to its clean, pleasant design and easy-to-use mobile app, is one of the simplest crypt platforms for newcomers.

Also, you can purchase and sell cryptography a few clicks away, and the change provides some of the safest safekeeping for your digital assets that we’ve ever met.

Regardless of the platform, you select, it is pretty speculative to invest in cryptocurrencies. So never invest more than you will lose.